Shares of Roblox (RBLX) -), the popular video game creator, have been struggling recently. Down more than 7% for the year, the company's stock is down around 60% since it debuted in 2021. Though Roblox shares jumped slightly in July, the stock fell again in August, a trend that has continued into September.

The company reported a 15% year-over-year increase in revenue for the second quarter of 2023, with bookings jumping by 22% compared to the year-ago period. The company additionally reported a net loss of 46 cents per share.

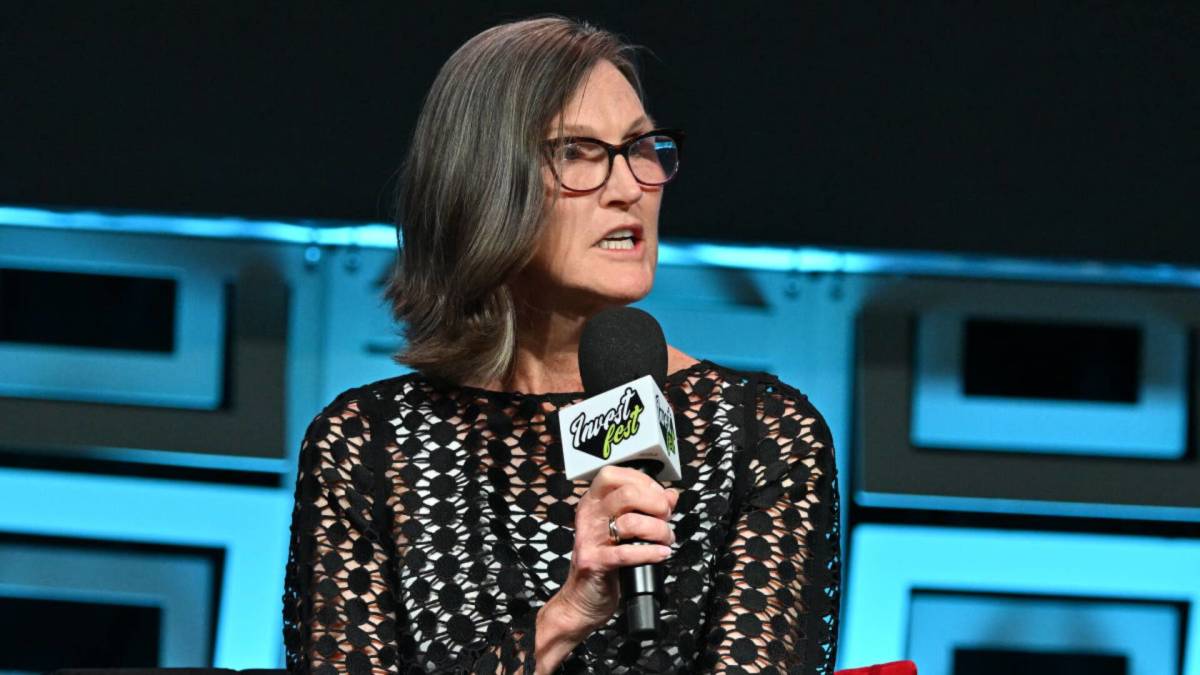

Related: Cathie Wood gushes over her favorite stock -- but experts aren't seeing the light

Despite Roblox's recent rocky performance, Ark Invest has identified the firm as one of its lauded tech disruptors. Ark's flagship Innovation fund picked up 405,330 shares of Roblox Sept. 20, worth around $10.6 million based on Roblox's closing price of $26.25 per share.

The ETF's Roblox holding, worth $228.5 million, is weighted at 3.18% of the fund, which is dominated by Ark's Tesla (TSLA) -) holding.

Cathie Wood, CEO and investment lead of Ark Invest, has been one of Tesla and Elon Musk's most ardent supporters for several years, now. Wood recently defended her Tesla thesis, predicting that, largely because of a coming push into autonomous taxis, Tesla will be trading at a range of $1,400 to $2,000 per share by 2027.

Tesla stock closed Sept. 20 at $262.59 per share.

More on Ark Invest:

- Cathie Wood knows how the U.S. economy can avoid a recession

- Cathie Wood dumps nearly $30 million worth of two beloved tech giants

- Cathie Wood dumps another $1.8 million of a beloved stock after record earnings

Despite her seemingly endless support of the electric vehicle maker, Wood has sold around $50 million worth of Tesla stock throughout September.

Ark Innovation trimmed its Tesla holding by 32,080 shares, worth around $8.4 million, Sept. 20. The day before, the same fund dumped around $20.5 million worth of Tesla stock. Ark trimmed its total Tesla holdings by approximately 30,000 shares, worth around $8.4 million, Sept. 14. The investment firm cut its Tesla holdings by around 50,000 shares, worth $13.8 million, Sept. 13.

Tesla, which is up more than 110% for the year, remains Ark Innovation's largest holding, weighted at 11.25% of the fund. After its latest round of trimming, the ETF's Tesla holding has fallen in value to around $808.3 million.

This holding was worth more than $877 million Sept. 14.

Action Alerts PLUS offers expert portfolio guidance to help you make informed investing decisions. Sign up now.