Alphabet (GOOGL) (GOOG) stock is tipping lower on Wednesday, down about 2% on the day. That’s far from a disaster, although bulls may be experiencing a little jealousy as the stock market bounces on the day.

The company reported earnings last night alongside Microsoft (MSFT), the latter of which is up more than 7% after its better-than-expected results.

Alphabet reported a mixed result for the quarter, including in-line revenue expectations. However, with the stock down 21.5% coming into the print, investors seemed to have been expecting worse.

Of course, tacking on an additional $70 billion to its buyback plan certainly alleviates some of the pain.

The reality is pretty simple with Alphabet: Currently down more than 23% from its highs, investors have to ask themselves if it’s cheap enough to own yet.

At 20 times this year’s earnings estimates, a massive buyback plan and a fortress balance sheet, I’m not sure what else investors need to see. That said, many stocks are in a bear market and in that scenario, we can’t rule out lower prices.

Let’s look at the chart.

Trading Alphabet Stock

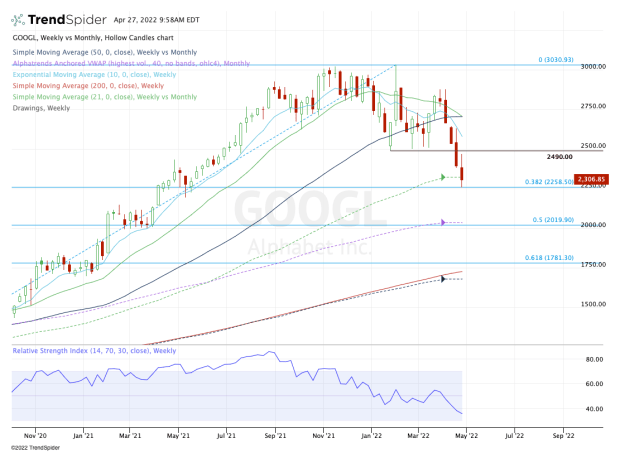

Chart courtesy of TrendSpider.com

From a fundamental perspective, it’s hard not to like Alphabet stock. Especially if we take a long-term outlook with the name. However, the technical situation is a little muddy.

If Alphabet stock finishes lower this week, it will mark the stock’s fifth straight weekly decline. When the stock broke down late last week, it was clear that $2,500 support wasn’t going to hold.

Unless it was reclaimed, it opened the door down to the $2,250 area, as we outlined earlier this week.

That’s where the stock finds its 38.2% retracement from its all-time high to the Covid-19 low. Further, it’s where it finds the rising 21-month moving average — a measure that hasn’t been tested since April 2020.

So far, it's holding.

If we get a bounce here, we need to see if Alphabet stock can fill the gap near $2,370. That doesn’t show up on the weekly chart above, but it’s there. Above that and prior support at $2,500 is on the table.

If Alphabet stock continues lower, then investors need to be prepared for the next support level. On the weekly chart, that’s around $2,000. That’s about 10% below current levels and would represent a hearty decline — with shares down about 33% from the highs.

It seems unlikely, but in this environment, you just never know.

Around $2,000, the stock finds the monthly VWAP measure and the 50% retracement.