Cathie Wood-led Ark Investment Management on Monday loaded up more shares in Robinhood Markets Inc (NASDAQ:HOOD), Coinbase Global Inc (NASDAQ:COIN) and Block Inc (NYSE:SQ) on the day shares of the cryptocurrency-linked fintech stocks rose after the recent slump.

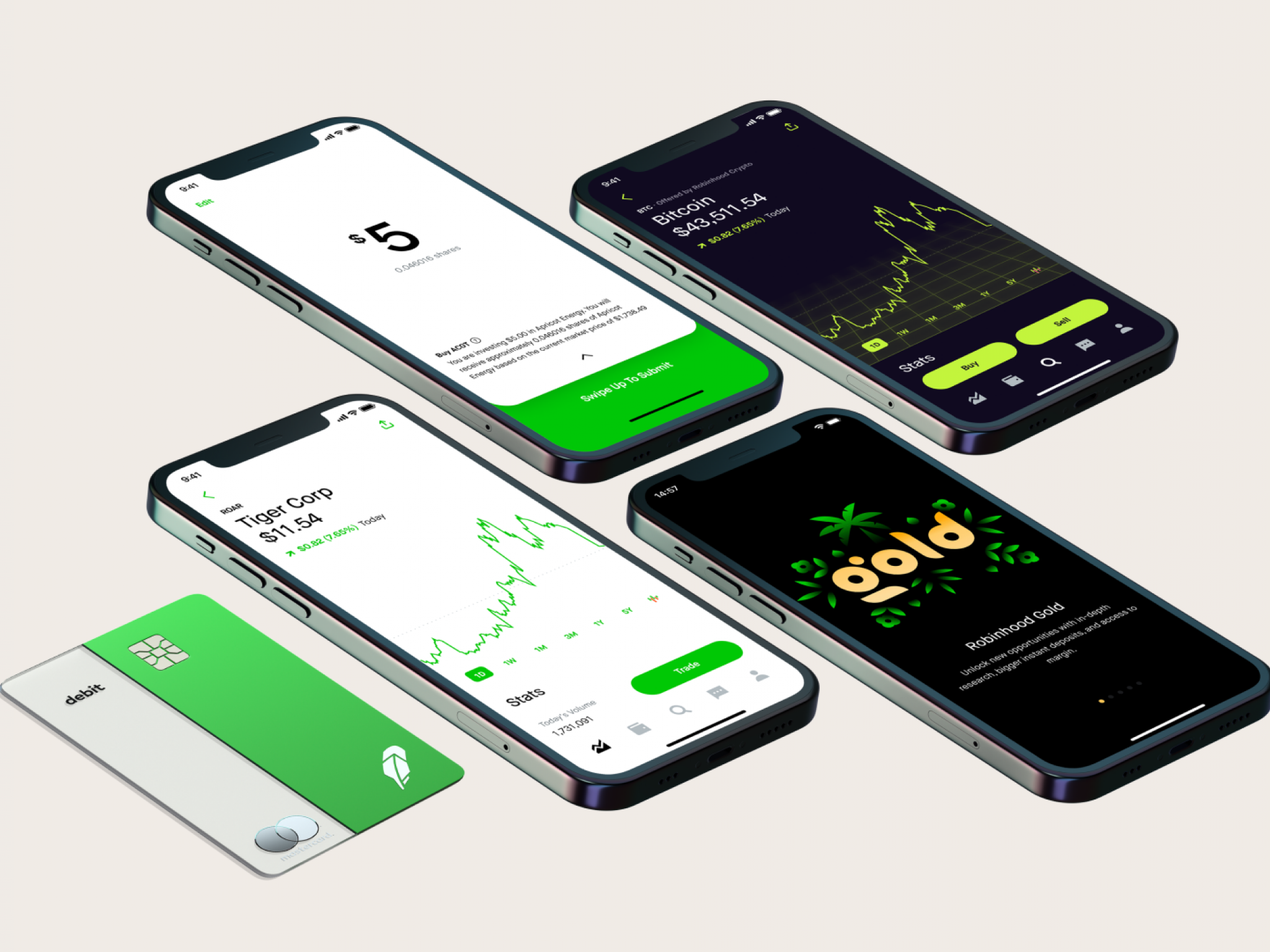

The popular money manager bought 129,000 shares — estimated to be worth $1.8 million — in Robinhood on the day shares of the financial platform that deals in stocks, exchange-traded funds and cryptocurrencies soared.

Robinhood stock closed 11.15% higher to close at $14.15 on Monday. The stock is down 59% since going public in July.

The asset management firm has been piling up shares in the commission-free trading app that also deals in Bitcoin (CRYPTO: BTC), Ethereum (CRYPTO: ETH), Dogecoin (CRYPTO: BTC) and other cryptocurrencies.

| Company | No. of shares | Estimated $ value (million) |

| Robinhood | 129,000 | 1.8 |

| Coinbase | 34,538 | 6.56 |

| Block | 105,287 | 12.87 |

The money managing firm bought shares in Robinhood via the Ark Innovation ETF (NYSE:ARKK) on Monday. It also owns shares via two other ETFs — the Ark Fintech Innovation ETF (NYSE:ARKF) and the Ark Next Generation Internet ETF (NYSE:ARKW).

See Also: Cathie Wood Buys The Dip In Heavy-Crypto-Exposure Stocks Robinhood And Block

The three ETFs held 24.4 million shares — worth $310.5 million — in Robinhood, prior to Monday’s trade.

Ark Invest also snapped up 105,287 shares in the Jack Dorsey-led financial services and digital payments company Block and 34,538 shares in Coinbase. The purchased shares were estimated to be worth $12.8 million and $6.56 million in Block and Coinbase respectively.

Block shares closed 10.8% higher at $122.3 a share on Monday, while those of Coinbase closed 7% higher at $190.15 a share. Shares of Block and Coinbase are down 25.5% and 24.3% respectively.

Ark Invest held 5.9 million shares — worth about $653 million — in Block, ahead of Monday’s trades.

In Coinbase, it held 5 million shares — worth $904.8 million — prior to Monday’s trades.