Boeing (BA) stock has been sick for a long time. Will that change when the aerospace giant reports earnings before the open on Wednesday?

With each wave of travel-related optimism, the bulls hoped that “this time would be different” and they would see a sustainable rally in Boeing.

Admittedly, Boeing stock has had some strong gusts of momentum over the past year. There were moments where it seemed as if “this is it!” as the stock was finally trading better.

But each time, Boeing found a way to disappoint, whether it was concern about one of its models, news about its leadership, quality aspects, or an orders update.

The bulls have loved Boeing over the years because of its strong cash flows and its standing as part of a duopoly in the passenger-jet industry.

Those arguments aren’t holding up anymore, surely not after the company’s 737 Max debacle and its more bloated balance sheet. And even though carriers like United Airlines (UAL) are out with significantly improved outlooks, Boeing stock hasn’t been able to rally.

In fact, it’s sitting on the cusp of new 52-week lows ahead of its earnings report.

Trading Boeing Stock

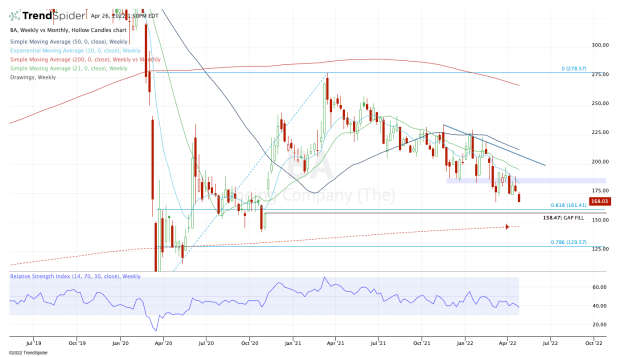

Chart courtesy of TrendSpider.com

I have been charting Boeing stock for a long time. And for more than a year this gap-fill level has been making me wonder whether it will ever be filled.

On Nov. 9, 2020, Boeing ripped higher, gapping up about 13% and beginning a multiweek upside rally. While that was a powerful move, it left a gap at $158.47 — a gap that has sat unfilled for almost a year and a half.

With the earnings report looming and the stock sitting at 52-week lows, we now need to question whether a move lower could be in order. After all, we just saw United Parcel Service UPS stock tip lower despite better-than-expected results.

A look at the chart shows a few more key measures popping up near that gap-fill mark. Specifically, I’m looking at the 61.8% retracement less than $3 away at $161.41. I’m also looking at the 200-month moving average, which is admittedly a bit further away, down near $146.

Yet, all of these measures make me wonder if we could see some sort of dip down to the $150 area on a bearish post-earnings reaction.

If this area fails — and that’s a big “if” considering we don’t even know whether this zone will be tested — then the $125 to $130 area will be on watch.

On the upside, active resistance has come from the declining 10-week moving average.

Right now, that measure is right at the bottom of the prior support zone at $183 to $188. If Boeing clears the 10-week, see if it can clear $188. If it can do that, the declining 21-month moving average is on the table.