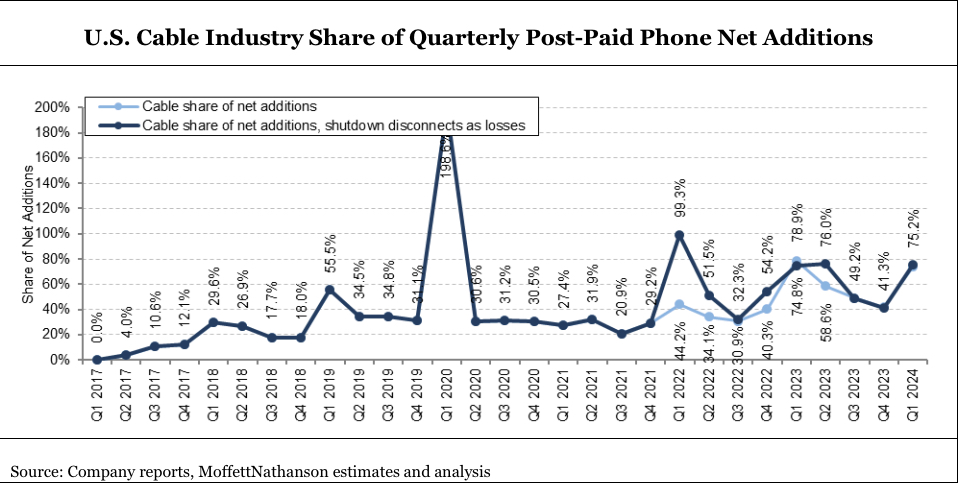

Cable operators controlled more than 75% of U.S. net additions for wireless customers in the first quarter, according to a new tally published by equity analyst Craig Moffett.

Simply put, cable operators are able to bundle discounted bundles of fast, reliable wireline home broadband and mobile that are undercutting the offerings of wireless giants.

“Cable’s success owes to a very clear advantage,” Moffett wrote in a Thursday morning report. “Cable can offer its bundle everywhere; every cable customer — and indeed, every customer in a Charter or Comcast market — can get the same bundle at the same price.

“That's not true for the TelCos,” he added. The wireline footprints of wireless companies including T-Mobile, AT&T and Verizon “simply don't support a converged offering.”

The wireless giants “aren’t even in the ballpark of having a national offering,” Moffett also noted. Consider that AT&T, the closest to that benchmark among the trio, currently has fiber available in only 12% of households.

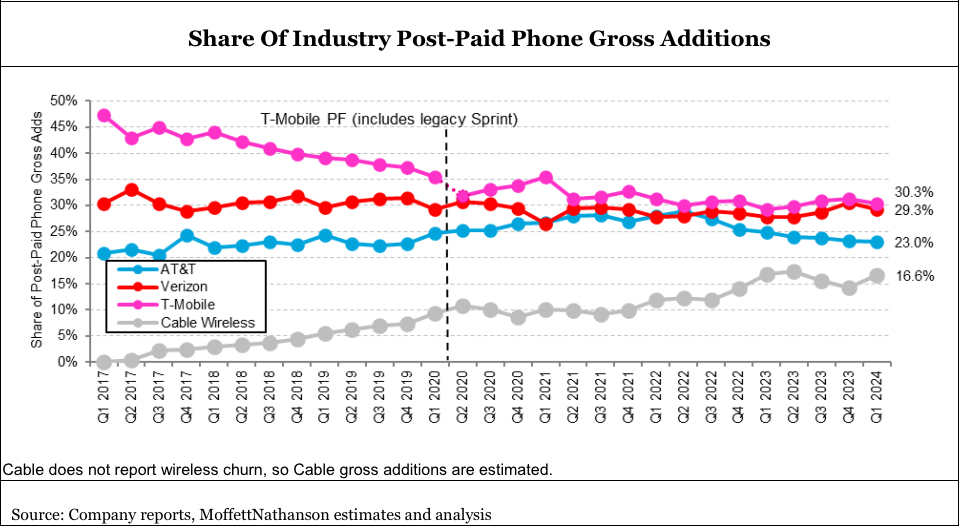

Meanwhile, cable’s share of gross mobile additions has grown steadily, surpassing 16% in the first quarter.

“To put a finer point on it, a converged offer that is available in 12% of the country, for a national wireless operator that competes in 100% of the country, is lunacy,” Moffett added. “It simply isn’t a viable strategy.”

The ranks of U.S. cable operators launching mobile services has increased recently, with Breezeline and Mediacom Communications hoisting new offerings in recent weeks.

A new, separate research report published earlier this week by S&P Global Ratings suggested that mobile products from tier 2 and 3 U.S. cable operators won't enjoy near the prosperity of Comcast's Xfinity Mobile and Charter's Spectrum Mobile. The reason: Comcast and Charter have the ability to offload much of their Verizon MVNO traffic to their own network resources via WiFi and other mechanisms.