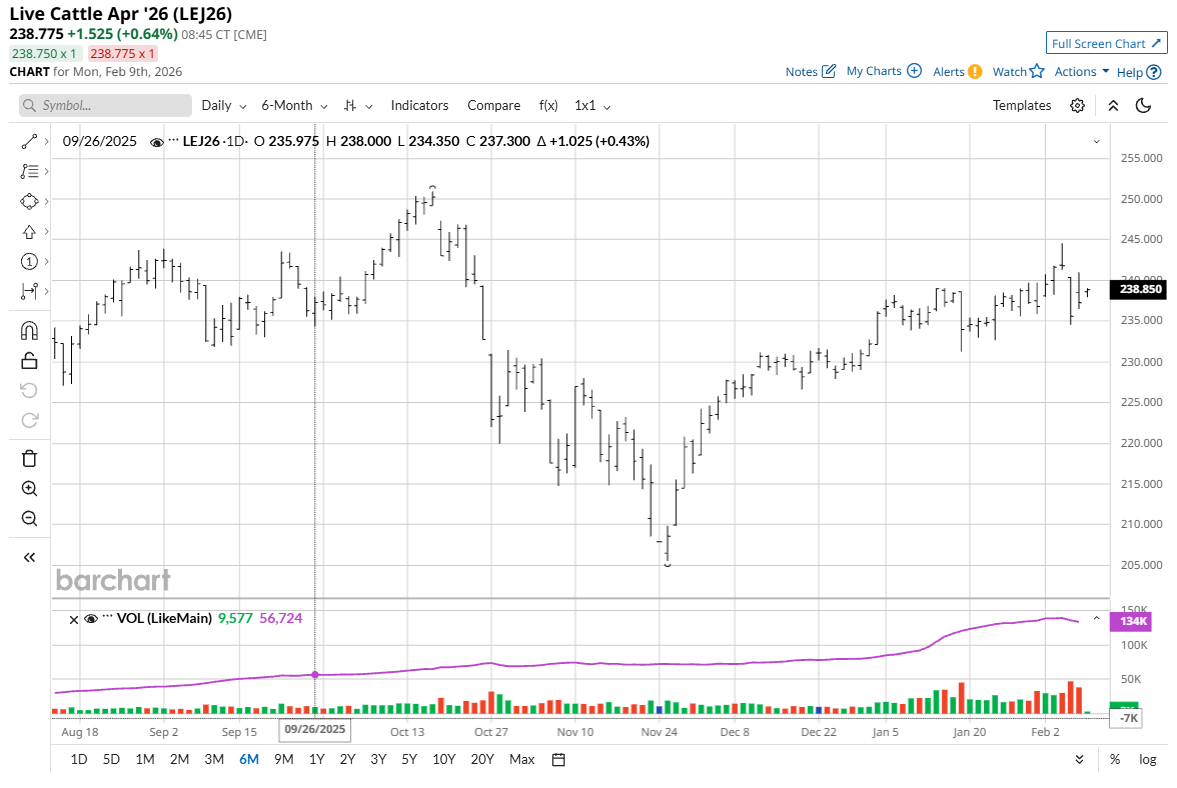

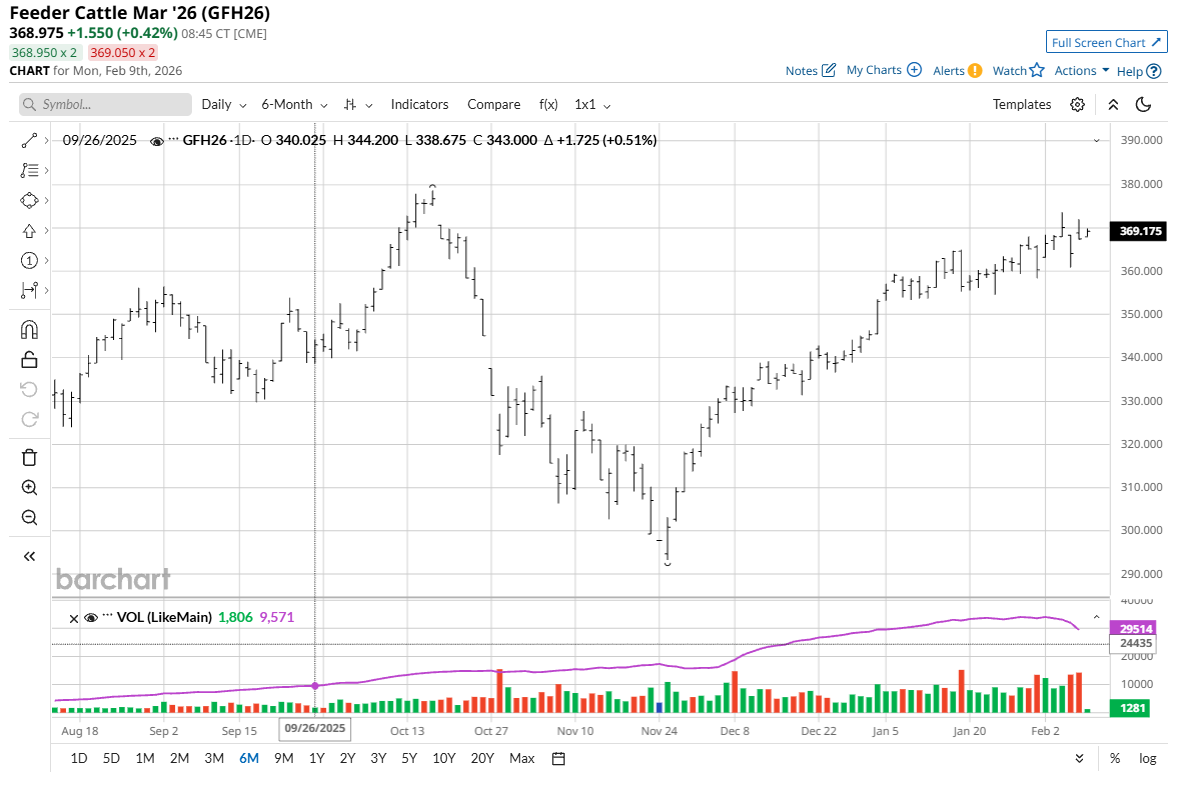

April live cattle (LEJ26) futures last Friday rose $1.65 to $237.25 and for the week were up 45 cents. March feeder cattle (GFH26) futures Friday gained $3.35 to $367.425 and on the week gained $7.15. Despite some higher volatility and profit-taking pressure from the shorter-term futures traders late last week, the longer-term cash and beef market fundamentals remain solid, while the near-term technical posture for the cattle futures markets is also bullish overall.

Cash cattle trading activity picked up late last week, with the USDA on Friday reporting steers averaging $239.91 and heifers averaging $239.85. The USDA last Monday reported average cash cattle trading for the week prior at $239.44.

Cash cattle and beef market fundamentals and technicals remain solid, but the U.S. stock market has wobbled, and other commodity markets have become more unstable — namely gold (GCJ26), silver (SIH26), and copper (HGH26).

While some instability in outside markets generally does not significantly impact the cattle and hog futures markets, the enormity of recent daily price moves in gold and silver has spooked most commodity markets traders.

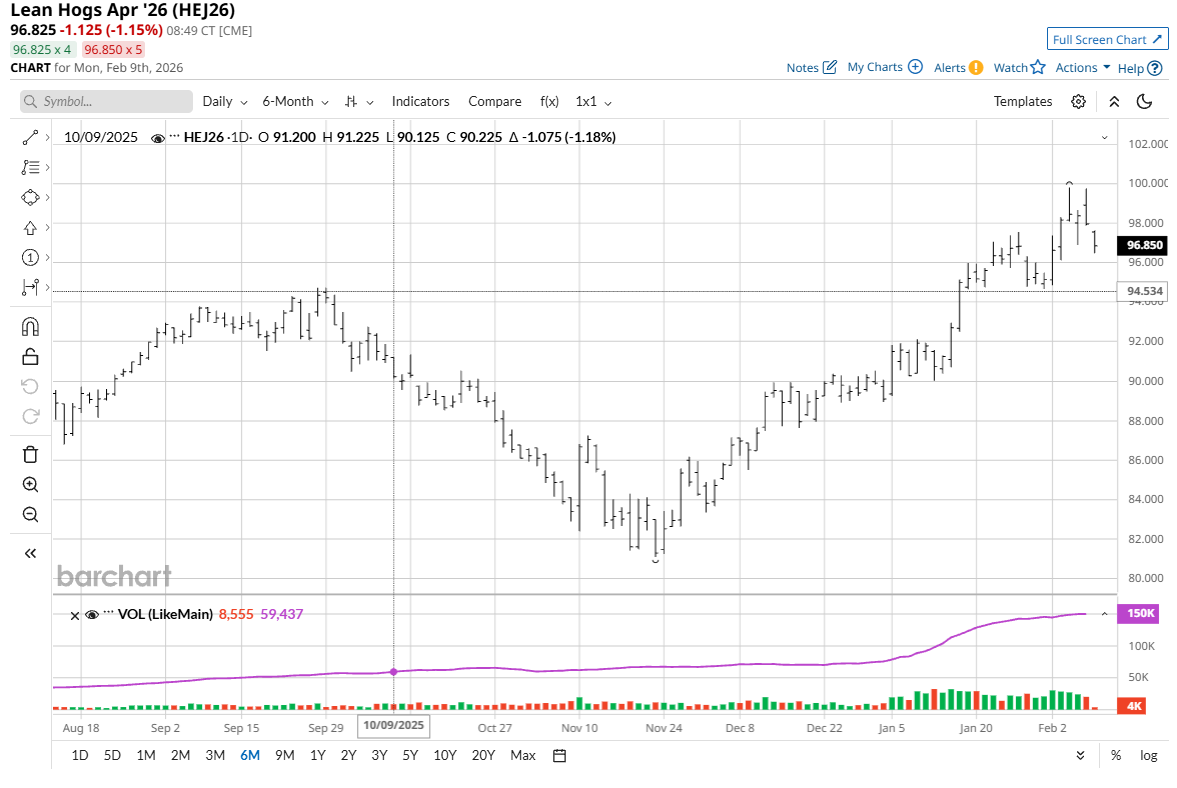

For the cattle futures bulls to make runs at the record highs scored last fall, and for lean hogs (HEJ26) to continue to trend higher, it’s likely the U.S. stock indexes will need to at least hold near their present levels, while the metals markets will need to squash the recent extreme daily price volatility.

U.S. Cattle Supplies on Feedlots Remain Historically Low

The USDA’s semi-annual cattle inventory report in late-January confirmed the U.S. herd declined for the ninth straight year. The USDA also verified stepped-up heifer retention in that report, lending evidence toward early herd-rebuilding. However, that process is likely to take time and strong demand for ground beef, combined with reduced cattle slaughter, is likely to continue to underpin cash and futures prices.

Don’t be surprised to see live cattle and feeder cattle futures prices challenge their record highs scored last fall — and possibly sooner rather than later.

Lean Hog Futures Prices Trending Solidly Higher

April lean hog (HEJ26) futures on Friday fell 42 1/2 cents to $97.95 but for the week were up $2.80. The lean hog futures market late last week paused and saw some mild profit taking after April futures hit a contract high last Wednesday. Still-bullish technicals and the recent rallies in the cash hog and CME lean hog index prices will likely keep hog futures prices elevated in the near term. Hog futures’ premium to the CME lean hog index also is a positive element for the futures market.

The latest CME lean hog index is up 32 cents to $83.38. Today’s projected cash index price is up another 19 cents to $86.57. The national direct five-day rolling average cash hog price quote for last Friday was $62.81.

Improving wholesale pork market fundamentals have supported price gains in futures as grocers ramp up pork purchases to compensate for tighter beef supplies, exacerbated by recent weather and reduced slaughter.

U.S. Pork Export Sales Need to Improve

The USDA last Thursday reported that U.S. pork export sales of 35,100 MT for 2026 were down 37% from the previous week and down 48% from the prior 4-year average. Exports of 37,600 MT were up 5% from the previous week and 6% from the prior 4-week average.

Those numbers need to improve in the coming weeks for the cash hog, futures, and fresh pork markets to remain elevated. This week saw no pork purchases from China, as reports say that nation is dealing with a glut of pork supplies.

I enjoy hearing from my Barchart readers all over the world. I try to respond to all your emails to me. My email address is jim@jimwyckoff.com.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.