For the first time in a long time, Carnival Cruise (CCL) stock was looking attractive this morning.

From a trader’s perspective, we like stocks that have a trend. It can be an uptrend or a downtrend, but in both cases, there’s a way to trade it. With Carnival, it has been a pretty choppy mess.

Lately, though, the stock was at least moving in the bulls’ direction and following some of the short-term moving averages higher.

At one point on Tuesday, Carnival stock was higher by 8.9%. That’s as it had its highest booking week ever between March 28 and April 3. The easing of Covid-19 restriction is proving to be a boon for the cruise industry, not just Carnival.

Royal Caribbean (RCL) and Norwegian Cruise Line (NCLH) also shot higher on the news as well. In fact, they have been trading better as the cruise industry continues to recover.

However, those two stocks are barely higher on the day now, while Carnival stock is now up just 3.5%.

What does the chart look like and how close are we to a breakout?

Trading Carnival Stock

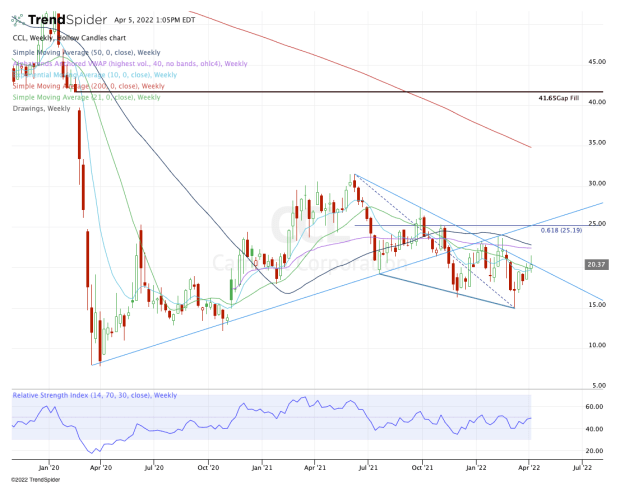

Chart courtesy of TrendSpider.com

Coming into Tuesday, I was hopeful with Carnival stock for several reasons. First, it was above its short- and intermediate-term daily moving averages, which is not clear on the weekly chart above.

However, it was above the 10-week and 21-week moving averages, which is notable. Further, it was building off the recent rally and breaking through current downtrend support (blue line), a resistance level that’s been in play since the high in June.

Now we’re in a tough spot — which is not what traders like. They like clearly defined risk/reward setups. In the case of Carnival, we don’t have that, but we could if it finishes this week strong.

If the stock can close above $20 and downtrend resistance, this week’s high at $21.50 remains in play. On a weekly-up rotation over that mark, it opens the door to the 50-week moving average and the weekly VWAP measure.

If shares can clear the 2022 high of $23.86, then the 61.8% retracement is in play near $25.

On the downside, it’s all about the 10-week and 21-week moving averages. If the stock loses these measures, we could be looking at a scenario where Carnival stock rolls back over.

From an investment perspective rather than a trading perspective, it’s hard to imagine Carnival getting hit so hard that it revisits the $16-range given the positive booking trends. That said, if the overall market comes under enough pressure, it’s not out of the question.