Nike (NKE) this year has been trading well but still has lagged the indexes.

The athletic-apparel giant's shares are up about 6.5% year to date, lagging the S&P 500 and Nasdaq, which are up 6.8% and 13.6%, respectively.

That said, Nike does hold a slight edge over the indexes when it comes to one-year returns. It’s down just 3.8% vs. a 4.1% loss for the S&P 500 and a 7.4% decline for the Nasdaq.

Don't Miss: Trading the S&P 500 and Nasdaq as Earnings Season Revs Up

Perhaps more important to investors is the stock’s underperformance vs. Lululemon Athletica (LULU), which is up about 17% on the year and 2.8% over the past 12 months. A large part of that outperformance has been driven by Lululemon’s recent earnings report and subsequent rally.

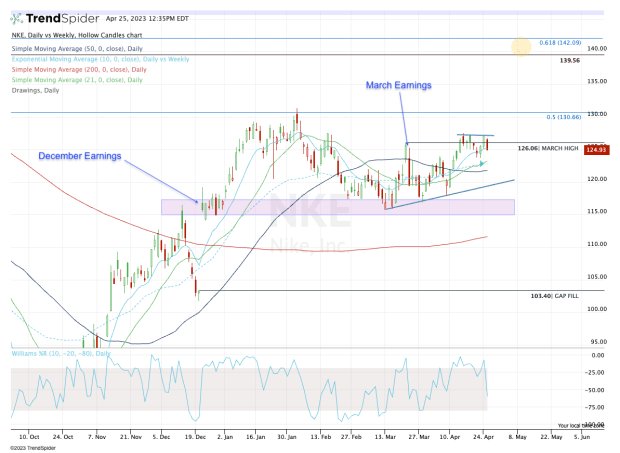

Enough of the stats blast. Investors want to know whether Nike can clear recent resistance and resume its recent sprint higher. Let’s have a look at the chart.

Trading Nike Stock

Chart courtesy of TrendSpider.com

Nike’s earnings report in late December kickstarted a big upside rally that sent it to $131, but the company’s mid-March earnings report sapped a lot of the bullish momentum.

On the plus side, the earnings-induced pullback in March set up the charts for a higher low — a bullish technical development — that came from a strong support area in the $115 to $117.50 area.

On Monday Nike stock traded well, but on Tuesday it has faltered along with the rest of the market.

Don't Miss: McDonald's Reports and the Stock Presents a Buy-the-Dip Opportunity

On a dip, the shares will ideally hold last week’s low near $123.50, along with the 10-week and 21-day moving averages just below this mark. A break puts uptrend support back in play (blue line).

If all these measures fail, then the $115 to $117.50 area is back on the table.

On the upside, Nike stock needs to clear and hold above the March high near $126. If it can do that, the weekly high for the past two weeks comes into play near $127.50.

Above $127.50 puts the 2023 high in play near $131. If Nike stock can close above this mark, the stage could be set for a much bigger run, potentially up to the $139 to $142 area.

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.