Alphabet (GOOGL) (GOOG) shares have spent most of the day under pressure.

The overall market is lower, too, but certainly not as sharply as Alphabet. At the session low, the shares were down almost 9%. At last check, the stock was off 7.5%.

If Alphabet closes anywhere near these levels, it will mark the stock’s worst performance in several months.

The reason behind the decline comes from its new AI chatbot, Bard.

As previously reported by TheStreet, The decline comes after Alphabet “posted an online ad, powered by its new AI technology, that provided incorrect information.”

Of course, it doesn’t help that ChatGPT has come bursting onto the scene and that Microsoft (MSFT) — which has invested in ChatGPT’s parent, OpenAI — is making strides in using AI for search.

Trading Alphabet Stock

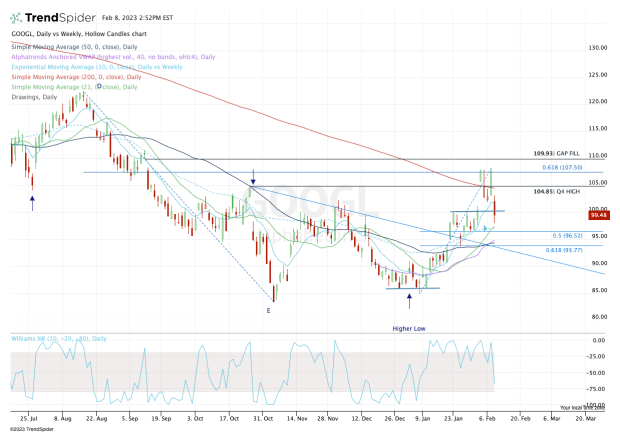

Chart courtesy of TrendSpider.com

On Tuesday, Alphabet stock closed strongly, so today’s gap down and hard fade has trapped a lot of active traders.

Generally when trading a stock like Alphabet, traders will at least have an opportunity to exit with minimal damage. That was not the case with today’s action.

From here, keep the $100 level in mind, which was key resistance until the shares broke out last week ahead of the earnings report. While the quarter was disappointing, bulls bought the dip.

If Alphabet stock can regain $100, the fourth-quarter high and 200-day moving average are in play near $105.

Above that and it’s clear that the 61.8% retracement at $107.50 is resistance, while there’s a gap-fill just above it at $109.93. It would take Alphabet regaining $110 for this stock to be in a clear breakout.

If the shares cannot regain $100, the $96.50 to $97.50 area is key in the short-term. There we have the 50% retracement of the recent rally, as well as the 21-day and 10-week moving averages.

If those fail as support, it puts the $94 area in play, which is the 61.8% retracement, as well as the 50-day moving average and the daily VWAP measure.

I realize these zones are close together, but for the bulls it’s vital that the buyers step in somewhere between $94 and $97.

If they don’t, then it makes Alphabet stock more vulnerable to a deeper correction — perhaps even down to that big support area around $86.

Make sense of the market. Get daily analysis of market conditions and economic trends from our portfolio managers.