Boeing (BA) stock had a hard landing on Friday, falling about 5.5%. Since then, shares have been clawing back some of those losses.

The decline stemmed from a manufacturing issue as Spirit Aerosystems (SPR), which supplies fuselages for the Boeing 737 MAX, works to find a solution. The issue affects undelivered jets and will impact deliveries in the near term.

Spirit Aerosystems stock did not handle the news well, tumbling more than 20% on Friday, although it’s up about 7% so far on Tuesday.

As for Boeing, the stock is up almost 5% from last week’s low and is trying to push higher.

DON'T MISS: Is AMD Stock About to Bounce? Here's the Setup.

The company held its annual shareholders meeting on April 18. Next week, the firm will report earnings. The former seems to be giving the stock a lift today, while the latter will be the main driver next week — whether that's good or bad, we don't know.

So far, Boeing’s stock performance has slightly edged out the overall market, up about 9% so far this year vs. an 8.2% gain for the S&P 500. However, Boeing stock has rocketed off the 2022 low, up more than 70%.

Trading Boeing Stock

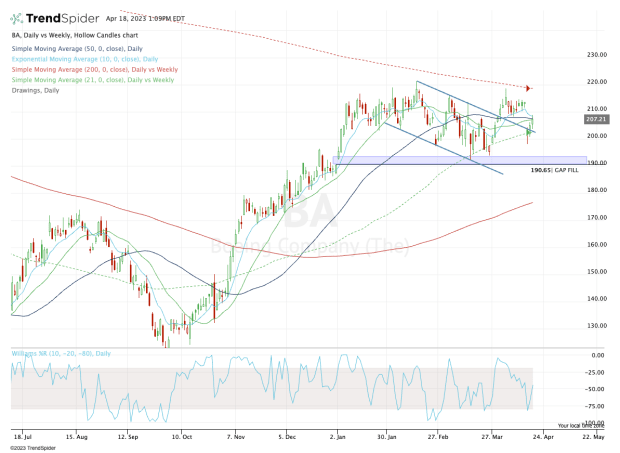

Chart courtesy of TrendSpider.com

After a nice breakout, Friday’s decline sent Boeing stock below the 10-day, 21-day and 50-day moving averages. However, it held the 21-week moving average and the $200 level.

Now pressing higher off last week’s lows, Boeing shares are struggling to regain the key daily moving averages that it lost on Friday (the 10-day, 21-day and 50-day).

If the stock cannot regain these measures, it should give bulls a pause. For starters, it would leave the $200 level in play, as well as last week’s low down at $198.15.

Ultimately, more weakness could usher in a test of the low-$190s, with a special focus on the gap-fill level down at $190.65. This was a key breakout area in early January, and it’s also where Boeing stock has found support multiple times this year.

On the upside, a move back through its key daily moving averages could fuel a rally back to the $215 to $218 resistance area.

This zone also contains the declining 200-week moving average, which has been resistance so far.

If the stock can push the upper end of resistance and break out over $220, then we’ll have a new range to start trading in Boeing stock. Until then, these are the levels we have to navigate.