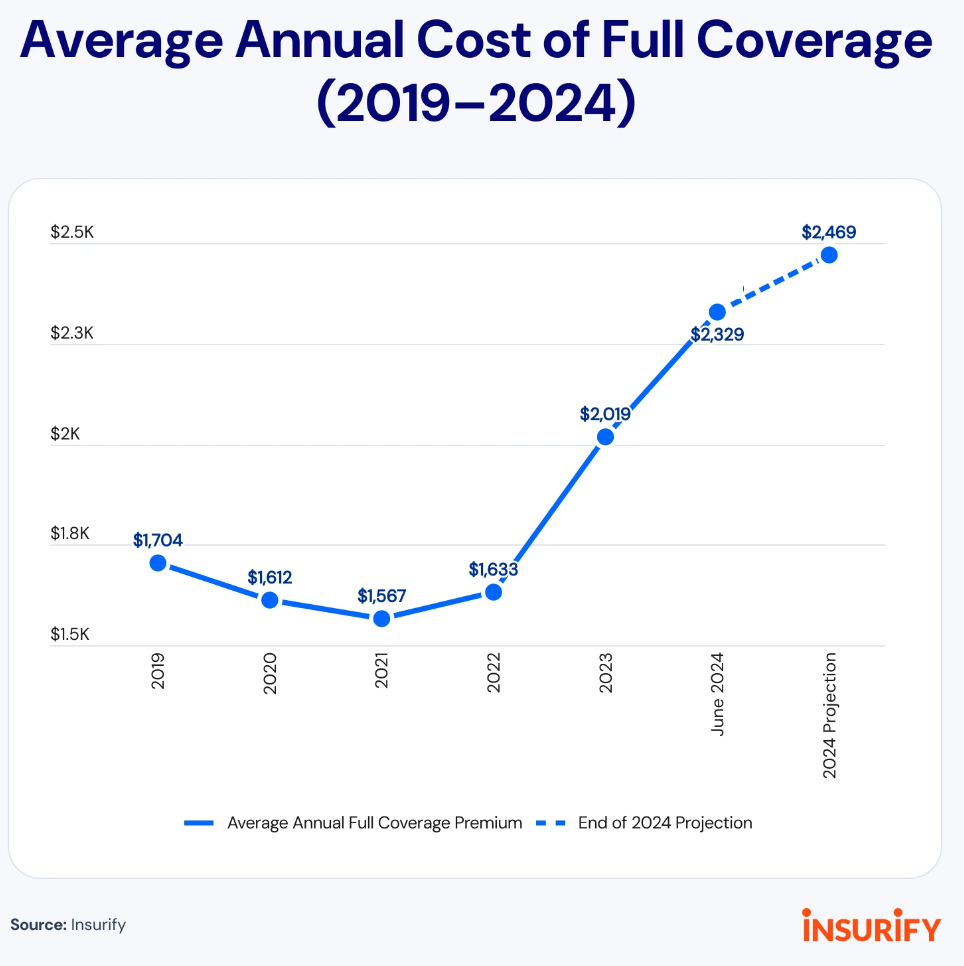

If it seems like car insurance rates are through the roof, it's not your imagination. The cost of full coverage car insurance increased 15% in the first half of 2024 despite experts predicting a slowdown in rate hikes, according to a new report by Insurify, an online insurance marketplace. In 2023, car insurance climbed 19% compared to the year prior, marking the biggest yearly increase since 1976. This year, insurance coverage in three states could increase by more than 50%.

According to Insurify data, the yearly average full-coverage premium is now $2,329. New Hampshire drivers pay the least for car insurance, at an average of $1,000 annually, and Maryland has the highest car insurance costs, with an average full-coverage rate of $3,400 annually.

Some of the most and least expensive states for car insurance may surprise you. We have listed them below, along with steps you can take to lower your cost.

What factors are driving the increase?

Although types of car insurance varies from state to state, nearly every state requires drivers to have some liability coverage. Comprehensive and collision coverage are optional in every state. However, one in seven, or 32.7 million people, drove without car insurance in 2022, according to the latest report by the Insurance Research Council (IRC). Several factors are to blame.

Vehicle maintenance and repair costs have increased by nearly 38% over the past five years, according to the Bureau of Labor Statistics Consumer Price Index (BLS CPI). The same vehicle technology that increases safety and can help drivers avoid accidents, such as blind spot monitoring, adaptive cruise control and lane assist, cost motorists thousands in repair costs. Mechanic labor hours have grown by 40% per claim over the last decade.

An increase in the severity of weather events is driving up auto insurance premiums. According to CCC Intelligent Solutions, hail-related auto claims accounted for 11.8% of all comprehensive claims in 2023, up from 9% in 2020.

Claims from accidents with fatalities have also risen sharply. In the U.S., an estimated 19,515 people died in motor vehicle traffic crashes in 2023, according to National Highway Traffic Safety Administration estimates. Vehicle theft rates and traffic congestion in high-population areas have also led to an increase in insurance costs. Electric vehicles cost 46.9% more to repair than gas-powered cars, with an average repair cost of $6,700, according to CCC data.

States with the highest insurance costs

Insurify analyzed the ten most expensive states for car insurance to identify the hidden factors affecting policyholders.

States with the cheapest insurance costs

In comparison to the rising cost of auto insurance in the ten most expensive states, these are currently the ten states with the cheapest auto insurance.

States where insurance is rising the fastest

The reasons behind the extreme increases in these five states vary, but the shifting weather patterns due to climate change and an increase in severe weather events add to the problem. Three of these states are forecasted to have 2024 rate increases of over 50%: Minnesota, Missouri and California.

Ways to reduce insurance rates

The good news is that drivers can take steps to lower their insurance rates.

- Shopping around and comparing rates from multiple providers may lower your annual cost.

- Bundling home and car insurance.

- Taking advantage of discounts and usage-based insurance programs, like remaining accident-free or for a vehicle's added safety features.

- Increasing your deductible will lower your premium.

- If you drive an older vehicle, consider dropping comprehensive and collision coverage.

- Telematics programs can also help reduce costs for cautious drivers.

“Some insurers have started making downward adjustments in areas where they’ve found opportunities to operate profitably while charging lower rates,” Betsy Stella, vice president of carrier management and operations at Insurify said. “Generally, consumers will continue to see rates rise with inflation, or in areas where traffic accidents are increasing, but in some states, they could see premiums decrease a little again.”