Costco Wholesale (COST) are rallying on Friday, currently up 4.5% at last glance and at session highs after the company reported earnings on Thursday evening.

The reaction to the print was not decisively bullish, as Costco stock ended after-hours trading slightly lower.

Costco reported a top- and bottom-line miss, and earnings fell 7.6% year over year. When that’s considered, some investors are likely surprised that the warehouse club's shares are higher on Friday.

It likely helps that CFO Richard Galanti said, “all things being equal, we'll be comparing against easier compares six months from now.”

Don't Miss: Buy the Dip in Snowflake Stock? Here's the Must-Hold Support Level

That all said, the trading environment for retail stocks hasn’t been easy. Target (TGT) shares have slumped and are approaching a vital support level. Ulta Beauty (ULTA) was down more than 13% at last check on Friday after its disappointing quarter as well.

While the SPDR S&P Retail ETF (XRT) is actually 1% higher on the session, it made new year-to-date lows this morning.

So how does Costco look after the earnings? Let’s check the chart.

Trading Costco Stock on Earnings

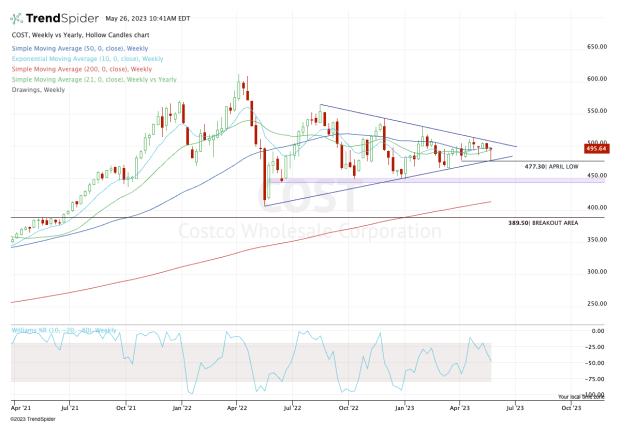

Chart courtesy of TrendSpider.com

The weekly chart does a great job highlighting the wedging pattern we’re seeing in Costco stock; that is, a series of higher lows and lower highs. It’s not common to see this type of pattern on such a long-term chart, as it’s been in play for about a year now.

The stock consistently found support near $450 before starting to trend higher. The only problem? Resistance has been trending lower.

Buy or Sell?: Trading Nvidia Stock After Earnings Send Shares to All-Time Highs

Earlier this week, Costco stock dipped down to the April low near $477 before bouncing and it’s now contending with the 10-week, 21-week and 50-week moving averages just below $500.

If Costco stock can hold above $500, then downtrend resistance is the next test for the stock. Ultimately, the bulls would love to see Costco clear the April high near $513.

That could open the door up to the $520 to $525 zone, then $540.

On the downside, a move back below $500 keeps the $475 to $477 area in play. Below that and the mid-$460s could be in play.

For now, let’s see how Costco handles $500.

Our Memorial Day sale is on now! Get exclusive investing insights from TheStreet’s premium products. Learn more.