It’s been a tough year for Cathie Wood and Ark investors. The asset manager's flagship fund, ARK Innovation ETF (ARKK), is down 71% from its high and 52% so far on the year.

I have started to notice, however, a few positives with ARKK. Perhaps the most optimistic observation is that it did not make new lows in June, while the S&P 500 and Nasdaq did.

For as much flack as Wood and ARKK get, I do find it very noteworthy that this ETF avoided new lows at a time where the market was moving lower.

Its top holdings, like Roku (ROKU), Tesla (TSLA) and Zoom Video (ZM), either did not make new lows last month or, in the case of Roku, very narrowly made new lows.

As a whole, that could speak well for growth stocks. It’s especially meaningful because these so-called risk-on stocks were clearly the most pressured during the bear market and they do tend to bottom before the broader market.

If this group is done going down -- and that’s a huge “if” -- then it could spell good things for the market overall.

Let’s look at ARKK's charts.

Buy or Sell ARKK Right Now?

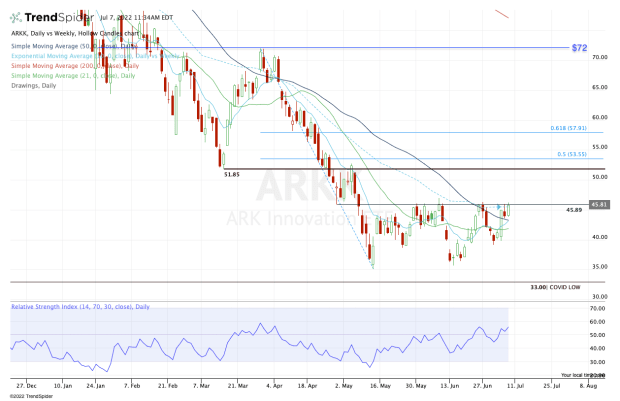

Chart courtesy of TrendSpider.com

Above is the daily chart of ARKK and below is the weekly. The daily does a good job highlighting the current hurdle that ARKK faces right now.

That’s the key $46 level, which was support in April but resistance in May and June. But each dip from this level has become more and more shallow, as ARKK did not make a new low last month.

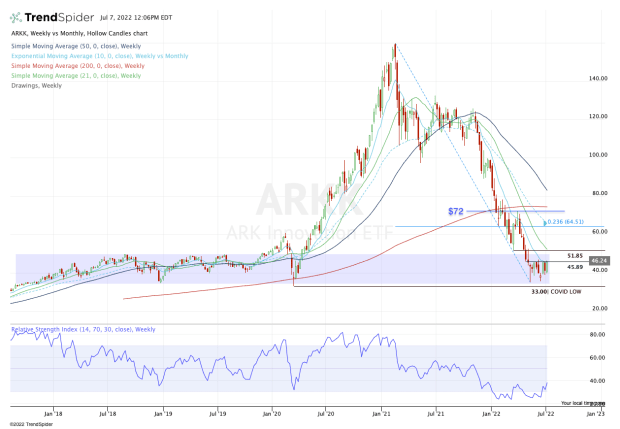

Further, ARKK is running right into its 10-week moving average after having already cleared the 50-day moving average. On the weekly chart below, you can see how stout this measure has been when it comes to resistance.

Chart courtesy of TrendSpider.com

This week’s high for ARKK is currently $46.23. The last two weeks’ highs are $46.27 and $45.99. If ARKK can cleanly rotate over this area — giving bulls a two-times weekly-up rotation — it could create a quick rally up to the $50 to $52 zone and the declining 21-week moving average.

If it pushes through that zone, the $53.50 and $57.50 to $58 areas will be on watch. And it could also be the start of a much larger so-called reversion trade.

After such a painful fall, it would not be all that odd to see a massive move higher in ARKK.

That doesn’t mean it can’t eventually make new lows or that we’re right back in a bull market.

But if ARKK can find its groove and shift into some sort of monstrous bear-market rally, we could be looking at a push up toward the high-$60 to low-$70 area.

That would put the 10-month, 50-week and 200-day moving averages in play, as well as the 23.6% retracement.

The fact that a rally of this magnitude would take ARKK stock only back to the 23.6% retracement -- meaning a retracement of about one-quarter of its losses -- is pretty eye-opening and shows just how far this name has fallen.

It may seem like a long shot, but that doesn’t mean it’s impossible.

On the downside, $39 to $40 has been meaningful. A break of this zone likely puts the lows back in play.