The first quarter was all about tech, as Tesla (TSLA), Nvidia (NVDA) and other large-cap stocks powered the Nasdaq higher.

But other large cap names struggled. Among them was Johnson & Johnson (JNJ), which endured a nine-week losing streak at one point in the quarter.

That’s very uncharacteristic for this high-quality holding. In fact, it’d been several decades since we’d seen a skid of that length.

Don't Miss: Is Boeing Stock About to Take Flight? Here's the Level to Watch.

On the plus side, buyers get a nice discount and an opportunity to accumulate Johnson & Johnson stock after a decline like that.

In April 2022, when many stocks were hitting 52-week lows, J&J stock was hitting all-time highs. That’s impressive. So is the fact that it has raised its dividend for 60 straight years and now yields about 3%.

The stock is now trading at less than 15 times earnings and forecasts are calling for low-single-digit earnings and revenue growth this year and next year.

Let’s take a closer look at Johnson & Johnson stock.

Trading Johnson & Johnson Stock

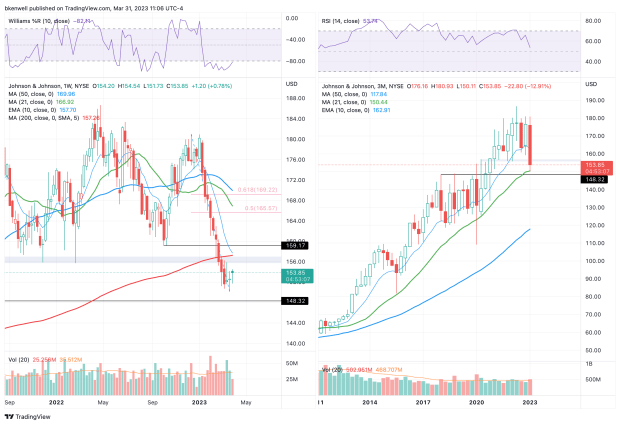

Chart courtesy of TradingView.com

When J&J was selling off in February, the prior support zone between $156 and $157 appeared set to combine with the 200-week moving average to buoy the share price.

Instead, J&J continued its losing streak. It broke through this area and found its footing near $150.

If we zoom out even further to the quarterly chart (on the right), traders will notice support came into play right at the 21-quarter moving average. They’ll also notice a larger support level near $148.

Don't Miss: Trading the Dow: Laggard or Leader Going Forward?

As good as the quarterly chart looks for the bulls, they are not completely out of the woods.

Specifically, Johnson & Johnson stock needs to reclaim the $156 to $157 zone, as well as the 10-week and 200-week moving averages. If the stock can’t do that, then the recent lows remain in play near $150 and the stock remains vulnerable to more selling pressure.

If, however, J&J can regain these measures, investors can turn their attention to the $160 area, then $165 and $169.

If it can clear all these marks, Johnson & Johnson stock could undergo a significant rally.

Action Alerts PLUS offers expert portfolio guidance to help you make informed investing decisions. Sign up now.