A.H. UPDATE: The (META) earnings results are in, and investors are not happy. Why not?

- EPS: $1.64 vs $1.85 Expected (-11.32%)

- -4% Revenue Y/Y vs. +19% Cost increase Y/Y

- +28% Headcount Y/Y

- Metaverse (Reality Labs) has lost $3.7B in Q3

As a result, shares of Meta have tanked more than 20%, erasing more than 6 years of gains. Comparatively, the bearish put trade outlined below will have gained 178% by its Friday expiration if shares of Meta remain below $120 (currently trading at $104.30), a dynamic example of the leveraging power of options.

(GOOG), (MSFT), (TXN), and a host of other large-cap stocks reported earnings Tuesday night.

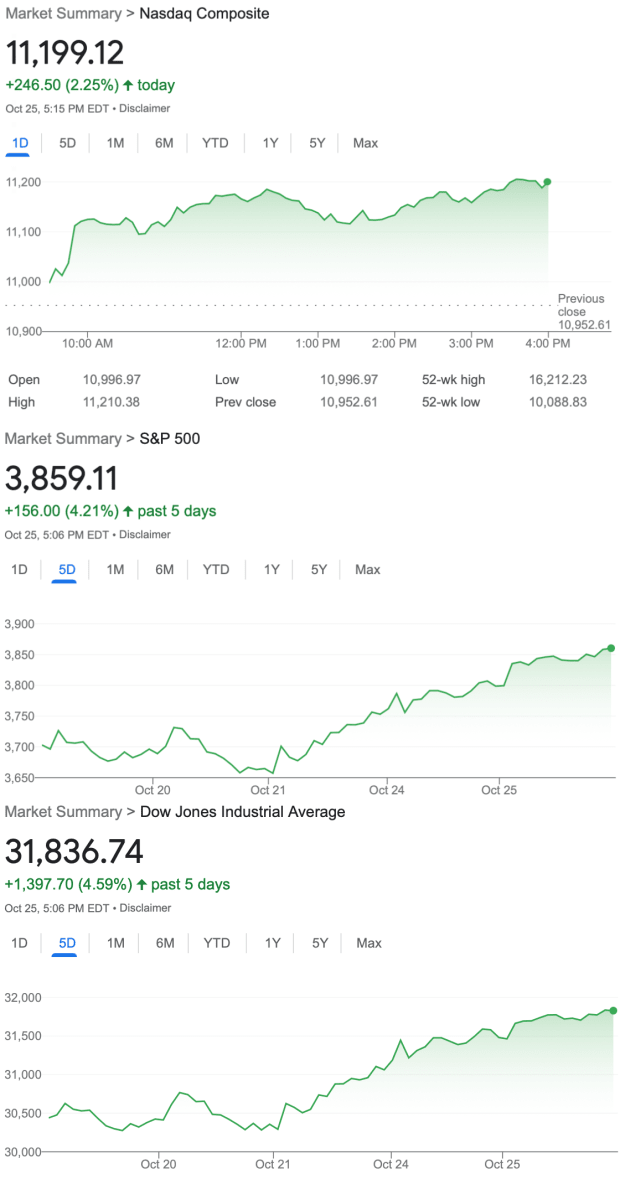

The setup leading into their reports: Heavily green. Between Friday, October 14th and Tuesday, October 25th, the Nasdaq index had risen roughly 8.5% — more than half of that in just the past 5 days. They weren’t alone — all three major indices were up heavily this week.

Ready to start trading the technicals? Try Rebel Weekly. Ride the waves of market momentum with two actionable trade ideas designed to capture technical break outs and break downs — delivered to your inbox every week.

Interestingly, Market Rebellion also identified a peculiar occurrence on Monday:

VIX and SPY Correlation: What does it mean?

While it isn’t necessarily the harbinger of doom that many have come to see it as, it’s still an important occurrence to be mindful of. Recall that the VIX is simply a reflection of options positioning, and an indication of the expected size of upcoming SPX moves.

When the VIX and (^IN) are both rising nearly equal amounts, it indicates that options traders are maintaining caution. This can be a signal of indecision — and much like a reversal candle at the top of a rally — a possible sign of a reversal in the short-term trend.

It makes sense that the options market would begin to get a little defensive at a time like this. Heading into earnings, a big rally like the one above isn’t as bullish as it may seem.

How to Trade Earnings: Goldman Sachs Strategy

Back in 2016, Goldman Sachs published a report about how to predict the likely trajectory of stocks that reported earnings.

What they found: Stocks that underperformed leading up to earnings tend to have positive reactions, and stocks that outperformed leading up to earnings tend to have negative reactions.

-Goldman Sachs strategists Katherine Fogertey and John Marshall.

It makes sense for a lot of reasons. When stocks are oversold or overbought, they often don’t even need a reason to reverse some of the move — retracement is just the nature of the stock market. Additionally, as the team of Goldman strategists explain:

And likewise, stocks that perform well (like the entire tech sector over the past week and a half) have a higher set of expectations going into earnings. With fresh money positioned into the names, it makes sense that a little bad news can cause a cascade of washouts. And a little bad news is exactly what we got on Tuesday night.

Ready to start trading? Try Unusual Option Activity Essential. Learn how you can follow the "smart money" with a fresh UOA trade idea each week - including technical levels so that you know where to enter and exit!

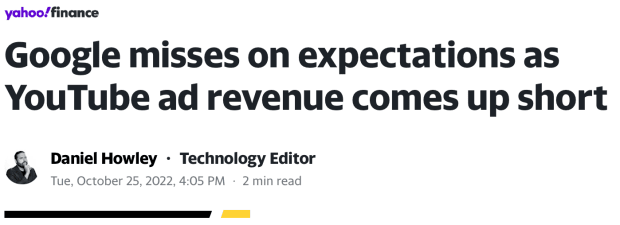

Alphabet Earnings Miss

Alphabet wasn’t the only one.

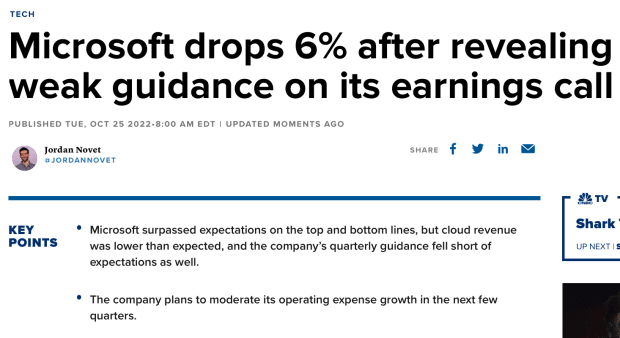

Microsoft Earnings Beats, but Cloud Misses

This follows last week's disappointing release from Snap, another possible signal of slowing ad-spend.

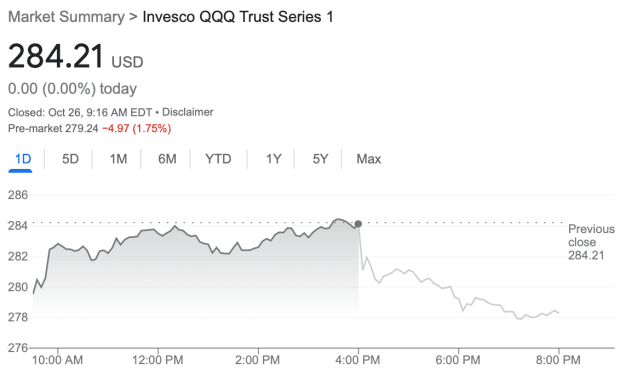

Price Action Following Microsoft and Alphabet Earnings

In short: It looks pretty bad. It’s nothing extraordinary relative to the year that we’ve had thus far, but still, you wouldn’t want to be holding short-term calls on much of anything into this open.

Now, just being overbought doesn’t necessarily mean anything. As economist John Maynard Keynes famously said,

As we saw above, all it takes is a little push to start a wave of selling. Overbought conditions are like a gasoline leak, and bad earnings news is like the spark that starts the fire. Now, investors will be forced to watch as it spreads to other similar stocks that have yet to report earnings.

What’s Next: Meta Earnings Report Wednesday at the Close

So now we’re up to speed. Stocks rallied pretty hard over the past two weeks, gave some of it back prior to the open today, and now Meta is up to bat. We already know they’re spending a lot on the Metaverse — which has received lukewarm reviews, but is still in the earliest stages of development. Meta has recently said it may take 10 years before that segment of the company is profitable.

That’s not what Meta investors want to hear at a time when margins are already under attack by inflationary forces and supply chain woes. On Monday, Brad Gerstner of Altimeter capital called for the company to cut focus on increasing its margin, in large part by cutting Metaverse spending down to $5B per year.

Despite the name change, the most important number for Meta Platforms doesn’t have anything to do with the metaverse — it’s all about ad revenue. A big win here could defy everything else and send the stock back into rally mode. Unfortunately, based on the information we received from Alphabet on Tuesday, and Snap last week it doesn’t look like that’s in the cards. Apple’s privacy changes continue to hinder Facebook, arguably more than any other company.

Additionally, worries about an economic slowdown do not mix well with ad spending. On top of that, Tiktok continues to grow its audience, broadening its demographic in the process. As of October, 26% of Tiktok’s massive audience is now aged 25-44 — a signal of the app’s grip continuing to strengthen. As screen time continues to be stolen from Meta, as companies cut costs, and as Apple’s privacy changes continue to bite, the setup does not look great for Meta here.

How to Play Meta Earnings

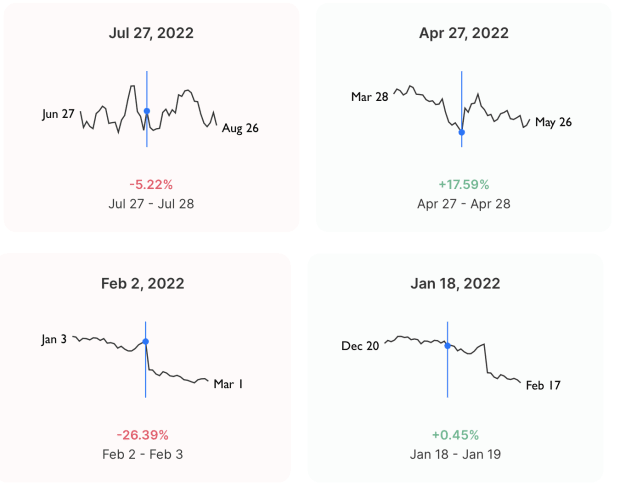

Meta’s average 1-day earnings move in 2022 is 12.41%, and the stock already has a habit of falling after reporting earnings. Earlier this year, Meta took home the record for the largest single-stock loss of market cap in one day, when the stock fell more than 26% following a sour earnings report. The company lost $230B in value as a result.

As of Tuesday’s close, the options market was pricing in an implied move of about 12.2% — indicating that options were fairly priced relative to the average earnings move. However, with volatility surging, and the stock already down significantly, it’s likely that those figures — and the options strategy you may choose — will need to be re-assessed.

Nonetheless, options provide many tools for traders to make any number of predictions. To offset the IV crush that often follows earnings and to cut down on bloated option premiums, options traders could opt for long put debit spreads placed within range of the average earnings move. At the time of writing, with Meta trading currently trading at $131.74, an example of that style of spread would be something like a long $125, short $120 put spread expiring October 28th, which would likely have a rough cost of around $1.80 for a max profit of $3.20. This spread realizes a full profit if Meta makes a move in line with its 2022 average earnings move — from here, that would take Meta down to about $116, giving the above spread a bit of wiggle room.

Of course, this is just one of many ways that traders could choose to play this name. And it goes without saying, any options trade made on earnings is a high-risk one — especially a short-dated move like the trade example illustrated above. However, that’s why earnings provide such attractive risk/reward ratios.

Handle With Care if You Plan to Mettle With Meta

Proceed with caution in this name. Bulls looking to establish a position in Meta would likely be best served to wait on the sidelines until the earnings report is released.

Bears, on the other hand, may be able to find an opportunity in the wash of volatility — if Meta’s ad revenue takes the same shape as Alphabet and Snap’s this week.