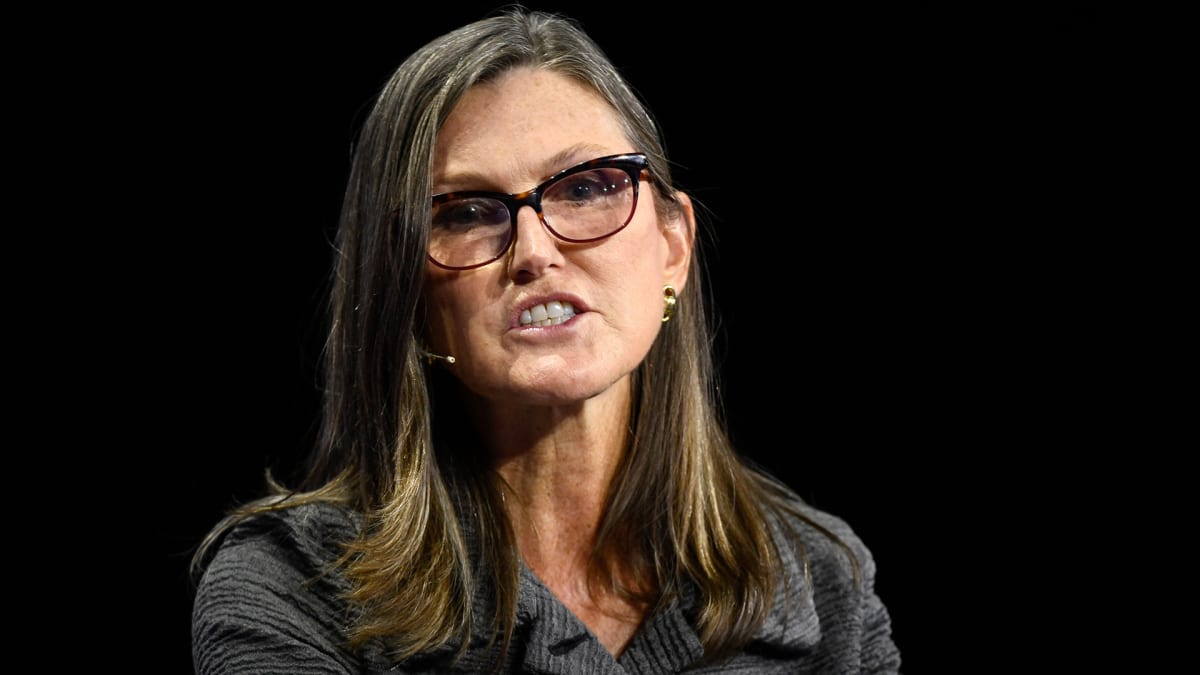

Throughout this year’s stumble in the stock market, famed money manager Cathie Wood, has both bought and sold young technology stocks, which are her staple.

The chief executive of Ark Investment Management repeated this pattern Friday.

All the valuations below are as of Friday’s close, and all the trades came in the Ark Next Generation Internet ETF (ARKW).

It purchased 144,251 shares of online securities brokerage Robinhood Markets (HOOD) Friday, valued at $1.7 million. The stock has dropped 37% year to date.

Ark Next Generation Internet unloaded 145,134 shares of e-commerce company Shopify (SHOP) Friday, valued at $5 million. The stock has plunged 74% so far this year.

The Ark fund dumped 217,690 shares of online sports gambling company DraftKings (DKNG) Friday, valued at $3.3 million. The stock has slumped 43% year to date.

And Ark Next Generation Internet sold 52,623 shares of videogame platform Roblox (RBLX), valued at $2.4 million. The stock has dived 55% so far this year.

Wood Misses Her Mark

Ark’s ETFs have tumbled this year, as their technology-stock holdings suffered from weak earnings. Wood has defended her strategy by noting that she has a five-year investment horizon.

And the five-year track record of her flagship Ark Innovation ETF (ARKK) could indeed give investors comfort up to May 9. The fund’s five-year return beat that of the S&P 500 until then. But the five-year annualized return of Ark Innovation totaled only 3.8% through Oct. 28, far behind the S&P 500’s 10.6% return.

The fund’s performance also falls below Wood’s goal for annualized returns of 15% over five-year periods.

Ark Innovation’s share price has tumbled 60% so far this year, and it’s down 76% from its February 2021 peak.

The $7.8 billion fund’s underperformance may finally be starting to push investors away. Ark Innovation saw a net outflow of $368 million in the three months through Oct. 28, according to VettaFi, an ETF research firm. But it has still registered an inflow of $1.41 billion year to date.

Wood's Fans and Critics

You might wonder why so many investors have stuck with Wood, despite the returns. The fact that she had one spectacular year certainly helps. Ark Innovation ETF skyrocketed 153% in 2020.

Wood has become something of a rock star in the investment world, appearing frequently in the media. She is clearly intelligent and articulate, explaining financial concepts in ways that novice investors can understand.

Still, Wood has her detractors. On March 29, Morningstar analyst Robby Greengold issued a scathing critique of Ark Innovation.

“ARKK shows few signs of improving its risk management or ability to successfully navigate the challenging territory it explores,” he wrote.

Wood countered Greengold’s points in an interview with Magnifi Media by Tifin. “I do know there are companies like that one [Morningstar] that do not understand what we're doing,” she said.