Chancellor Jeremy Hunt has delivered his so-called “back to work” Budget for 2023 – striking a surprisingly upbeat tone that was a far cry from his dour warnings of difficulty when he entered office last October.

Though he was not without caution, Mr Hunt said the Office for Budget Responsibility (OBR) now forecasts that the UK will not enter a technical recession this year and that the government “will meet the prime minister’s priorities to halve inflation, reduce debt and get the economy growing”.

Among the measures announced were plans to boost pensions, expand free childcare and cut duty on fuel and draft beer. He also committed to go ahead with a rise in corporation tax, extend the energy price guarantees and increase military spending.

This year’s package responds to changes in the world economy and was delivered in a calmer fiscal backdrop compared with Mr Hunt’s Autumn Statement, which was delivered in the wake of Liz Truss’s disastrous “mini-budget”.

As ever with a budget, there are thousands of figures behind the decisions. Below, The Independent has gathered a series of graphs that provide context to the changes.

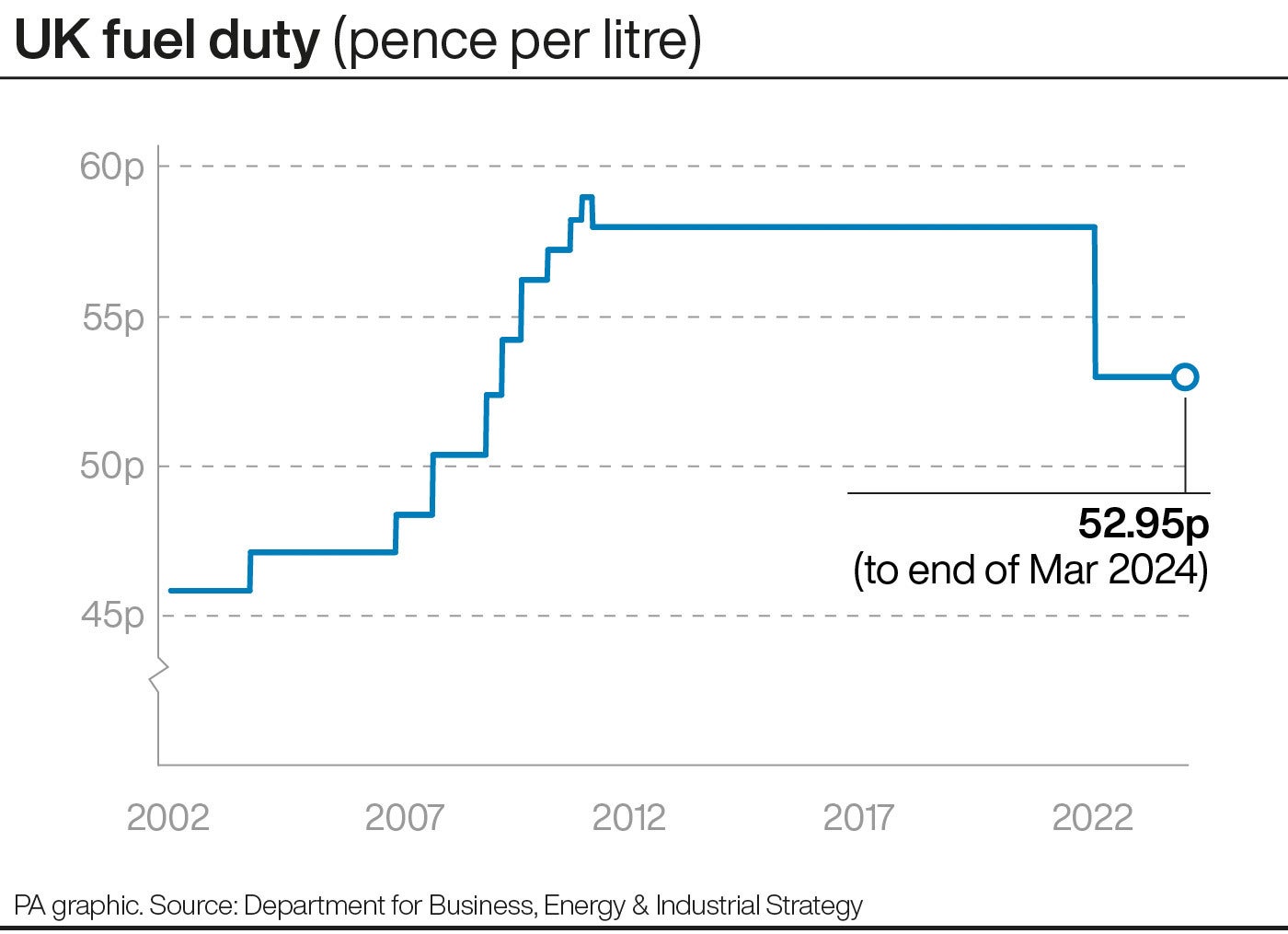

Fuel duty cut

A 5p cut to fuel duty will continue for a further 12 months, with the Chancellor predicting a saving of £100 next year for motorists.

Mr Hunt said: “Because inflation remains high, I have decided now is not the right time to uprate fuel duty with inflation or increase the duty.”

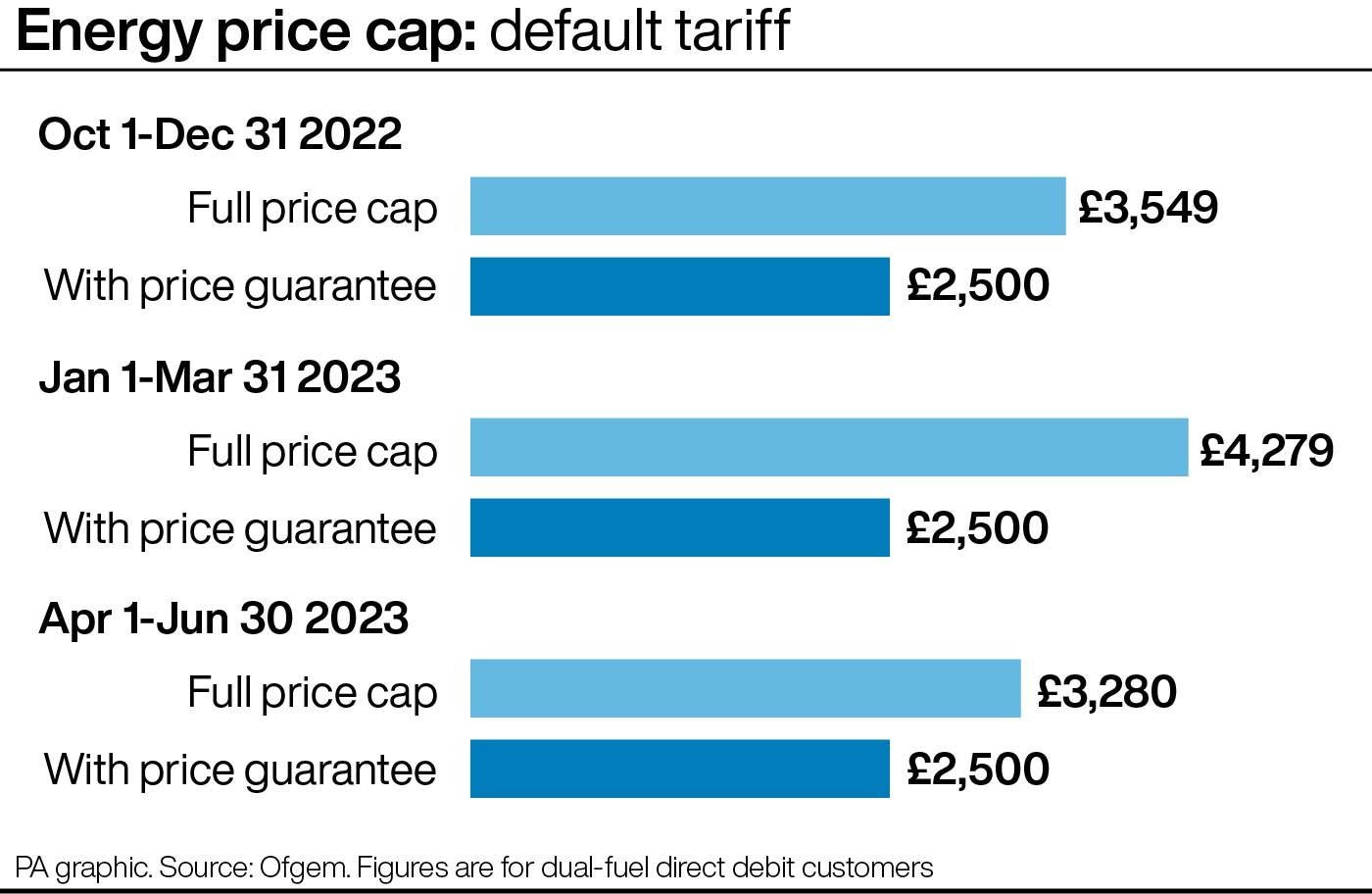

Energy price cap

Ahead of his Budget speech, Mr Hunt confirmed that the energy price guarantee for households will be extended for another three months at its current rate.

The support scheme has limited a typical household energy bill to £2,500 since October, but was due to increase to £3,000 in April to reduce the burden on state finances.

However, the Treasury has said it will now continue the scheme at £2,500 until July, as had been widely reported, in a move which will cost it around £3 billion.

As wholesale energy prices have dropped, it has become increasingly affordable for the Government to continue protecting customers with the same deal they are on now.

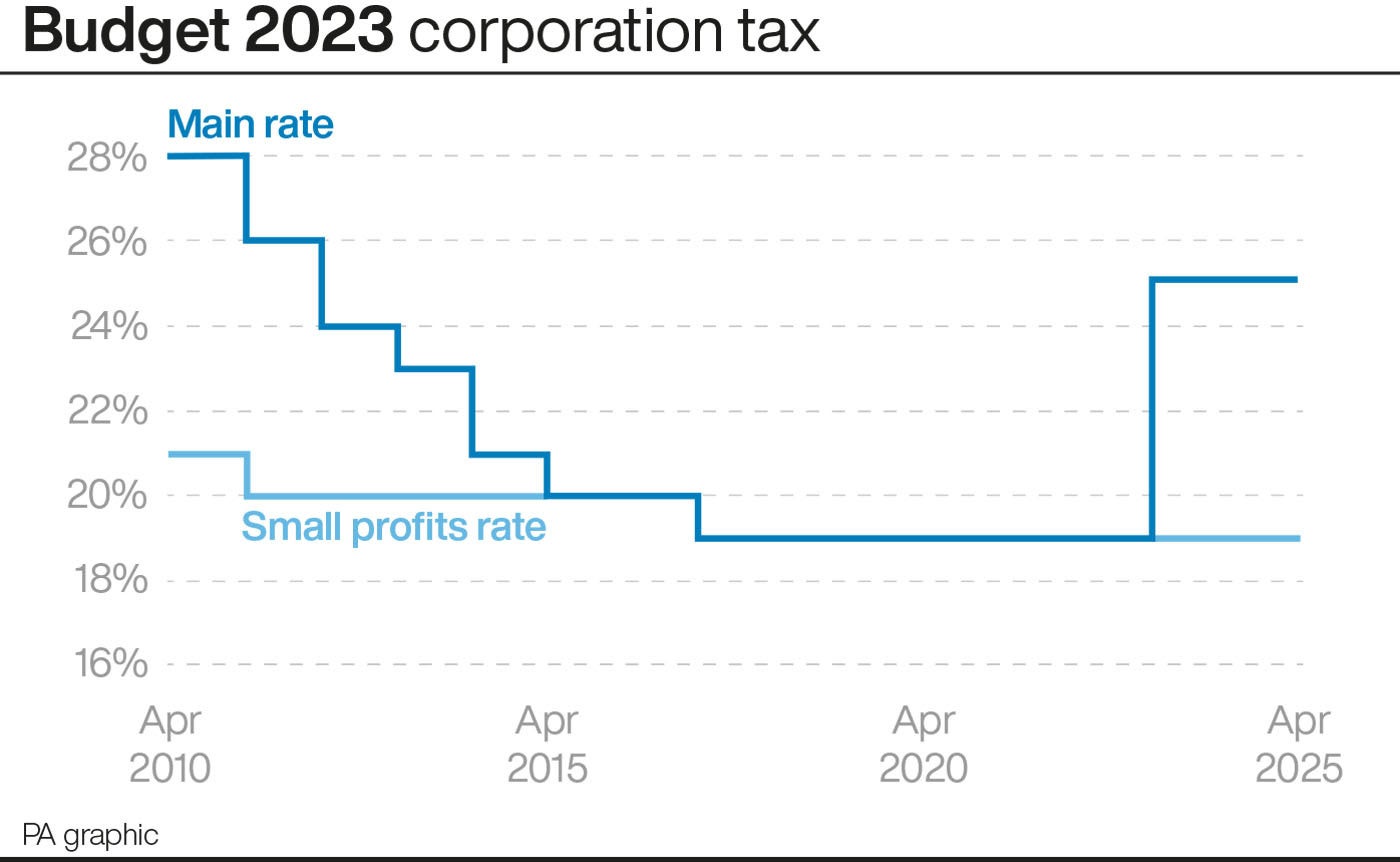

Corporation tax rise

The chancellor confirmed the planned increase in corporation tax to 25 per cent will be going ahead, but announced a new policy of “full capital expensing” over the next three years, which will mean every pound invested in IT equipment, plant, or machinery can be deducted immediately from profits.

He said the government would not rest until the UK is “Europe’s most dynamic enterprise economy”.

He told MPs: “We already have lower levels of business taxation than France, Germany, Italy or Japan. But I want us to have the most pro-business, pro-enterprise tax regime anywhere. Even after the corporation tax rise this April, we will have the lowest headline rate in the G7 - lower than at any period under the last Labour government.

“Only 10 per cent of companies will pay the full 25 per cent rate. But even at 19 per cent our corporation tax regime did not incentivise investment as effectively as countries with higher headline rates.”

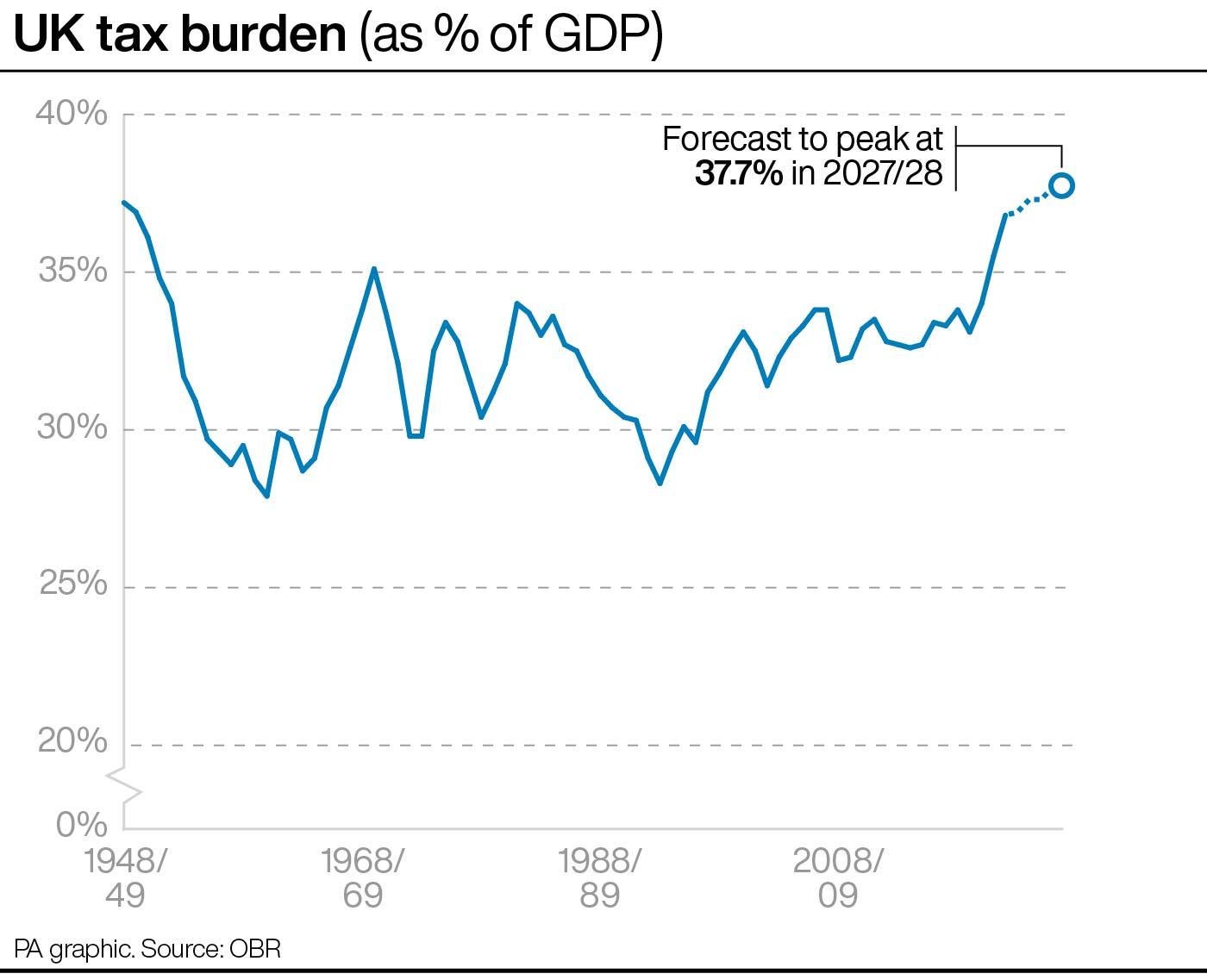

Tax burden rising

The chancellor resisted demands from Tory MPs, including Boris Johnson, to scrap April’s increase in corporation tax.

The move will contribute to the tax burden hitting a post-Second World War high of 37.7 per cent in 2027-28, with the ratio of corporation tax receipts to GDP set to be the highest since the tax was introduced in 1965.

Mr Hunt promised “the most generous capital allowance regime of any advanced economy” to help offset some of the increase.

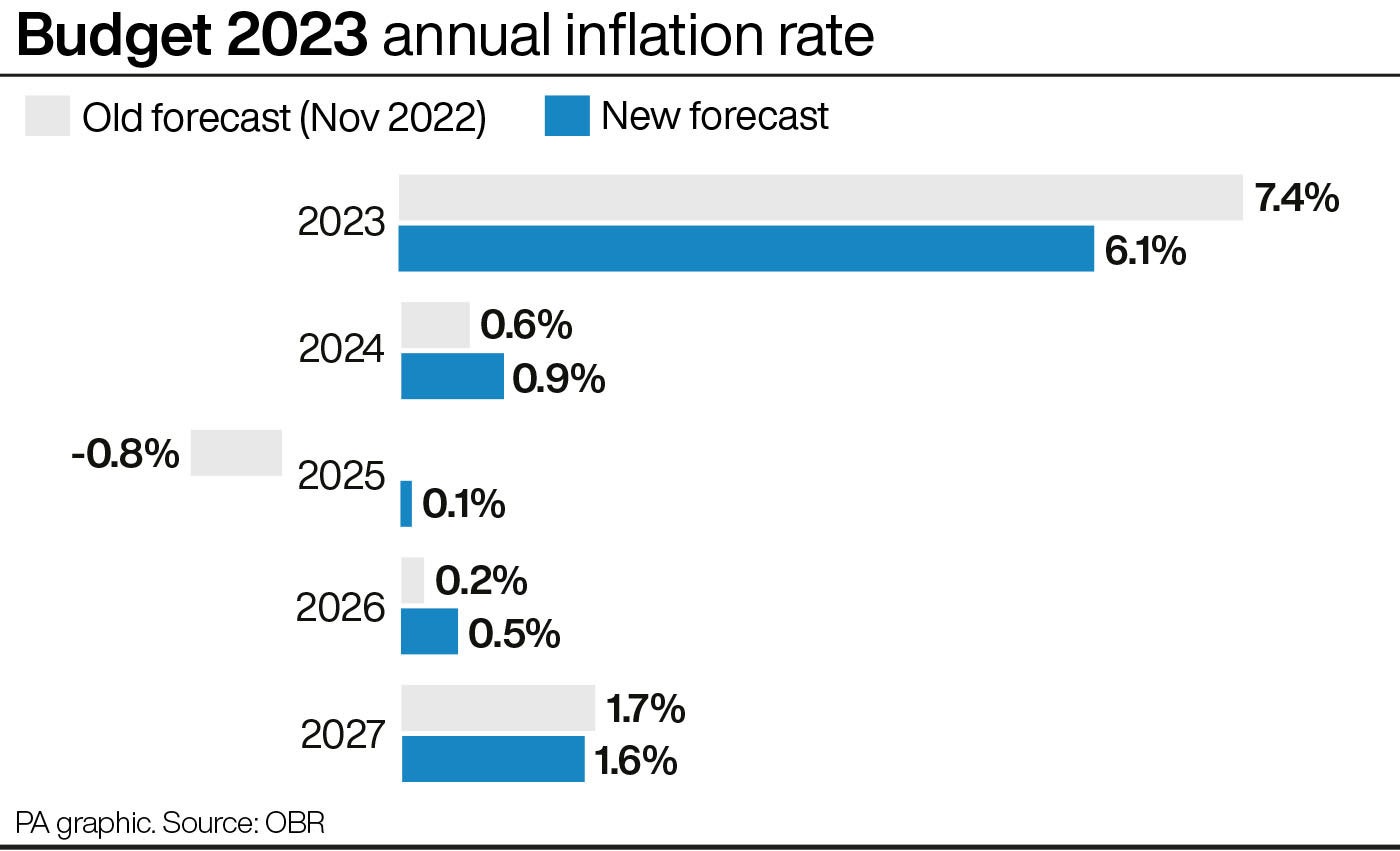

Inflation rate falling

Inflation is on track to fall to 2.9 per cent by the end of the year, according to the OBR.

Rocketing energy prices saw inflation strike 10.7 per cent in the final quarter of last year.

Mr Hunt said: “Today the Office for Budget Responsibility forecast that because of changing international factors and the measures I take, the UK will not now enter a technical recession this year.

“They forecast we will meet the prime minister’s priorities to halve inflation, reduce debt and get the economy growing.”