Occidental Petroleum (OXY) shares are down about 2.7% on Monday, but are off the session lows. Today’s action follows the stock’s explosive finish to last week, as shares rallied 9.9% on Friday.

The move not only kickstarted a major breakout, but came on reports about Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) potentially increasing its position — again.

Buffett & Co. quickly became a 10% shareholder in Occidental Petroleum and that stake has recently grown to a 20% holding.

On Friday, news broke that Berkshire had received permission from the Federal Energy Regulatory Commission to up its stake to 50%, if desired. That would indicate the firm is looking to increase its position.

Given the way Buffett has been accumulating the stock, coupled with this recent news, it makes one wonder whether Berkshire will eventually move in for a takeover of the company.

Back in June, we noted that support came into play around $55. Now that that level has held and shares are rotating above resistance, let’s revisit the technicals.

Trading Occidental Petroleum Stock

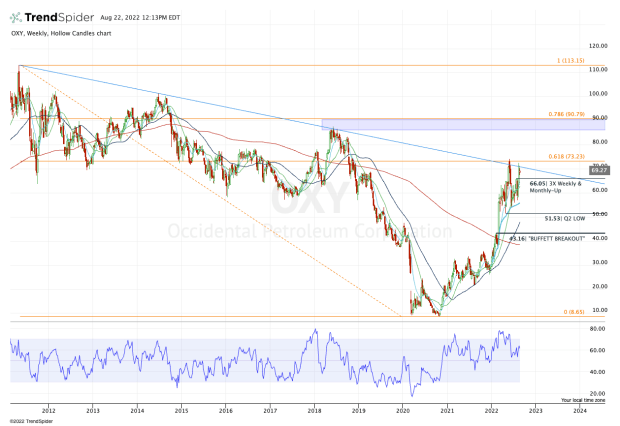

Chart courtesy of TrendSpider.com

Above is a weekly chart of Occidental stock and below is the daily look. The weekly view does a great job highlighting two things.

First, the stock is trading right into its long-term downtrend line (blue line). Second, Occidental has also hit the 61.8% retracement, a notable development for many traders.

However, the weekly chart is so zoomed out that it’s hard to see the three-times weekly-up rotation underway from Friday’s surge, a move that also sent the stock up over last month’s high.

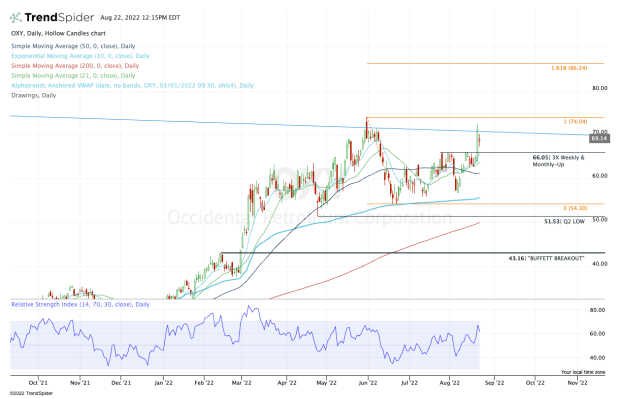

Chart courtesy of TrendSpider.com

When both charts are taken into consideration, traders can see that Occidental stock is both trading very well and at a point where we need to be observant (the point of downtrend resistance and the 61.8%).

Could Buffett be the deciding factor?

Conservative traders may consider buying Occidental stock on a move over $72.50 — last week’s high. That puts the 2022 high in play near $74 before we turn our attention higher.

More aggressive traders will simply be long Occidental so long as it’s above the $66 rotation point.

If we’re talking about longer-term upside potential areas, a move over $74 could put the $86 to $90 area in play. When looking at the daily chart, the 161.8% upside extension comes into play near $86. If we look at the weekly chart, one can see resistance came into play near $86 in 2018, while the 78.6% retracement comes into play near $90.

Traders should keep this zone in mind if they plan on holding for a while. Further, that’s also true if Occidental stock can stay above $66 and eventually rotate above $74.