Shares of Roku (ROKU) -) tanked 8% Wednesday after Wells Fargo analyst Steve Cahall cut his price target for the company. Cahall, citing concerns about a softening trend in the ad market for the fourth quarter, brought his price target down to $70 from $84, and warned that Roku might experience some pullback.

"We heard at our Advertising Day last month that scatter remains weak quarter-over-quarter, while Roku will also face a reduction in media and entertainment spend due to the ongoing Hollywood strikes," he wrote, adding that he expects weaker fourth-quarter guidance as well.

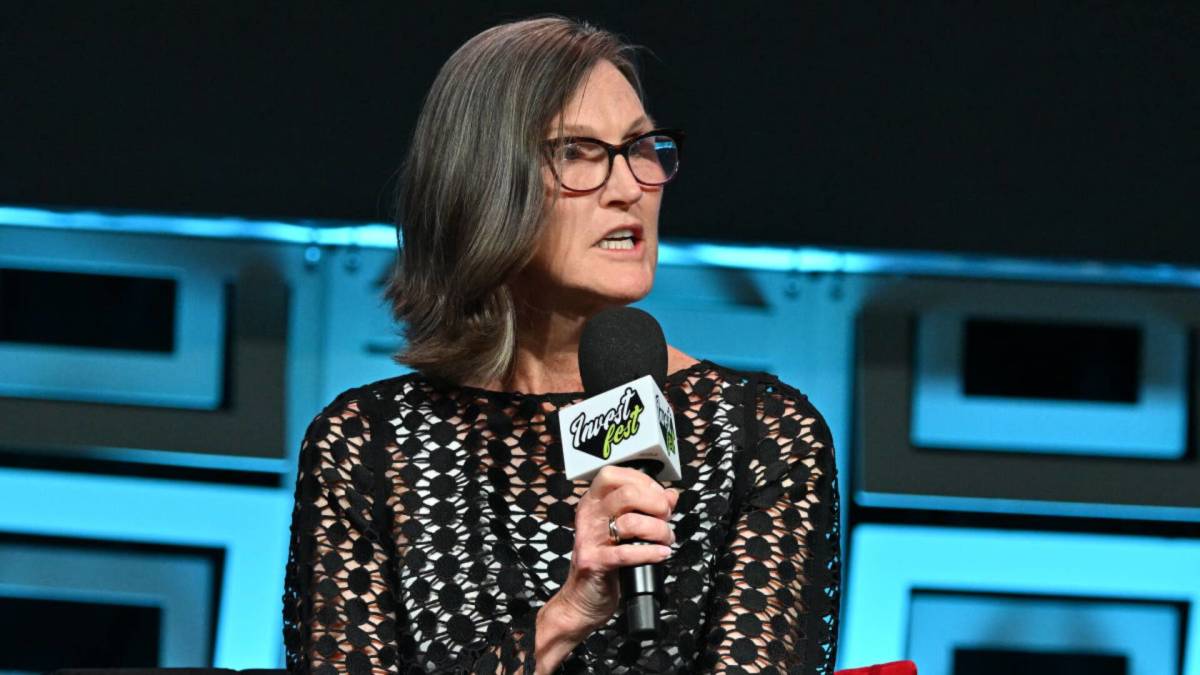

Related: Cathie Wood takes $7 million out of wildly successful stock right before earnings

The analyst additionally projected that revenue per streaming hour will fall 8% year-over-year in the fourth quarter, and that platform revenue would come in at $780 million, below Street consensus.

Though Roku's stock is down about 17% over the past quarter, shares of the company are up more than 50% for the year.

Shares of Roku rose more than 2% after market open.

Analysts, on average, have given Roku a "hold" rating, with an average price target of $84.43.

To Cathie Wood of Ark Invest, the dip presented an opportunity to snap up more shares in one of her firm's favorite stocks. Ark's flagship Innovation ETF picked up 104,393 shares of Roku Wednesday, a purchase worth around $6.5 million.

This brings the fund's total Roku holding up to 7.62% of the fund, worth just shy of $500 million.

The company will announce its third-quarter results Nov. 1.

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.