Nine of the ten largest debt raises ever completed for U.S. Cultivation & Retail companies were closed in 2021 and, to a much lesser extent, YTD 2022. Over $3.8B of debt was sold over this period, far more than in any similar period in U.S. Cannabis history.

Investors should be paying close attention to the efforts of MSOs to extend or refinance their upcoming debt maturities.

The debt and equity issuance boom in 2021 provided excess liquidity from which the MSOs are still benefiting. Five of the ten companies on the chart had cash balances above $100M as of June 2022.

Investors are now focusing on the downside of this boom and looking at the maturity schedules of this debt.

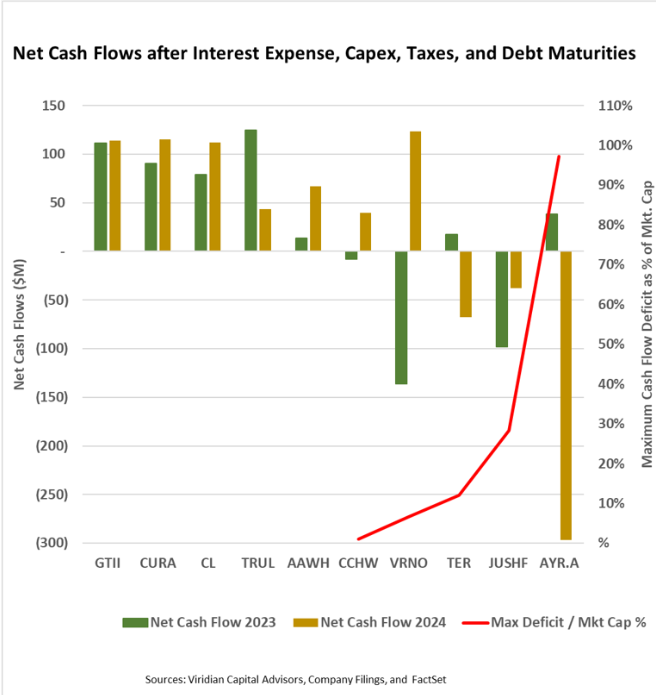

This week’s graph looks more deeply at MSO liquidity, including debt maturities. We utilized consensus analyst estimates for 2023 and 2024 EBITDA, Capex, and Taxes. We imputed interest expense using 10% of net debt at the beginning of each year. Company filings and FactSet provided debt maturity schedules.

The graphs' bars represent net cash flows after interest, taxes, CAPEX, and debt maturities. The green bars show the 2023 net cash flow, while the brown bars show the 2024 net cash flow. The largest total positive net cash flow companies are on the left.

In 2023 and 2024, all companies except Jushi (JUSHF: OTC) have positive projected net cash flow before debt maturities.

Several companies have taken steps to forestall the issue of debt maturities. For example, in July 2022, Green Thumb (GTII: CSE) extended the maturities of $233M of debt from 2024 to 2025.

The red line on the graph (measured on the right axis) shows the maximum net cash flow gap as a percent of current market capitalization. Five of the ten companies have no projected shortfalls in either 2023 or 2024.

-

Verano (OTC:VRNOF) has approximately $280M of debt maturities in 2023, and projected cash flows will be $135M shy of fully funding these maturities. This gap, although seemingly large, only amounts to 6.6% of Verano's market cap and should be financeable.

-

Potentially more problematic, Jushi (OTC:JUSHF) has a net cash flow shortfall of about $97M in 2023, representing about 28% of its market cap, and AYR Wellness (OTC:AYRWF) has a 2024 gap of $297M, representing 97% of current market cap.

-

The Viridian Capital Chart of the Week highlights key investment, valuation and M&A trends taken from the Viridian Cannabis Deal Tracker.

The Viridian Cannabis Deal Tracker provides the market intelligence that cannabis companies, investors, and acquirers utilize to make informed decisions regarding capital allocation and M&A strategy. The Deal Tracker is a proprietary information service that monitors capital raise and M&A activity in the legal cannabis, CBD, and psychedelics industries. Each week the Tracker aggregates and analyzes all closed deals and segments each according to key metrics:

- Deals by Industry Sector (To track the flow of capital and M&A Deals by one of 12 Sectors - from Cultivation to Brands to Software)

-

Deal Structure (Equity/Debt for Capital Raises, Cash/Stock/Earnout for M&A) Status of the company announcing the transaction (Public vs. Private)

-

Principals to the Transaction (Issuer/Investor/Lender/Acquirer) Key deal terms (Pricing and Valuation)

-

Key Deal Terms (Deal Size, Valuation, Pricing, Warrants, Cost of Capital)

-

Deals by Location of Issuer/Buyer/Seller (To Track the Flow of Capital and M&A Deals by State and Country)

-

Credit Ratings (Leverage and Liquidity Ratios)

-

Since its inception in 2015, the Viridian Cannabis Deal Tracker has tracked and analyzed more than 2,500 capital raises and 1,000 M&A transactions totaling over $50 billion in aggregate value.

The preceding article is from one of our external contributors. It does not represent the opinion of Benzinga and has not been edited.