Shares of Bumble (BMBL) are buzzing higher, roaring higher by more than 40%. When you look at the chart though, you would hardly know the stock had such a powerful rally on Wednesday.

That’s what bear markets look like.

As shareholders of Peloton (PTON), Pinterest (PINS) and others can attest, these rallies look good in the headlines, but on the chart they are barely more than a blip.

That’s not to discredit the company’s results. Bumble did not report the strongest quarter, but it continues to push in the right direction.

The midpoint of management’s full-year revenue outlook was in line with consensus expectations, even as the dating-apps provider will take a minor hit as it pulls out of Russia.

The stock was oversold going into the report, and the results were enough for investors to bid the stock higher. In that sense, it’s not unlike Snap (SNAP) or Match (MTCH), which both rallied after reporting.

The flip side is: Will Bumble stock fade like the rest of the names that were oversold and then rallied on their earnings reports?

Trading Bumble Stock

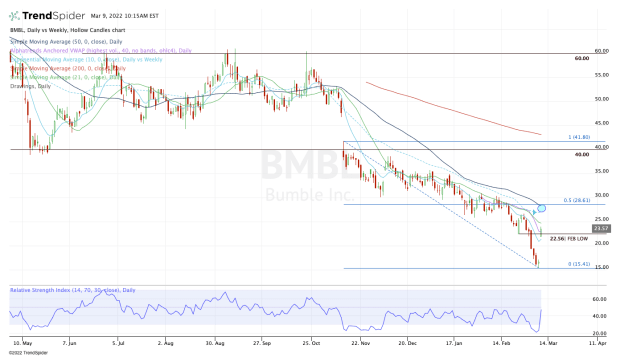

Chart courtesy of TrendSpider.com

Today’s move is a great relief after all of the downside. From its earnings decline in November, Bumble stock was down more than 65% before today’s move.

Even with a 40% rally, the shares are still down 50% from their pre-earnings close in November and 72% from the all-time high near $85.

Now they're back up through the 10-day moving average and last month’s low; that's a step in the right direction. Bumble stock needs to hold up above this area. Should it fall back below these marks, the gap is back down to $17.13.

Currently, the stock is above its daily VWAP measure, but we’ll see how long that lasts. If it can stay above it, $25 and the declining 21-day moving average will be the next obstacles.

Thus far, the 21-day has been active resistance for this stock (and many others, too).

On a stronger push, I’m looking for $27 to $28 as resistance. There, we have the declining 10-week and 50-day moving averages and the 50% retracement of the current range.

A broad caveat: Bumble may have a tough time making progress through this area unless the overall market snaps out of its downtrend.