The semiconductors are in constant discussion and for good reason. As it relates to General Motors (GM), the company cited semiconductor shortages in a recent profit and deliveries update.

It wasn’t an earnings report, but the company updated investors on Friday morning by saying it expects second-quarter net income between $1.6 billion and $1.9 billion.

Shares slipped slightly in the pre-market on the news, but it’s been a bit more volatile since the open. At one point, GM stock was up 3.5% on the day, but as of 12:30 ET, it’s up almost 1% on the day.

The company said second-quarter sales fell 15.4%, although that was better than the 17.1% decline that consensus estimates were calling for. Part of that decline can be pegged to a semiconductor component shortage, which impacted about 100,000 vehicles.

Tesla (TSLA), Ford (F) and others are now on watch for second-quarter delivery results as well.

However, General Motors reiterated its prior outlook for full-year adjusted earnings of $6.50 to $7.50 as share and automotive net cash provided by operating activities between $16 billion and $19 billion.

Trading GM Stock

Chart courtesy of TrendSpider.com

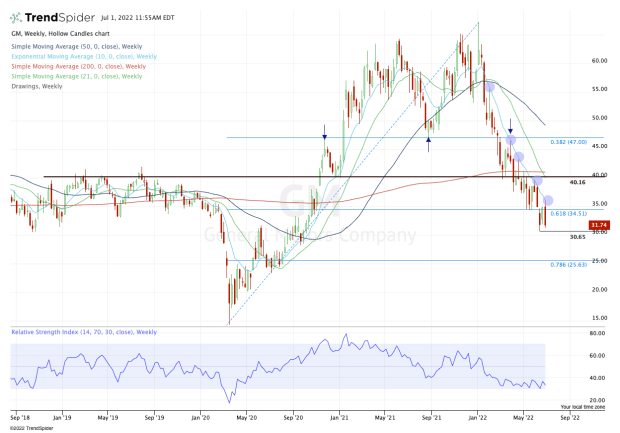

It’s easy to forget just how well GM stock was trading, as it hit new highs in early January. Despite a lot of market-wide drama that unfolded right out of the gate, this stock looked pretty good.

Then it tumbled below the 10-week, 21-week and 50-week moving averages. Upon a late-month rally, it was rejected by these measures.

Since then, it's been all downhill. Just look at the way the 10-week moving average has been active resistance, continuing to squeeze GM stock below multiple key levels.

The chart clearly shows two levels of significance at this moment: $35 is resistance and $30 is support. The problem for bulls is that GM also remains below the 10-week moving average.

If GM stock can clear the 10-week moving average and $35, then we could see a larger push to the upside. Potentially, that could put the $40 area on the table. In that zone, GM has a key level that failed to hold as support, as well the declining 21-week moving average and the flat 200-week moving average.

On the downside, a break of $30 support that isn’t repaired could open the door down to the $25 area, where GM stock finds the 78.6% retracement from the all-time high down to the Covid low from March 2020.