Berkshire Hathaway (BRK.B) (BRK.A) knows how to draw a crowd, especially for its annual meeting and quarterly reports.

Not only is the company a conglomerate deserving of investors’ attention, but its legendary investors in Warren Buffett and Charlie Munger often unload a bevy of insight and commentary on the market.

Even amid the stock’s correction, Berkshire Hathaway is still worth $700 billion. It has accumulated massive positions in the market’s biggest names, with Apple (AAPL) being its most well-known holding.

As the weekend unwinds, fascinating tidbits are coming out from the meeting. For instance, Buffett & Co. bought some $600 million worth of Apple stock in the first quarter and would have bought more had the stock not bounce.

The company is well-known for its large cash position, but Berkshire Hathaway put over $40 billion to work in Q1 as markets have swoon. That goes for both the bond and stock markets.

At one point, Berkshire Hathaway was bucking the selloff and trending higher. Now it’s down in three straight weeks and in four of the last five. Can it halt its skid this week?

Trading Berkshire Hathaway Stock

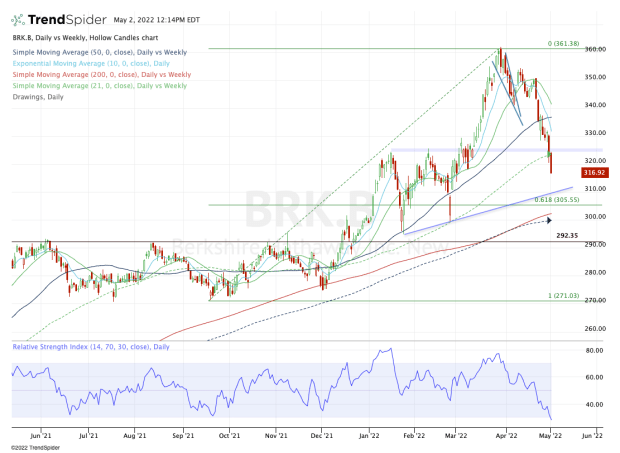

Chart courtesy of TrendSpider.com

Shares are down about 1.5% on the day, so it could easily reverse the current losses. However, with the decline, Berkshire Hathaway stock is currently knifing through the 21-week moving average, which buoyed it on Friday.

The stock is also breaking cleanly below the prior breakout area near $325.

At this very moment, Berkshire stock is a bit in no man’s land. Traders either need to see it rally back into the $325 area to see how it responds or it needs to continue moving lower.

If it rallies back toward $325 and reclaims this area in the next few days, then bulls can get long with a defined stop-loss at this week’s low. If it rebounds to $325 and is rejected, then it may very well be a potential short position — as much as I’m not a fan of shorting Berkshire Hathaway.

Instead, a more attractive setup would be a dip down into potential support.

While uptrend support (blue line) could provide a bid, my focus is more on the $300 to $305 area. In that zone, we have the 61.8% retracement, as well as the 200-day and 50-week moving averages.

It’s not guaranteed to be support, but it would mean that the stock is down about 17% from the high. If it doesn’t hold, the $292 breakout could be in the cards. Still, I would first consider $300 to $305 a critical area.

In a nutshell, let’s watch $300 to $305 on the downside and $325-ish on the upside.