/Carnival%20Corp_%20logo%20at%20night%20by-%20JHVEPhoto%20via%20Shutterstock.jpg)

With a market cap of $33.3 billion, Carnival Corporation & plc (CCL) is a global cruise company providing leisure travel services across North America, Australia, Europe, and other international markets. It operates multiple cruise brands and travel-related assets, offering cruises and vacation experiences through various sales channels worldwide.

Shares of the Miami, Florida-based company have lagged behind the broader market over the past 52 weeks. CCL stock has gained 12.8% over this time frame, while the broader S&P 500 Index ($SPX) has increased 13.9%. In addition, shares of the company are down 6.1% on a YTD basis, compared to SPX’s 1.5% rise.

However, shares of the cruise operator have outpaced the State Street Consumer Discretionary Select Sector SPDR ETF’s (XLY) 6.4% return over the past 52 weeks.

Despite Q3 2025 revenue of $6.33 billion missing expectations, CCL shares jumped 9.8% on Dec. 19 as adjusted EPS of $0.34 beat forecasts by a wide margin and adjusted net income of $454 million exceeded guidance by more than $150 million, driven by strong close-in demand and tight cost control. Investors also reacted positively to full-year 2025 record results, including $3.1 billion in adjusted net income and $7.2 billion in adjusted EBITDA. Optimism was reinforced by robust 2026 guidance projecting $3.5 billion in adjusted net income, higher net yields, record bookings at historically high prices,

For the fiscal year ending in November 2026, analysts expect CCL’s adjusted EPS to increase 12.9% year-over-year to $2.54. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

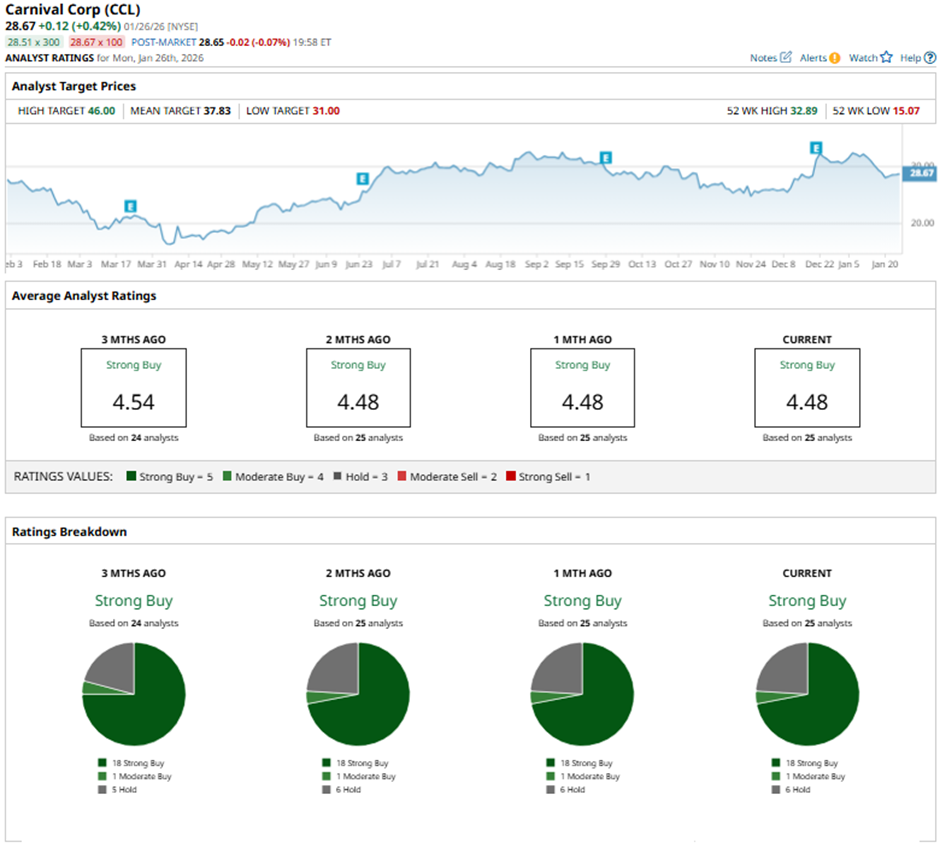

Among the 25 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 18 “Strong Buy” ratings, one “Moderate Buy,” and six “Holds.”

On Jan. 6, Bernstein raised its price target on Carnival to $33, maintaining a “Market Perform” rating.

The mean price target of $37.83 represents a premium of 31.9% to CCL's current price. The Street-high price target of $46 suggests a 60.4% potential upside.