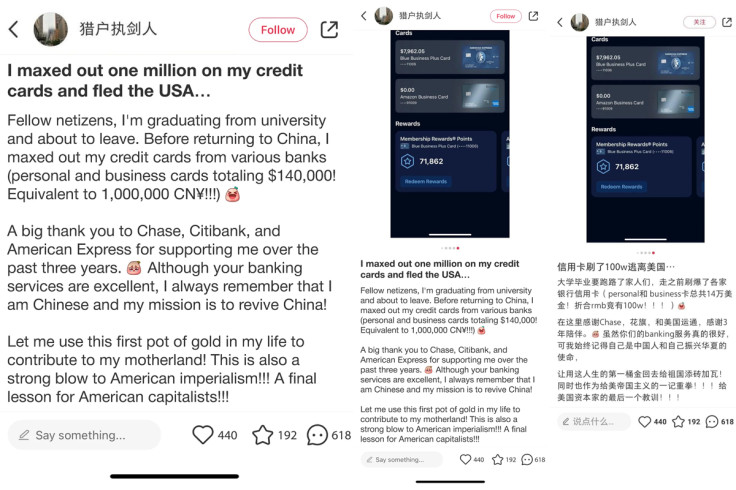

A Reddit post recently went viral after an international student relayed how he fled the US to return to China so he could escape a credit card debt amounting to $140,000 (roughly £110,000).

The alleged student took to Reddit, confessing to racking up massive credit card debt across Chase, Citibank, and American Express. The student also posted his 'appreciation' for the support of the banking companies, but reaffirmed his commitment to China.

The Reddit post read: "A big thank you to Chase, Citibank and American Express for supporting me over the past three years. Although your banking services are excellent, I always remember that I am Chinese, and my mission is to revive China!"

According to a report by NextShark, the graduating university student accumulated a significant amount in debt, roughly equivalent to 1 million yuan, through personal and business credit cards.

Citing resistance to American imperialism, the individual wrote, "Let me use this first pot of gold in my life to contribute to my motherland! This is also a strong blow to American imperialism!!! A final lesson for American capitalists!!!"

The Illusion of Easy Money

The response to the student's actions was divided. Some users expressed disbelief and frustration, while others raised concerns about potential legal repercussions and the long-term impact on the student's credit score.

Meanwhile, some users delved into the complexities of cross-border debt collection, highlighting companies' limitations in pursuing repayment in such situations.

"Nothing will come of it. People do this all the time, the credit card companies just take the hit. His credit is ruined in America but if he doesn't come back it doesn't really affect him anywhere else. It technically is not illegal to default on your debts," a Reddit user (u/No-Sense-6260) claimed.

While avoiding credit card debt repayment entirely isn't advisable due to legal and financial repercussions, card issuers face challenges in debt collection, especially across borders.

Let's explore the steps they can take to recover these debts.

Moving Abroad Doesn't Erase Your Debt

According to debt counselling agency Money Management International, creditors can still pursue collection efforts even if you've trasferred locations or countries. This usually involves sending statements and attempting to contact you by phone or email.

While missed payments may not directly impact the debt itself, they'll be reported to credit bureaus and damage your credit score. This can have significant consequences down the line.

If you continue to miss payments, your creditors may resort to legal action by filing a lawsuit to recover the outstanding debt. Ignoring a lawsuit or failing to appear in court with legal representation will likely result in a judgment against you that would legally require repayment of the debt.

If you have assets in the US, like bank accounts or investments, a court order might allow creditors to seize them for partial debt recovery. Similarly, the creditor can access your wages if you still work in a US-based company to recover the debt.

Now when it comes to international lawsuits for debt collection, it can be complex. Moreover, they aren't easy on the creditors' pocket. For this, various factors such as debt size and local laws are considered before deciding to sue you in your new country.

In many cases, pursuing legal action abroad might not be cost-effective for the creditor. Remember, even if you're only abroad temporarily, a judgment against you can linger. Upon your return, your creditors could still pursue debt collection, potentially affecting your wages or seizing certain assets.

Legal and Financial Repercussions

According to Forbes, your defaulted credit card debt can haunt you for years. Even after a significant amount of time, it could be sold to debt collection agencies, who may employ aggressive tactics to recover the funds.

These agencies often purchase defaulted accounts in bulk at a discount, making them highly motivated to collect. Be aware that navigating debt collection after an account is transferred can be a complex and challenging process.

Owing serious back taxes to the IRS can prevent you from getting a passport or even lead to the revocation of your current one. If you're already abroad when your tax debt is flagged, the State Department might only issue a limited passport to ensure your return.

Financial responsibility is critical to a secure future. By controlling spending and building a healthy savings plan, individuals can avoid the stress of accumulating debt and potentially having to return to work later in life.

A recent report by the Pew Research Center highlights this point, revealing that one in five Americans over 65 are forced back into the workforce due to depleted savings.

Another report suggests switching to cash can be a powerful savings tool. Research shows it can lead to up to 4 percent less spending, and some merchants incentivise cash to be used at lower prices.

The physical act of using cash creates a stronger mental connection to spending, potentially leading to greater control over your budget and significantly, your credit score.