Mumbai: As widely expected, the Reserve Bank of India (RBI) on Wednesday hiked policy repo rate by 50 basis points (bps) to 4.90 per cent with immediate effect.

Repo rate is the rate at which the banks borrow from the RBI. Higher repo rate would make loans expensive for borrowers, adding to their EMI burdens.

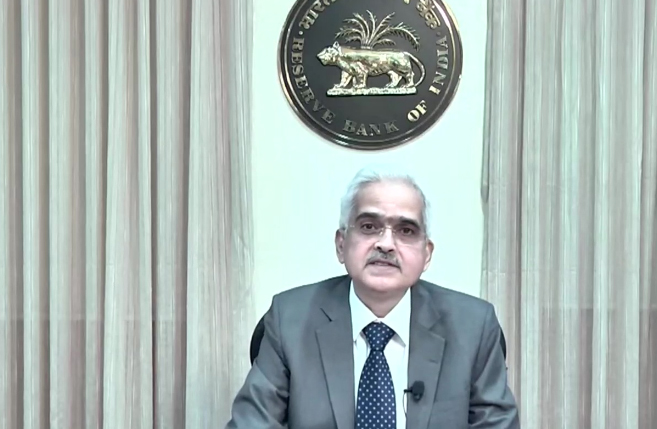

The MPC voted unanimously to increase the policy repo rate by 50 bps to 4.90%: RBI Governor Shaktikanta Das@RBI @DasShaktikanta pic.twitter.com/cHMa3WrDCw

— Dynamite News (@DynamiteNews_) June 8, 2022

The Monetary Policy Committee (MPC) or rate-setting panel's decision has come close on the heels of increase in repo rate by 40 basis points in an off-cycle meeting in May.

Making monetary policy statement, RBI Governor Shaktikanta Das said that the MPC voted unanimously to increase the policy repo rate.Following the hike in repo rate, the standing deposit facility (SDF) rate stands adjusted to 4.65 per cent and the marginal standing facility (MSF) rate and bank rate to 5.15 per cent.

"The MPC also decided to unanimously remain focussed on withdrawal of accommodation to ensure that inflation remains within the target going forward while supporting growth," the Governor said.

Consequently, the standing deposit facility - the SDF rate - stands adjusted to 4.65% and the marginal standing facility - MSF rate and bank rate - to 5.15%: RBI Governor Shaktikanta Das@RBI @DasShaktikanta #RBI

— Dynamite News (@DynamiteNews_) June 8, 2022

Das noted that the war in Europe is lingering and the economy is facing newer challenges each passing day which is accentuating supply chain disruptions.Amid the elevated inflation, crude price volatility and geo-political crisis, economists and market-watchers had expected RBI to hike repo rate in the range of 25-50 basis points.

Governor Shaktikanta Das had earlier hinted that more rate hikes were in the pipeline, saying that expectations of increase in the repo rate was a 'no-brainer’.

In what seems a co-ordinated action, the government had last month reduced excise duty on diesel and petrol to provide relief to people by cooling down the prices. It also calibrated duties on raw materials of steel to cool down prices of steel for the local industry.

Both retail and wholesale inflations have surged adding to the woes of common man. The consumer price index (CPI)-based inflation had touched eight-year high of 7.79 per cent in April, 2022. The Wholesale price index (WPI)-based inflation has been in double digit for nearly a year now. (UNI)