Shares of Exxon Mobil (XOM) on Tuesday were trading about 1.5% higher at last check. That's a reversal from the slightly lower open and from the drop of almost 3% at the lowest point in trading.

The mixed trading action followed the integrated oil giant's report of record profit in the fourth quarter.

Exxon delivered 65% year-over-year earnings growth and beat analysts’ top- and bottom-line expectations for the fourth quarter.

The energy space is still easily the best-performing S&P 500 sector over the past 12 months. And when you look at Exxon’s results, it’s not hard to see why.

Many of these companies are generating monstrous cash flow. We saw that last week when Chevron (CVX) announced a $75 billion buyback plan.

With Exxon Mobil stock regaining a key breakout area, let’s look at the charts.

Trading Exxon Mobil Stock on Earnings

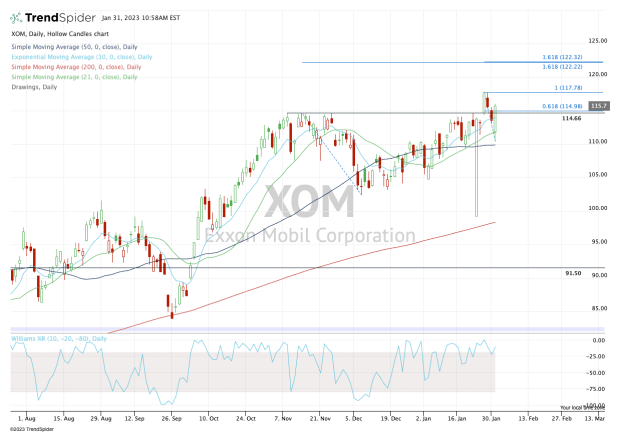

Chart courtesy of TrendSpider.com

With Monday’s dip and today’s open, Exxon Mobil stock opened below the key $114 to $115 breakout area. This level was resistance in October and November and most recently in January.

The stock’s strong rally on Thursday sent it to record highs and above $115, but the quick pullback created doubts about how much momentum the bulls had.

If Exxon Mobil can finish strong today — and ideally this week — then investors have a case to make about more upside.

Above $115 keeps the recent high in play near $117.75. If the stock can clear this level, the 161.8% extension from both the recent range and the long-term range comes into play near $122.25 — call it $122 to $122.50.

If we see that zone, it’s a reasonable profit-taking zone for shorter term traders, at least for some of the position.

On the downside, $110 and the 50-day moving average is a key line in the sand. If the stock breaks this measure — and especially if it closes below it — that opens the door for more downside.