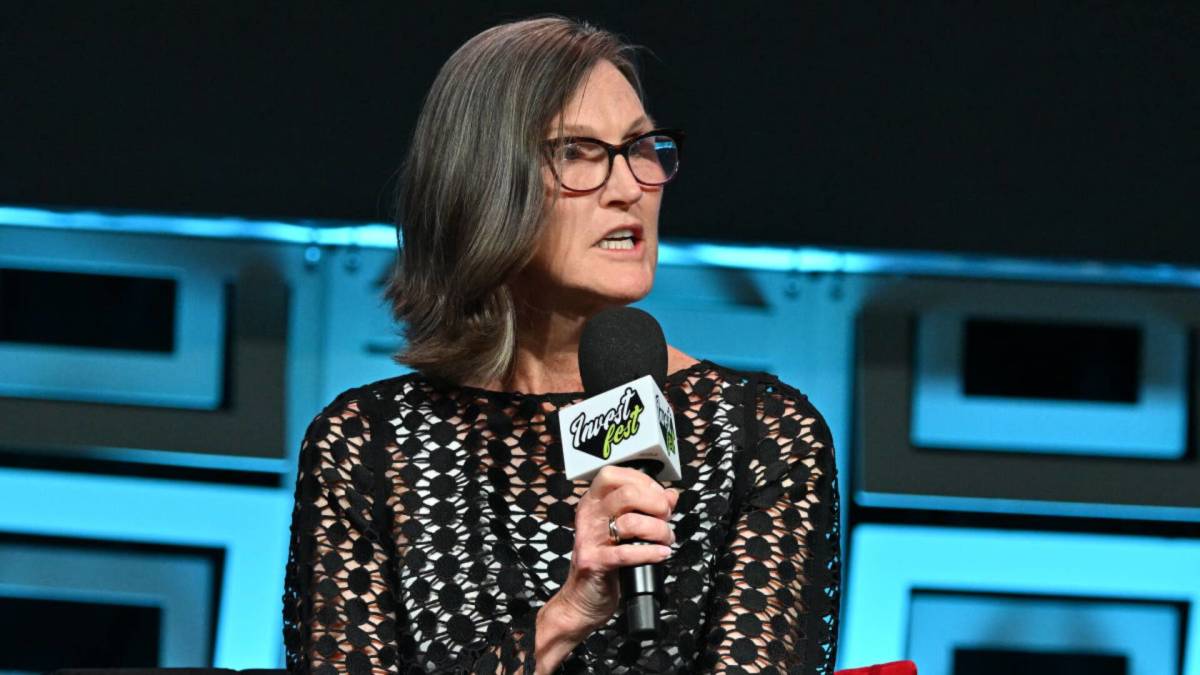

Cathie Wood, head of Ark Investment Management, often dives in to buy her favorite stocks when they drop.

That’s exactly what she did on Monday, August 5. But this time, she purchased a big blue-chip tech stock rather than the smaller companies representing her usual stock and trade.

The investment community has divergent views toward Wood, who may be the country’s best-known investor after Warren Buffett. Boosters say she’s a technology visionary, while detractors say she’s just a mediocre money manager.

Wood (Mama Cathie to her followers) rocketed to acclaim after a stupendous return of 153% in 2020 and lucid presentations of her investment philosophy in numerous media appearances.

But her longer-term performance is less impressive. Wood’s flagship Ark Innovation ETF (ARKK) , with $5.1 billion in assets, produced negative annualized returns of 13% for the last 12 months, 32% for the past three years, and 2% for five years.

That’s quite woeful compared to the S&P 500.

The benchmark stock market index posted positive annualized returns of 18% for one year, 7% for three years, and 15% for five years. Ark Innovation’s numbers also fall well shy of Wood's goal for annual returns of at least 15% over five-year periods.

Cathie Wood’s straightforward investment strategy

Her investment philosophy is pretty simple.

Ark ETFs usually purchase emerging-company stocks in the high-tech categories of artificial intelligence, blockchain, DNA sequencing, energy storage, and robotics.

Wood maintains that companies in those categories will change the world.

Of course, these stocks are quite volatile, so the Ark funds’ values frequently fluctuate up and down. Wood frequently adds to and subtracts from her top names because of their volatility.

Investment research titan Morningstar offers a harsh assessment of Wood and Ark Innovation ETF.

Investing in young companies with slim earnings “demands forecasting talent, which ARK Investment Management lacks,” Morningstar analyst Robby Greengold wrote in March.

The potential of Wood’s five high-tech platforms listed above is “compelling,” he said. “But the firm’s ability to spot winners and manage their myriad risks is less so…. It has not proved it is worth the risks it takes.”

Related: Cathie Wood flip-flops on embattled tech stock

This isn’t your father’s investment portfolio. “Results range from tremendous to horrendous” for Wood’s young, often unprofitable stocks, Greengold said.

Wood has defended herself from Morningstar’s criticism. “I do know there are companies like that one [Morningstar] that do not understand what we're doing,” she told Magnifi Media by Tifin in 2022.

“We do not fit into their style boxes. And I think style boxes will become a thing of the past, as technology blurs the lines between and among sectors.”

However, some of Wood’s customers apparently agree with Morningstar.

Over the past 12 months, Ark Innovation ETF suffered a net investment outflow of $2.3 billion, according to ETF research firm VettaFi. For perspective, Ark Innovation’s total assets dropped 15% in just the last 12 days.

Cathie Wood goes big on Amazon

On Monday, Ark funds snapped up 176,963 shares of retail/technology colossus Amazon (AMZN) , worth $28.5 million as of that day’s close. This was Wood’s first trade in the company since she purchased shares on June 6.

Related: Analysts rethink Amazon stock price targets after earnings

Amazon's stock price has slid 18% over the last month, along with other tech stocks, amid a pullback in the mania over artificial intelligence. So Wood may have viewed the company as a bargain. Its stock traded at $164.70 on August 6.

It has dropped 11% since Amazon reported second-quarter earnings on Aug. 1 because of the company’s heavy capital spending, much of it focused on AI.

Amazon’s capital spending totaled $30.5 billion in the first half of the year, and the company said it would dole out even more in the second half.

Morningstar, Osterweis like Amazon, too

Morningstar analyst Dan Romanoff shares Wood’s bullishness on Amazon. He raised his fair value estimate for the stock to $195 per share from $193 after “solid” second-quarter results.

“The company’s third-quarter outlook aligned with our revenue estimate and was better than our operating income estimate,” he wrote in a commentary. “Changes to our model are modest but center around continued profitability enhancements in the near term.”

Fund manager buys and sells:

- Warren Buffett's Berkshire sheds stock of major bank

- Morningstar unveils top-tier value stocks to own

- Cathie Wood flip-flops on embattled tech stock

Amazon is improving efficiency throughout its network, lowering costs and improving delivery speeds, Romanoff said.

That “ultimately drives increased purchases by Prime members.” Given the stock’s pullback over the past month, “we see shares as increasingly attractive,” he said.

Nael Fakhry, co-manager of Osterweis Growth & Income Fund (OSTVX) , recently told TheStreet.com that Amazon is one of his favorite stocks. He thinks the company will buy back shares and may start a dividend.

The author owns shares of Amazon.

Related: Veteran fund manager sees world of pain coming for stocks