Most alternative assets seem to simply represent a leveraged play on the stock market.

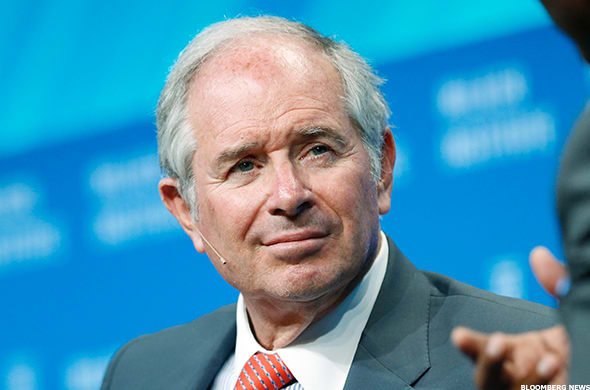

That particularly seems to be the case with Blackstone (BX), the world’s largest alternative asset manager, and a stock I own. It’s headed by legendary Chief Executive Stephen Schwarzman.

Blackstone shares have dropped more than 36% year to date, far exceeding the 16% slide for the S&P 500. And last year, when the S&P 500 climbed 29%, Blackstone posted a whopping 106% gain.

So Blackstone has moved in the same direction as the stock market but at a much faster pace both ways.

The company’s investments are largely made up of private equity, hedge funds and real estate. And this has been a bad year for all three.

The S&P Listed Private Equity Index, which includes Blackstone and other private equity companies, has dropped 29% so far this year. This doesn’t measure private equity investments directly, but gives you an idea.

And The FTSE Nareit All Equity REIT index has lost 22.35%. That measures publicly-traded real estate, while Blackstone mostly invests in private real estate. But again it gives you an idea.

For hedge funds, the HFRI Fund Weighted Composite Index slumped 4% year-to-date through November.

Blackstone also invests in credit and insurance.

Inflation, Interest Rates, Economy

All of its asset classes have suffered from raging inflation, soaring interest rates and economic sluggishness.

Meanwhile, Blackstone’s dividends surged early in the year compared to 2021, presumably because it continued to sell off assets at a profit. But the dividend slumped in the third quarter, with that payout annualizing to a yield of 4.37%.

So where does Blackstone go from here? Given the company’s history, it seems logical to assume it will move in the same direction as stocks, but further and faster.

Many experts believe that the Federal Reserve will stop raising interest rates around mid-year and that stocks will rise in response. But there’s obviously no guarantee that will indeed happen.

Morningstar analyst Greggory Warren likes Blackstone, giving it a narrow moat (competitive advantage). He puts fair value for the stock at $115, compared to a recent quote of $83.

Blackstone is ‘Pre-eminent’

“We consider Blackstone to be the pre-eminent alternative asset manager, with $950.9 billion in total assets under management (AUM) at the end of September,” he wrote in a commentary.

“The company has scale in each of its four business segments.”

That includes private equity, which accounts for 24% of fee-earning AUM and 31% of base management fees; real estate, which accounts for 39% and 40%; credit & insurance, which accounts for 27% and 20%; and hedge fund solutions, which accounts for 10% and 9%.

“Blackstone has also built out a large base of employees, including in-house executives, consultants, and advisors,” Warren said.

These folks “have decades of industry experience and can successfully revitalize a company or property through cost-cutting, acquisitions, or other strategic maneuvers.”

That has “provided Blackstone with the ability to not only gather but retain assets in various market conditions as well as a means of differentiating itself from peers,” Warren said.

The company enjoyed $44.8 billion in capital inflows during the third quarter of 2022 and $337.8 billion over the past year was sitting on $182 billion in dry powder as of Sept. 30.

“Blackstone continues to be our top pick among the three alternative asset managers we cover,” which also includes KKR (KKR) and Carlyle Group (CG), Warren said.

The author of this story owns shares of Blackstone.