/Cadence%20Design%20Systems%2C%20Inc_%20logo%20on%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)

Cadence Design Systems, Inc. (CDNS), headquartered in San Jose, California, provides software, hardware, and other services worldwide. With a market cap of $85.9 billion, the company licenses its electronic design automation (EDA) software technology and provides a variety of professional services. Cadence's design realization solutions are used to design and develop complex chips and electronic systems, including semiconductors.

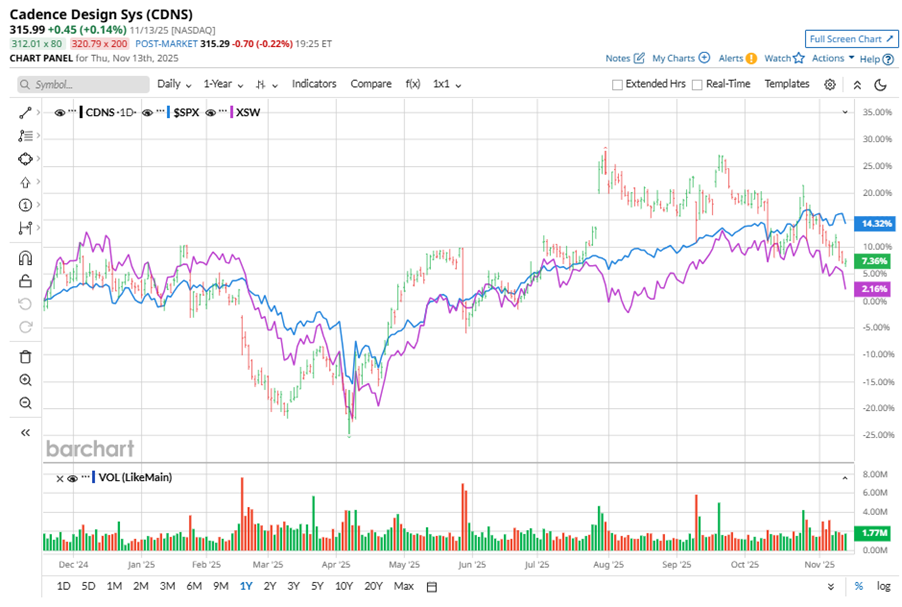

Shares of this EDA giant have underperformed the broader market over the past year. CDNS has gained 3.1% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 12.6%. In 2025, CDNS stock is up 5.2%, compared to the SPX’s 14.6% rise on a YTD basis.

Narrowing the focus, CDNS’ outperformance is apparent compared to the SPDR S&P Software & Services ETF (XSW). The exchange-traded fund has declined about 1.1% over the past year. Moreover, the stock’s returns on a YTD basis outshine the ETF’s 1.9% losses over the same time frame.

On Oct. 27, CDNS shares closed up by 1.8% after reporting its Q3 results. Its adjusted EPS of $1.93 exceeded Wall Street expectations of $1.79. The company’s revenue was $1.34 billion, beating Wall Street forecasts of $1.33 billion. The company expects full-year adjusted EPS in the range of $7.02 to $7.08, and expects revenue to be between $5.26 billion and $5.29 billion.

For the current fiscal year, ending in December, analysts expect CDNS’ EPS to grow 25.1% to $5.63 on a diluted basis. The company’s earnings surprise history is mixed. It beat or matched the consensus estimate in three of the last four quarters while missing the forecast on another occasion.

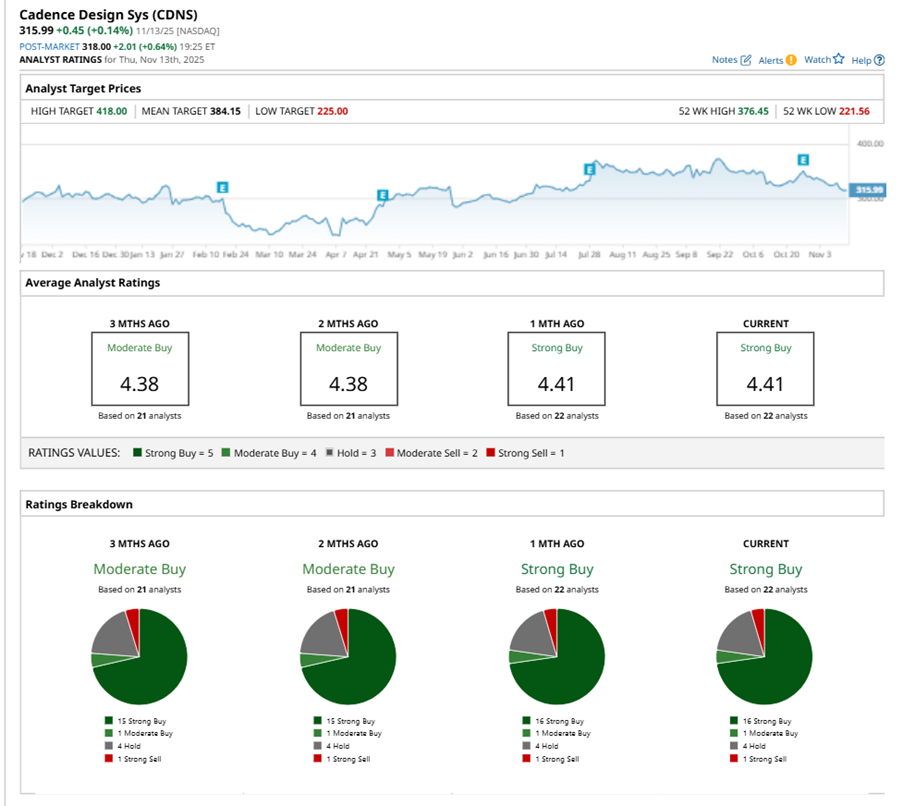

Among the 22 analysts covering CDNS stock, the consensus is a “Strong Buy.” That’s based on 16 “Strong Buy” ratings, one “Moderate Buy,” four “Holds,” and one “Strong Sell.”

This configuration is more bullish than two months ago, with a “Moderate Buy” rating overall, consisting of 15 analysts suggesting a “Strong Buy.”

On Oct. 28, Rosenblatt kept a “Neutral” rating on CDNS and raised the price target to $335, implying a potential upside of 6% from current levels.

The mean price target of $384.15 represents a 21.6% premium to CDNS’ current price levels. The Street-high price target of $418 suggests an ambitious upside potential of 32.3%.