/Broadridge%20Financial%20Solutions%2C%20Inc_%20smartphone-by%20rafapress%20via%20Shutterstock.jpg)

Broadridge Financial Solutions, Inc. (BR) is a New York-based financial technology and services company with a market cap of $25.7 billion. It provides mission-critical infrastructure and technology solutions to the financial services industry, including banks, broker-dealers, mutual funds, and corporate issuers. Its core offerings include investor communications and proxy services, as well as securities processing, trade lifecycle technology, and data-driven platforms that support order capture, trade settlement, portfolio accounting, and wealth management operations.

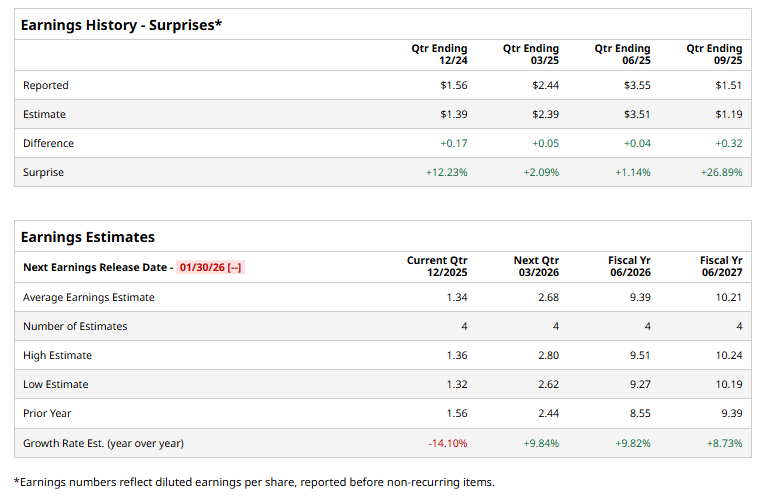

The fintech titan is gearing up to announce its second-quarter results shortly. Ahead of the event, analysts expect BR to report a non-GAAP profit of $1.34 per share, down 14.1% from $1.56 per share reported in the year-ago quarter. Furthermore, the company has surpassed analysts’ earnings expectations in each of the past four quarters.

For fiscal 2026, Broadridge is expected to deliver an adjusted EPS of $9.39, up 9.8% from $8.55 in fiscal 2025. Moreover, in fiscal 2027, its earnings are expected to increase 8.7% year over year to $10.21 per share.

Broadridge’s stock prices dipped 2.8% over the past 52 weeks, notably lagging behind the S&P 500 Index’s ($SPX) 16.9% gains and the Technology Select Sector SPDR Fund’s (XLK) 24.4% surge during the same time frame.

Broadridge has underperformed the broader market over the past year primarily due to its defensive, lower-growth profile in a market that has strongly favored high-growth and AI-exposed stocks. While the company delivers stable, recurring revenue and predictable cash flows, its modest earnings growth, exposure to muted capital markets activity, and limited near-term catalysts have constrained upside.

However, analysts remain cautious about the stock’s prospects. BR maintains a consensus “Hold” rating overall. Of the nine analysts covering the stock, opinions include three “Moderate Buys” and six “Holds.” Its mean price target of $266.43 suggests a 20.8% upside potential from current price levels.