Warren Buffett may not be looking to cash in on the surge we’re seeing in AI stocks, but Berkshire Hathaway (BRK.A) (BRK.B) shares have been trading well in the past month.

While the stock is flat over the past 12 months and is only up about 4% so far on the year, traders have been able to navigate this one nicely.

In mid-April, Berkshire Hathaway stock gave buyers an excellent opportunity to buy the dip. It worked as the shares roared to year-to-date highs.

Don't Miss: How High Can AMD Stock Go? Chart Provides a Clue.

Keep in mind that Berkshire has a large portfolio of private businesses, but its public portfolio is dominated by Apple (AAPL). So as goes Apple, so goes a large portion of the value for Berkshire’s public portfolio.

So far, that’s been working out pretty well, although a large pullback could spell trouble.

That all said, Berkshire Hathaway stock is setting up another potential opportunity for longs.

Trading Berkshire Hathaway Stock

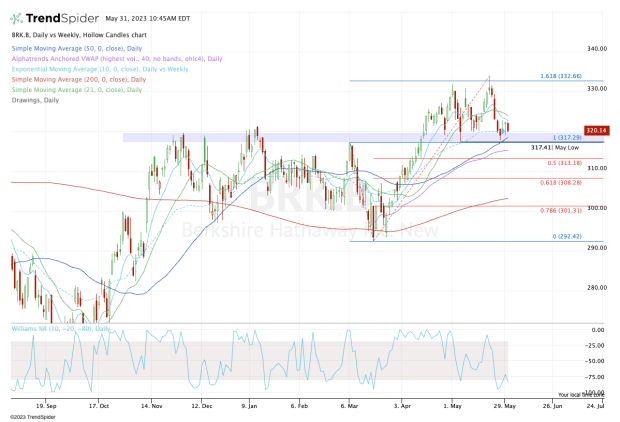

Chart courtesy of TrendSpider.com

Berkshire Hathaway stock did an excellent job powering higher, all the way to our price target zone of $332.50.

After a sharp four-day dip, support came into play right in the $317 to $318 area. This zone has been key. Not only was it the breakout trigger last month, but it’s where we find the 50-day moving average and this month’s current low.

If the bulls remain in control, the $317 to $320 zone should be support. Along with the measures mentioned above, there’s also a prior resistance zone as well as the 10-week moving average.

Don't Miss: Buying the Dip in WingStop Stock After It Touches a Record

If this area can’t support Berkshire Hathaway stock, the shares could see some weakness down to the 50% retracement and the daily VWAP measure.

Below that and the stock could dip to the $300 area.

On the upside, the bulls want to see a move up into the $326 to $328 area, which would put Berkshire Hathaway back above the 10-day and 21-day moving averages.

Above that would open the door back to $330-plus and, ideally, put the recent high near $333 back in play.

Keep in mind: Berkshire Hathaway stock tends to correlate with the overall market. So if the S&P 500 struggles, this one likely will, too.

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.