KEY POINTS

- The law also allows registered mining pools and individual entrepreneurs to take part in the burgeoning $BTC mining industry

- Russian lawmakers approved the use of digital assets for cross-border payments earlier this year

- Putin has said Russia should "seize the moment" in crypto regulation and operations

Russian President Vladimir Putin has signed a law that legalizes the mining of Bitcoin and other cryptocurrencies in the country, paving the way for the nation to have a chunk of the burgeoning industry.

An opportunity to lead

State-owned TASS reported Thursday that Putin signed a law legalizing digital currency mining, mining infrastructure operations, mining pools, address identifiers, and organizing mining pool activities.

He signed the law after previously saying that Russia should "seize the moment" in establishing a legal framework and kickstart regulatory work for the digital assets industry.

The outlet noted that as per the law, that only registered Russian legal entities and individual entrepreneurs will be allowed to mine. Individual entrepreneurs who do not exceed the energy limits set by the government will be allowed to mine without registering, as per the report.

The government will allow foreign cryptocurrencies to be traded on Russian blockchain platforms but the Bank of Russia will ban assets that it deems could threaten the country's financial stability.

US saturation brings mining to Russia

In mid-2023, reports emerged that mining hardware were entering Russia as the U.S. $BTC mining industry was becoming more and more saturated. Sanctions on Russia didn't seem to affect some mining hardware makers like MicroBT and Bitmain.

The regulatory environment in the United States and China's ban on mining has also helped drive interest in Russia in recent years as a potential hub for the emerging industry.

Russia's recent crypto push

Ahead of Thursday's big move, the Russian government has been stepping up positive actions around the crypto space.

Russian lawmakers recently approved a new law that permits the use of digital assets for international payments, possibly as part of the country's efforts to limit the impacts of western sanctions related to its financial economy.

Before the sanctions, Russia would have not allowed such "transactional freedom to its citizens," said Mati Greenspan, the CEO of crypto market research firm Quantum Economics. However, Bitcoin's growing use in "every day commerce" gave Russia an opportunity amid the sanctions, he added.

Global collaborations over sanctions

Russia has also been looking for other ways to mitigate the sanctions' impact on its financial health. In May, the Iranian Embassy's trade attaché in Russia, Rahimi Mohsen, revealed that Russia and Iran were working together on central bank digital currencies (CBDCs) and digital financial assets (DFA) to "simplify" their bilateral trade transactions.

Bitcoin rallies

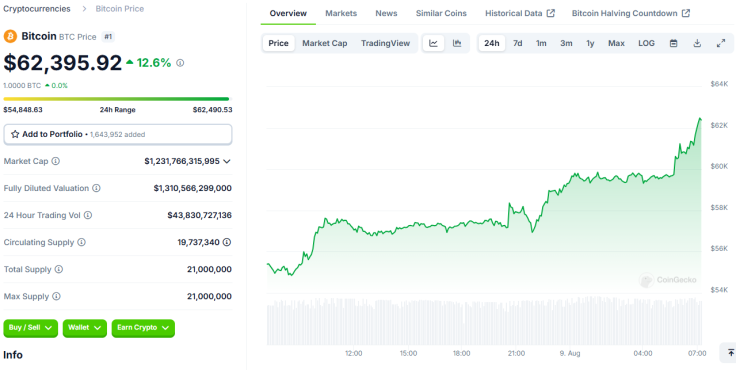

Following news of Putin's latest move related to Bitcoin and crypto, the world's top digital asset by market cap spiked above $62,000 Thursday night, as per CoinGecko. The coin has since retreated to $61,000, but has been in the green in the last 24 hours.

The surge came after a weekend global financial market bloodbath that pulled many assets in the red and triggered hundreds of millions in crypto liquidations.