Growth investors and market bulls tend to love Cathie Wood for her long-term investments.

Most notably, she crushed bitcoin, Tesla (TSLA) and other trends that unfolded over the past few years.

As a result, her flagship fund, the ARK Innovation ETF (ARKK), enjoyed an enormous rally. The shares climbed almost fivefold from the March 2020 low to the post-covid highs in early 2021.

The bear market caught up with ARKK, though, as the ETF eventually coughed up more than 80% of its value.

Don't Miss: Cybersecurity Stocks Are Surging. Here's the Trade Now.

While ARKK is trading better in 2023 than it was in 2022 — up 20% so far this year and outpacing the four major U.S. stock indexes — there is still a worry that more losses are to come.

At one point on Monday, the ARKK ETF was up almost 3% on the session. At last glance, it’s now down slightly on the session.

Let’s have another look to see what may be next.

Trading the ARKK ETF

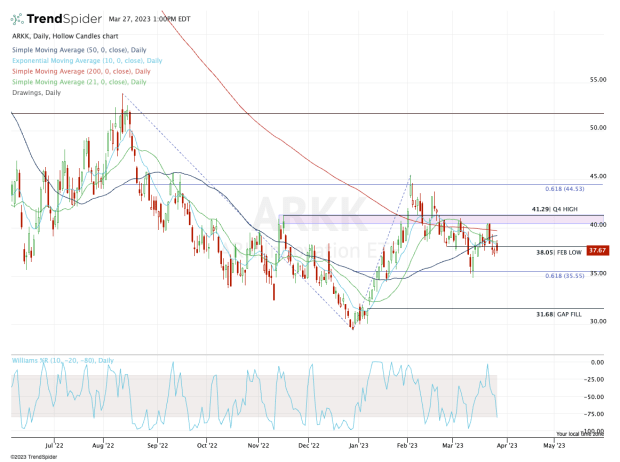

Chart courtesy of TrendSpider.com

There are a couple of nuances to garner our attention here. While the Nasdaq has performed well this month — names like Apple (AAPL) and Nvidia (NVDA) led it higher — ARKK has not traded all that well lately.

In fact, if it closes lower on Monday, it will mark the ETF’s fourth straight daily decline. Conversely, the S&P 500 and Nasdaq are going for their third straight daily gain.

Additionally, the ARKK ETF is below all its daily moving averages, while the Nasdaq is above all of them.

If we zoom in more closely, traders will notice that ARKK is slipping below last month’s low. Should it continue to lose ground, keep an eye on last week’s low near $37.

Technically speaking, a move below that level could open the door down to the current March low and the 61.8% retracement in the $35 to $35.50 area. If the selling really accelerates, the $31.68 gap-fill could be in play.

Don't Miss: Charge Up With First Solar Stock as Shares Power Higher

On the upside, $41 is the line in the sand. Above this mark puts ARKK back above all its daily moving averages, as well as the March high. That could open the door back up to $45, then the $50 to $53 zone.

Either way, for a larger move to occur the ETF’s top holdings will likely need to move in unison. The four largest holdings, in order, include: Tesla, Zoom Video (ZM), Roku (ROKU), Coinbase (COIN) and Exact Sciences (EXAS).

Together, those five stocks account for more than 39% of the ARKK ETF.

Action Alerts PLUS offers expert portfolio guidance to help you make informed investing decisions. Sign up now.