The 2022 bear market has been vicious. Wrought with worry about inflation and recession, stocks across the board have been selling off. But that doesn’t mean traders are waiting on the sidelines. A close look at option order flow indicates that the “smart money” — hedge funds, institutions, and traders with very big pockets — have found a promising sector to park their cash: Chinese equities.

Why Chinese Stocks are Outperforming the Market

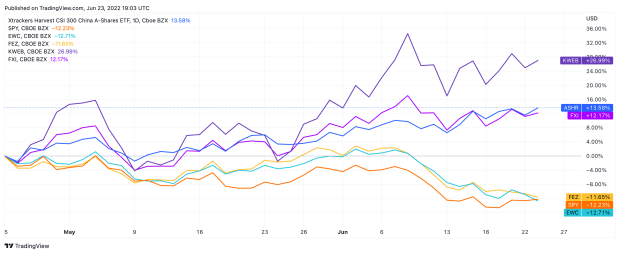

Chinese stocks have been outperforming their global counterparts by a large margin, as depicted in the chart below.

To get to the bottom of the price action, we have to acknowledge what factors have US equities under pressure. Those factors can be boiled down to worries about Fed tightening, inflation (especially as it relates to high energy prices), and the potential for an upcoming US recession. Why are Chinese equities immune to many of these macro-concerns?

For starters, Chinese stocks don’t care if the US economy enters a recession. And although Covid has caused some inflation in the price of Chinese gasoline, it pales in comparison to that of American gas prices. As of June 20th, the average price of a gallon of gas in China is $1.494 USD — just .034 cents above the global average, and far lower than American or EU national averages.

Most importantly, Chinese stocks were getting beaten down long before the US indices entered a bear market. This was mostly caused by a crackdown from the Chinese government, where they fined many of their largest companies, such as Alibaba and Tencent, wounding them with a series of antitrust penalties throughout 2021.

However, in 2022, the attitude changed. They stopped aggressively prosecuting companies for antitrust violations. They approved a previously rejected bid that would allow Alibaba (BABA) founder Jack Ma’s Ant Group to IPO. More importantly, they indicated their willingness to begin a process of quantitative easing — a practice that involves injecting money into the market — a practice that the US Fed is currently in the process of unwinding.

With this perfect storm of Chinese stocks trading well below their all-time-highs, a newly accommodative fiscal policy, and nowhere else to turn to, it’s no wonder the “smart money” has been all over this sector.

Unusual Option Activity in Chinese Stocks

Over the past two months, Market Rebellion has spotted numerous colossal, bullish option trades in the three Chinese ETFs mentioned above. They were so prevalent that Market Rebellion Co-Founder Jon Najarian took to CNBC’s Halftime Report to highlight one of the trades made in ASHR.

Let’s follow their footsteps for a moment, to take an inside look at how the “smart money” used call options to position into these Chinese stocks.

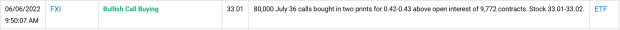

Unusual Call Buying In FXI

There was plenty of bullish flow before and after May 20th, but this trade of 80,000 out-of-the-money calls in the iShares China Large-Cap ETF (FXI) (bought in one giant print) really drives the point home: they were playing to win. This was when FXI was trading at $30.03, and these options were trading for $0.58. By June 6th, those previously OTM options had become at-the-money, and had more than doubled in price.

Were these aggressive traders done? Not a chance. They came back in and bought another 80,000 contracts — out-of-the-money yet again — in the same ETF.

These two trades alone cost a total of roughly $8,000,000 — and these are just scratching the surface of the bullish activity we’ve seen in Chinese stocks over the past two months. Let’s look at another Chinese ETF that has been getting a lot of attention lately.

Ready to start trading? Try Unusual Option Activity Essential. Learn how you can follow the "smart money" with a fresh UOA trade idea each week - including technical levels so that you know where to enter and exit!

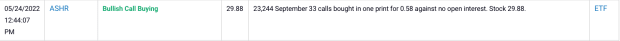

Unusual Call Buying in ASHR

These out-of-the-money calls purchased in Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR) on May 24th amount to a trade worth more than $1.4 million dollars. This was with the stock trading under $30. What happened next? The ASHR ETF ran more than 10% higher within a month.

The “smart money” continued buying as the stock ran up, with the most recent trading coming across the tape this morning.

These five aggressive call trades in the ASHR amount to more than $6.5 million dollars worth of bullish activity, and like with FXI, we’re only showing a portion of the unusual option activity we’ve witnessed in this name.

The Bottom Line: Someone (likely a hedge fund or institution) is very bullish on Chinese equities. They’ve been right all month, and they aren’t backing down yet.