Money is nice. While you have it. Run out, and everything can spiral into chaos. In a Reddit post shared by Kilowatt128f, the customer support representative for a major American bank recounted a particularly intense conversation with a couple on their honeymoon. The newlyweds’ credit card had stopped working, and frustration quickly boiled over. The wife called in for help, but her name wasn’t on the account, forcing her husband to step in and verify. However, what soon unraveled probably ended their trip quicker than planned.

Call center employees get their limits tested daily

Image credits: Getty Images (not the actual photo)

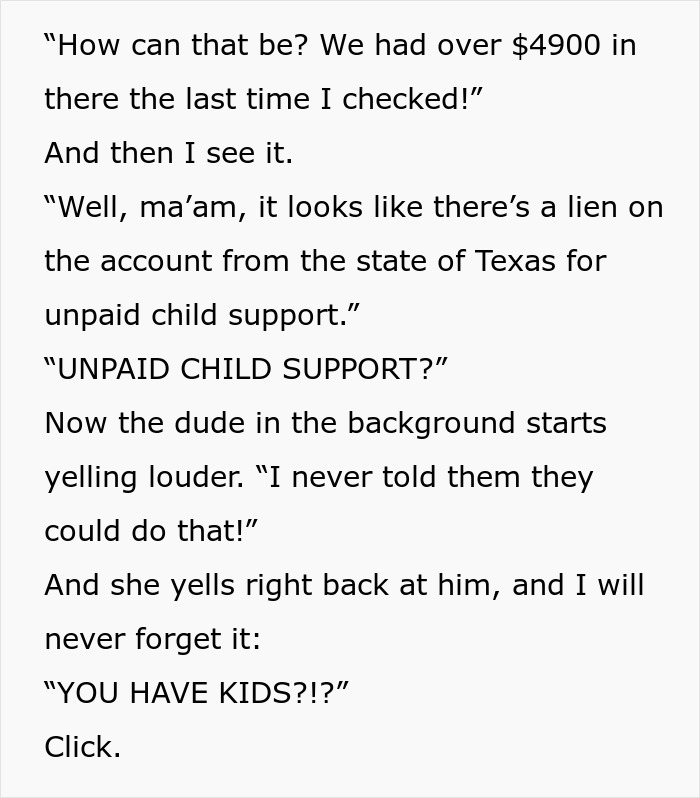

And some people have a real knack for instilling drama

Image credits: Blake Cheek (not the actual photo)

Image source: Kilowatt128

Financial infidelity is actually a pretty common problem

Image credits: DC_Studio / Envato (not the actual photo)

Money problems can be a major hurdle in romantic relationships. A 2022 study discovered that almost a third (30%) of couples suffered from financial infidelity in the year before.

When asked what form it took, people reported the following:

- secret purchases: 31.4%

- hiding debt or accounts: 28.7%

- lying about income: 22.6%

- draining money from savings: 10.4%

- lending money without consent: 6.9%

“Couples are likely to have varying levels of financial literacy,” Beverly Harzog, credit card expert at U.S. News & World Report, said. “The important thing is that they grow together and are able to make compromises when it comes to budgeting and spending.”

However, new research from Cornell University shows that when people experience financial stress, they are usually reluctant to talk to their significant other about it.

“When people feel stressed, they are more likely to think that if they initiate these conversations with their partner, it’s just going to lead to a fight, which is going to make them more stressed,” said research co-author Emily Garbinsky, associate professor of marketing and management communication at Cornell.

Whether couples successfully address their financial issues largely comes down to how they answer one specific question: are those differences perpetual or are they solvable?

Couples who feel that their financial problems are perpetual are more likely to assume they have no solution, according to Cornell’s research.

Partners may feel they have fundamental differences in how they think about money, and therefore it’s not worth it to have a conversation where no solution exists, Garbinsky explained.

But if they view their issues as fixable and can reflect on times when they previously were able to reach a compromise with each other, partners are likely more willing to talk about money, the research found.

Unfortunately, most couples by default tend to view their financial problems as perpetual, and therefore avoid discussing their financial issues.

The story has received a lot of reactions

Some people even shared their own similar experiences