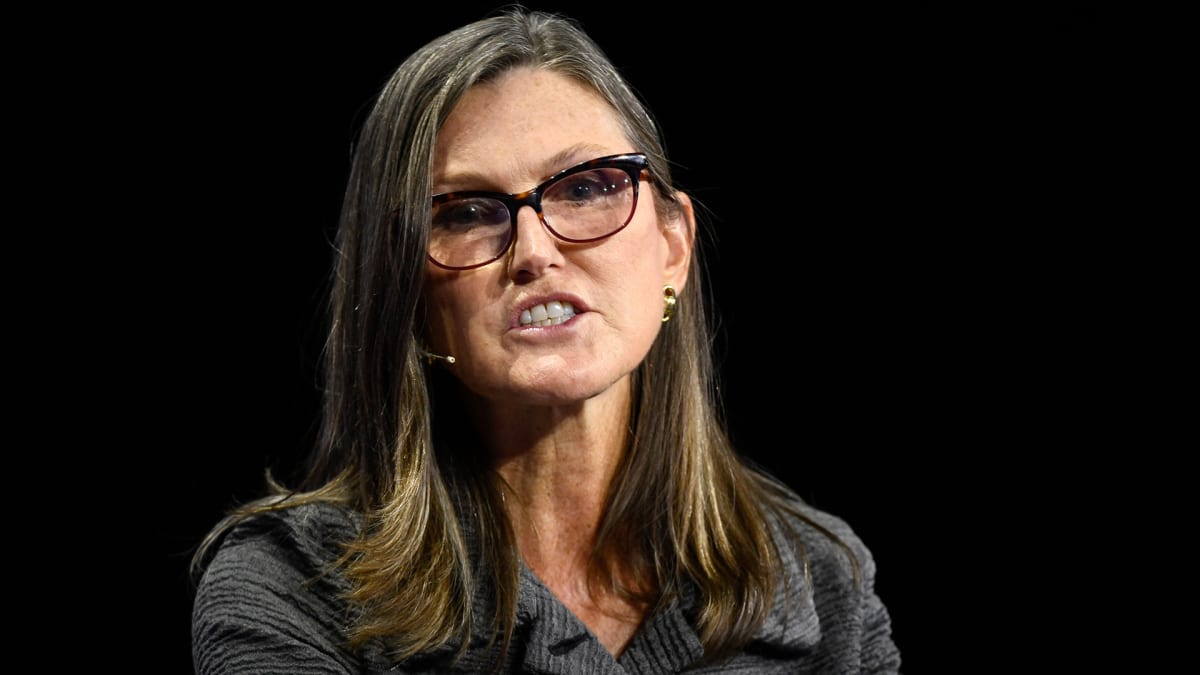

The prominent asset manager Cathie Wood, chief executive of Ark Investment Management, continued to buy and sell big-name stocks on Feb. 10.

Ark exchange-traded funds purchased 162,325 shares of beleaguered Coinbase Global (COIN), the biggest U.S. cryptocurrency exchange. That stash was valued at $9.3 million.

Wood likely views Coinbase as a bargain amid the stock’s 72% plunge over the past year, caused by turmoil in the digital-currency market. To be sure, the stock has rebounded 57% year to date.

She has been buying Coinbase for months. It ranks as the eighth biggest holding in Wood’s flagship Ark Innovation ETF (ARKK).

Ark Fintech Innovation ETF (ARKF) snagged 263,504 shares of online securities brokerage Robinhood Markets (HOOD) on Feb. 10, valued at $2.6 million as of that day’s close.

The stock has lost 25% over the past year, as financial markets struggled. But it has come back 23% year to date. It’s the 18th biggest holding in flagship Ark Innovation.

Wood Pares Exact Sciences, Nvidia Shares

Wood continued her recent selling of Exact Sciences (EXAS) Feb. 10. Ark funds dumped 115,345 shares of the company, valued at $7.4 million as of that day’s close. Exact Sciences is a medical diagnostics provider famous for its Cologuard at-home colon-cancer test.

Wood apparently is trying to take advantage of the stock’s recent bounce. Exact Sciences’ stock has lost 19% over the past year, but it has more than doubled since Oct. 14, buoyed by strong earnings and the rally of technology stocks.

Wood has unloaded more than 2 million Exact Sciences shares the year. But the company is still the third biggest holding in Ark Innovation ETF, behind No. 1 Tesla and Zoom Video Communications. Exact Sciences was No. 1 for part of January.

Another Feb. 10 sale by Wood: semiconductor titan Nvidia (NVDA). Ark funds shed 17,631 of the company’s shares, valued at $3.7 million.

Nvidia shares have slipped 12% over the past year but have surged 91% since Oct. 14, helped by the company’s strong fundamentals and an industry rebound. Wood sold some of the stock earlier this year, too.

Wood’s Returns Tumble

Meanwhile, Wood’s performance hasn’t exactly overwhelmed the investment world over the past year, as her young technology stocks have slumped. Ark Innovation has slid 45% during that period and 75% from its February 2021 peak.

That said, the fund has rebounded 26% so far this year, joining the tech stock surge.

Wood has defended her strategy by noting that she has a five-year investment horizon. But the five-year annualized return of Ark Innovation was only 1.69% through Feb. 10, compared with 11.27% for the S&P 500.

The fund’s performance also doesn’t come close to Wood’s goal for annualized returns of 15% over five-year periods.

Ark Innovation, with $7.4 billion in assets, saw a net investment outflow of $196 million during the past five days, according to ETF research firm VettaFi. But it has enjoyed an inflow of $1.34 billion over the past year.