BlueScope Steel shares have only slipped slightly after Australia's largest steelmaker flatly rejected a $13.2 billion takeover bid involving billionaire Kerry Stokes and a US partner.

BSL shares closed on Thursday down 1.6 per cent to $29.40, still well above the $20 to $25 trading range they spent nearly all of 2025, and only just under the $30-per-share price the Mr Stokes-controlled SGH and Steel Dynamics are offering.

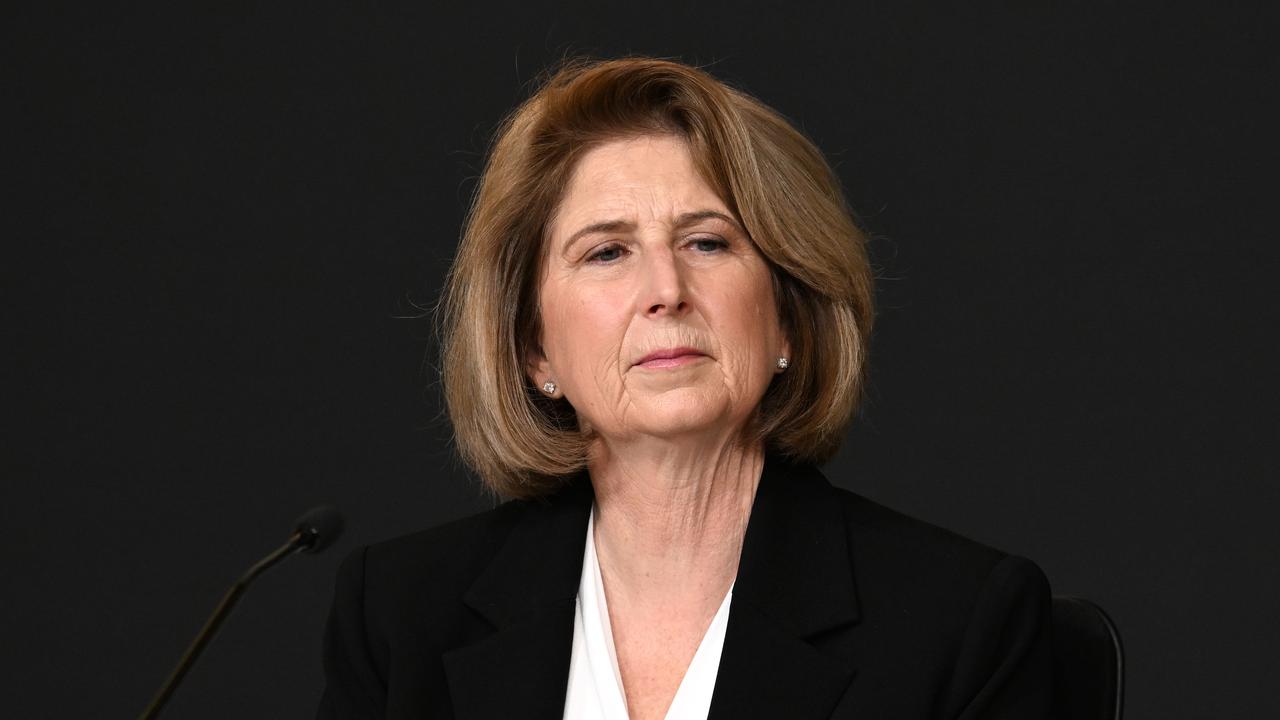

That indicates investors are still optimistic a deal will eventuate, even though BlueScope chairwoman Jane McAloon lambasted the consortium's bid as an "attempt to take BlueScope from its shareholders on the cheap".

"It drastically undervalues our world-class assets, our growth momentum, and our future," she said on Wednesday.

Investors were waiting for the next move by SGH and Steel Dynamics, who could choose to up their offer or walk away.

SGH shares were down 1.9 per cent to $48.03, while Steel Dynamics' Nasdaq-listed stock dropped 2.8 per cent to $167.83.

Hersh Oberoi, the Melbourne-based global research department director at Balfour Capital Group, said the bid was another sign steel was being repriced as strategic regional infrastructure, not just a traded commodity, amid the backlash to globalisation.

"That's effectively 'ownership aligned to jurisdiction', which is where the world is heading in a more fragmented trade environment."

The offer would give the steel sector a "strategic premium" halo and lift attention on peers as investors started asking whether other industrial names with hard assets and domestic relevance could become targets, Mr Oberoi said.

In the longer term, it reinforced a theme that policy-aligned industrial assets could command higher multiples than pure cyclical earnings would suggest, he said.

Steel is politically sensitive, Mr Oberoi added.

"Once ownership shifts, there's always scrutiny over where high-value decision-making sits, where investment is prioritised, and whether value-added functions migrate over time," he said.

"Even if jobs and operations are unchanged day one, governments and communities tend to focus on who ultimately controls strategic industrial capacity."