Like many top investors, Cathie Wood, head of Ark Investment Management, likes to take profit on her positions after major runups.

If you’re an experienced investor, you’ve likely heard of her. She may be the country’s most famous money manager after Warren Buffett.

Wood (Mama Cathie to her followers) soared to acclaim after a stupendous return of 153% in 2020 and lucid presentations of her investment philosophy in numerous media appearances.

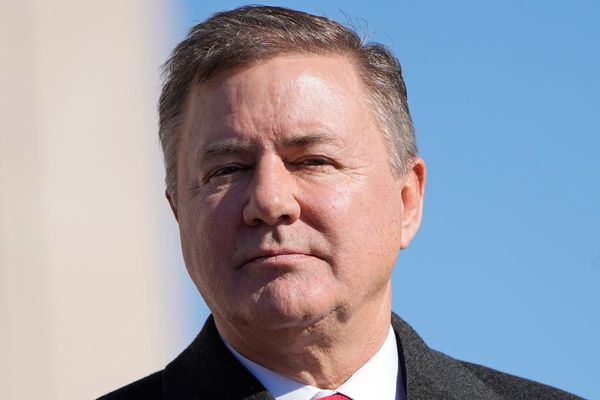

Image source: Cindy Ord/Getty

But her longer-term performance is less impressive. Wood’s flagship Ark Innovation ETF (ARKK) , with $6.3 billion in assets, produced annualized returns of 0.2% for the past 12 months, negative 27.23% for the past three years and positive 0.96% for five years.

That’s quite woeful compared to the S&P 500. The index posted positive annualized returns of 26.27% for one year, 10.26% for three years, and 15.33% for five years. Ark Innovation’s numbers also fall well shy of Wood's goal for annual returns of at least 15% over five-year periods.

Cathie Wood’s straightforward strategy

Her investment philosophy is pretty simple. Ark ETFs usually purchase emerging-company stocks in the high-tech categories of artificial intelligence, blockchain, DNA sequencing, energy storage, and robotics. Wood maintains that companies in those categories will change the world.

Of course, these stocks are quite volatile, so the Ark funds’ values frequently fluctuate up and down. Wood adds to and subtracts from her top names frequently.

Investment research titan Morningstar offers a harsh assessment of Wood and Ark Innovation ETF. Investing in young companies with slim earnings “demands forecasting talent, which ARK Investment Management lacks,” Morningstar analyst Robby Greengold wrote in March.

Related: Cathie Wood unveils surprising Tesla stock price target

The potential of Wood’s five high-tech platforms listed above is “compelling,” he said. “But the firm’s ability to spot winners and manage their myriad risks is less so…. It has not proved it is worth the risks it takes.”

This isn’t your father’s investment portfolio. “Wood’s reliance on her instincts to construct the portfolio is a liability,” Greengold said. “The highly correlated stock prices of its holdings belie its apparent diversification across many sectors.”

Wood has defended herself from Morningstar’s criticism. “I do know there are companies like that one [Morningstar] that do not understand what we're doing,” she told Magnifi Media by Tifin in 2022.

“We do not fit into their style boxes. And I think style boxes will become a thing of the past, as technology blurs the lines between and among sectors.”

But some of Wood’s customers apparently agree with Morningstar. During Ark Innovation’s rally of the past 12 months, it suffered a net investment outflow of $2.1 billion, according to ETF research firm VettaFi.

Wood’s recent trades

In the past week, Ark funds have sold 454,707 shares of online securities brokerage Robinhood Markets (HOOD) , valued at $10.8 million as of Wednesday’s close. That was the day of Wood’s last sale.

Robinhood’s stock has more than doubled over the past 12 months. So Ark had plenty of profits to take. The company still represents the seventh biggest holding in Ark Innovation.

Related: Cathie Wood creates new position in top tech stock

The stock’s surge came amid a boom in securities trading by retail investors, which means more revenue for Robinhood.

The company’s revenue soared 40% in the first quarter from a year earlier, to a record high of $618 million. Revenue from cryptocurrencies more than tripled (up 232%) to $126 million as bitcoin soared in the latest quarter.

Net income totaled $157 million, or 18 cents a share, swinging from a net loss of $511 million, or 57 cents a share. The latest earnings numbers smashed analysts’ expectations.

To be sure, the company does face a potential dark cloud. The Securities and Exchange Commission issued Robinhood a Wells Notice regarding its cryptocurrency business.

The SEC issues a Wells notice when it finds infractions. It allows the company or individual a chance to respond to the investigation before any rulings are issued.

Fund manager buys and sells:

- Cathie Wood creates new position in top tech stock

- These stocks could start paying dividends soon

- Single Best Trade: Veteran fund manager unveils top stock pick

Robinhood did respond, protesting the SEC’s decision. "After years of good faith attempts to work with the SEC for regulatory clarity…, we are disappointed that the agency has decided to issue a Wells Notice related to our U.S. crypto business," the company said in a statement.

But the threat remains. "The Wells Notice clouds the future of this [cryptocurrency] income stream," Lauren Ashcraft, financial services analyst at Emarketer, told Reuters.

Perhaps Wood shares her concern.

Related: Veteran fund manager picks favorite stocks for 2024