The markets are mixed to start the holiday-shortened trading week -- but not Disney (DIS). Shares of the entertainment giant are up 7% so far on the day.

At one point near the open, the entertainment giant's shares were up close to 10%. That’s on news that Bob Iger will return as the company’s CEO, succeeding Bob Chapek.

It’s no surprise that Disney shareholders are cheering the move, as Disney stock enjoyed immense success under Iger’s leadership, which previously lasted from 2005 to 2020.

Iger plans to serve for another two years as the company searches for a successor.

The move comes less than two weeks after Disney reported disappointing earnings.

After initially selling off, the stock found its footing. There were two very clear levels to watch in Disney stock. Once the upside level was reclaimed, it opened up the stock to more upside.

Let’s get an update now with the Iger news.

Trading Disney Stock With Bob Iger Back as CEO

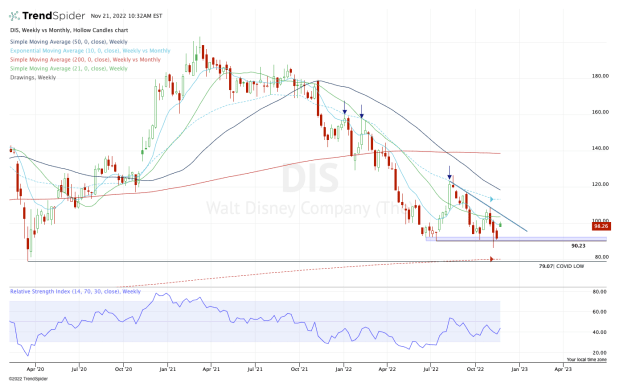

Chart courtesy of TrendSpider.com

Disney stock looks much better than it did a few weeks ago, but it’s hard to say that it’s out of the woods.

Despite hitting a low of $86.28, the $90 level was quickly reclaimed after the disappointing quarterly result. Now, though, the stock is finding sellers at the $100 area and the declining 10-week moving average.

If the stock is able to find its footing amid this morning's fade from this area, then the $105 area could be in play. The reaction to this zone would be telling.

Specifically, it puts the 21-week moving average in play, along with downtrend resistance.

On the downside, I’m interested to see where support comes into play.

The daily gap-fill is down at $93.16, while the weekly gap-fill is down at $97.18. With today’s fade from the high, the latter of these gaps has already been filled.

The bigger question is: If the first gap is filled down near $93, will Disney stock go on to retest the critical $90 area, which continues to hold on a weekly basis?

If that’s the case, the bulls must be on watch for a break of this level. Failure to hold it would open the door back down to the post-earnings low near $86, then the $80 area.

Near this zone, investors will find the covid low for Disney, as well as the 200-month moving average.

For now, let’s see how the stock handles ~$97 on the downside and $100 on the upside.

Black Friday Sale

Get Action Alerts PLUS + Quant Ratings investing insights for one low price.

- Action Alerts PLUS: Unlock portfolio guidance, access to portfolio managers, and market analysis every trading day.

- Quant Ratings: Get stock ratings, key financial metrics, and ratings upgrades and downgrades for your stock analysis.