TheStreet’s J.D. Durkin brings the latest business headlines from the floor of the New York Stock Exchange as markets close for trading Monday, March 25.

Related: Here is who is stepping down in massive Boeing resignation

Full Video Transcript Below:

J.D. Durkin: I’m J.D. Durkin - reporting from the New York Stock Exchange.

A muted day here on Wall Street, as investors await PCE inflation data due out later in the week. The most weighted-names in the Dow like United Health, Microsoft, and Goldman Sachs all pushing the benchmark index lower, while energy stocks were among the highest movers of the day. Names like Meta and Alphabet pushed communication services stocks down in the session despite their strong gains so far in 2024.

Additionally, the price of bitcoin spiked on Monday, and is on pace to finish up for the month of March.

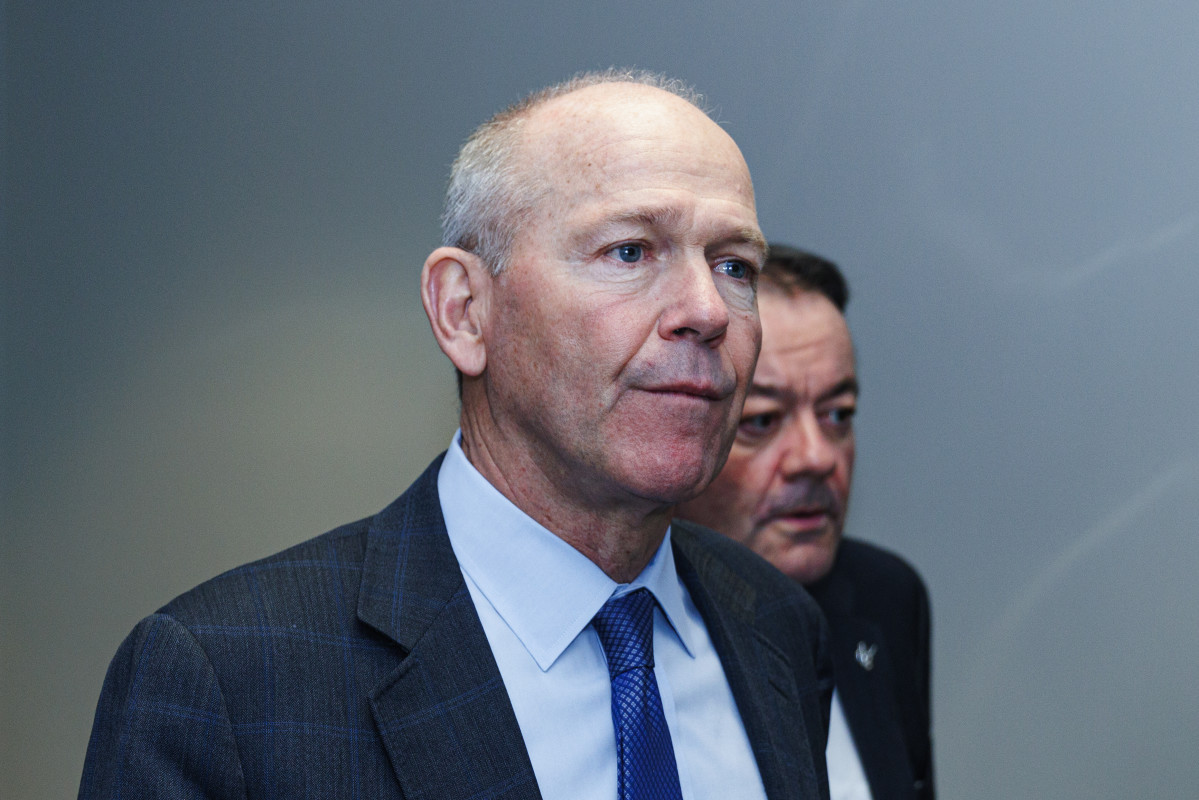

In other news - after five years of issues involving the company’s 737 Max jets, Boeing (BA) CEO Dave Calhoun announced he will step down at the end of the year. Boeing also announced that Stan Deal, chairman and head of its commercial planes unit, is retiring effective immediately, and Board of Directors Chair Larry Kellner will not seek re-election.

Boeing planes were involved in two fatal crashes in 2018 and 2019 - claiming the lives of 346 people. Those crashes led to Boeing’s MAX 8 fleet being ground for almost two years. The aircraft maker’s most recent issues started on January 6 of 2023 when a door plug blew out on an Alaska Airlines flight when the plane was flying at 16,000 feet. That incident led to multiple groundings for safety issues, costing the company more than $31 billion.

And as a result of the Alaska Airlines incident, other carriers have suffered negative fallout. Southwest only uses Boeing 737’s, and was expecting 58 new planes from Boeing in this year - but it will only receive 46, causing the carrier to re-evaluate its 2024 financial forecast. And United Airlines announced it would be taking the yet-to-be-certified Max 10 out of its fleet plans for the year.