Shares of Amazon (AMZN) are higher by roughly 1.2% on Monday, as Cyber Monday is underway.

So far, the online shopping trends of Black Friday and Cyber Monday have been strong. Further, the earnings rhetoric out of retailers has been pretty constructive over the past few weeks.

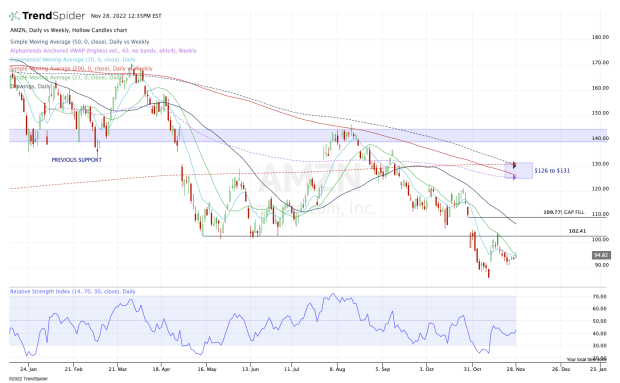

In the case of Amazon though, the stock is struggling at a key inflection point on the charts.

Although the stock is still up today, shares were up more than 3% earlier in the session.

While Apple (AAPL) is not helping matters — down more than 2% on the day — bulls are hoping for a stronger response from Amazon. There's still time until the close, but as it stands, there’s reason for a bit of caution here.

Trading Amazon Stock

Chart courtesy of TrendSpider.com

In the second quarter, Amazon stock put together a powerful rally off the $102.50 area, a zone that held as support multiple times over a multi-month stretch.

Shares ultimately rallied more than 40% from this zone. However, this support area eventually failed as FAANG was under intense selling pressure and after disappointing quarterly results from Amazon.

After earnings, the stock gapped below $100, tried to reclaim the $102.50 area and ultimately rolled over.

That’s the problem with the bear markets: Even once they’ve bottomed, there is a near-endless amount of overhead resistance levels that the stocks need to clear.

For Amazon, it’s struggling with its 10-day and 21-day moving averages.

The latter has been active resistance this month, while failure to regain the 10-day moving average would point to a further lack of strength.

If Amazon stock can’t reclaim these levels, then $91 remains in play — support from last week — followed by the gap-fill near $89.50. Below all of these measures and the 52-week low near $86 is on the table.

However, if Amazon stock can clear the 10-day and 21-day moving averages and take out today’s high of $96.40, it opens the door to the $102.50 to $104 area, which has been resistance since Amazon reported earnings.

Above that puts the 50-day in play, followed by the gap-fill level up near $110.

On a larger time frame, investors are looking for Amazon stock to push into the low-$120s, then test the $126 to $131 area.

However, let’s not get ahead of our skis. Amazon must prove that it has momentum on its side and that starts with the small but important task of clearing the 10-day and 21-day moving averages. Otherwise, know the downside levels.