Super apps and e-marketplaces are making a foray into buy now, pay later (BNPL) services in Thailand to stimulate consumption amid economic headwinds and stagnant inflation.

Grab is the first among the super apps to offer BNPL in Thailand, while Shopee is a trendsetter for the service among e-marketplaces.

The local BNPL sector recorded strong growth the last four quarters, driven by increased e-commerce penetration and the impact of the economic slowdown, according to ResearchAndMarkets.com.

BNPL payments in the country are expected to grow by 67.1% on an annual basis to reach US$2.9 billion in 2022.

BNPL payment adoption is expected to grow steadily, recording a compound annual growth rate of 33% from 2022-28, while the BNPL gross merchandise value in the country is forecast to jump from $1.7 billion in 2021 to $16.5 billion by 2028.

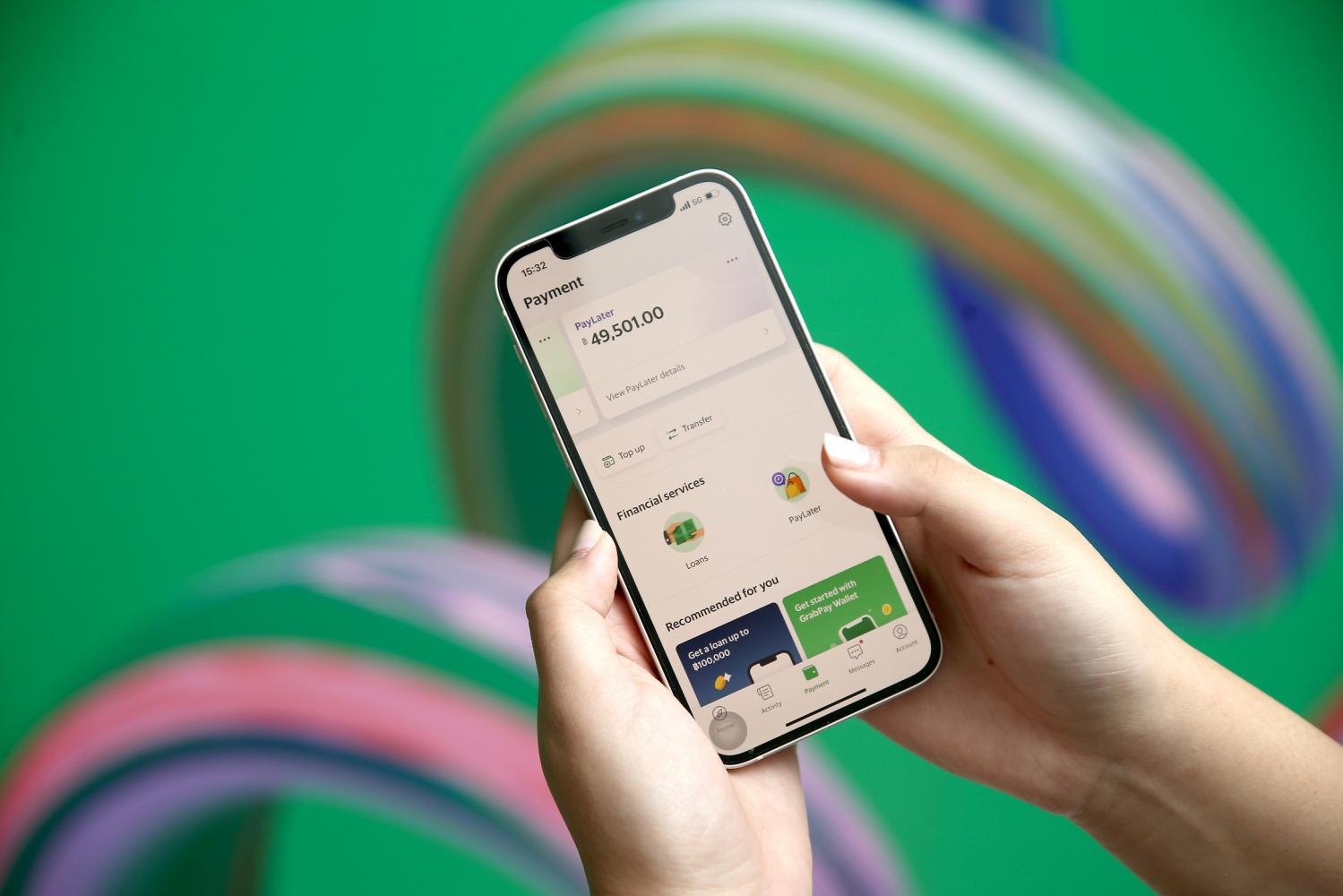

Grab introduced "PayLater by Grab" yesterday, in which users can opt to pay for all Grab services the following month on one bill, covering GrabFood, GrabMart and GrabExpress as well as transport services.

Worachat Luxkanalode, the new country head for Grab Thailand, said the service provides customers with enhanced flexibility, a seamless experience and extra benefits in terms of mobility and food, parcel and on-demand goods deliveries.

"The increased popularity of digital commerce over the past few years has given rise to new digital financial services that can better serve customers' needs," said Mr Worachat.

Citing the "e-Conomy SEA 2022" report, he said the total transaction volume of digital payments in Thailand is predicted to reach $113 billion in 2022 and grow by 12% within 2025.

"One of the fastest growing services is the BNPL service, which allows customers to manage their expenses more conveniently," said Mr Worachat.

Grab also plans to allow users to make four instalment payments as the scheme is developed.

He said Grab Thailand launched its payment service almost three years ago to support a seamless payment experience on the Grab platform.

"Today, almost two-thirds of Grab users choose cashless payment methods, including GrabPay Wallet and debit and credit cards," said Mr Worachat.

In the third quarter, Grab registered a loss of $342 million, a 65% improvement year-on-year. It booked revenue of $382 million, up 143% year-on-year.

Grab said for core food deliveries and overall deliveries, its segment-adjusted earnings before interest, taxes, depreciation and amortisation broke even for the quarter.

Yod Chinsupakul, chief executive of super app Line Man Wongnai, said the company is expanding its financial service business, including BNPL, apart from its digital lending.

For the e-marketplace frontier, Shopee, which is part of internet giant Sea, offers BNPL service in Thailand under the SPayLater brand.

Maneerut Anulomsombut, chief executive of Sea (Thailand), said SPayLater has gained acceptance among users in the face of economic challenges because it allows them to manage their payments.

Rival Lazada recently introduced LazPayLater payment option, which is being rolled out in stages to its users in the country. The move is to provide seamless financial services to further enhance customers' online shopping experience, Lazada said.