The real estate investment platform Cadre announced yesterday that it has partnered with BlackRock’s (NYSE:BLK) BlackRock Impact Opportunities Fund to acquire The Harvest at Marmalade apartments, a 252-unit multifamily asset in downtown Salt Lake City, Utah.

The BlackRock Impact Opportunities Fund was launched in 2021 with a target of $1 billion to uncover investment opportunities in under-capitalized companies and communities that are poised for growth.

The latest acquisition will bring the total number of Cadre’s actively managed multifamily investments to 16 assets. According to the company’s website, most of its active multifamily investments have a value-add strategy, which involves making improvements to a property in order to add value through increased rent collections.

Related: New Multifamily Real Estate Investment Offering In San Francisco Bay Area With 15.8% Target IRR

According to an article by FOX 13, Salt Lake City experienced the third largest rent increase in the past three years out of all large U.S. metros while home prices are up 50% over the past two years. The median sale price for homes in Salt Lake City is $562,500, nearly 25% higher than the national average.

Institutional investors have been aggressive in acquiring multifamily and single-family rental properties as the demand for rental units continues to skyrocket as a result of homeownership becoming less and less affordable.

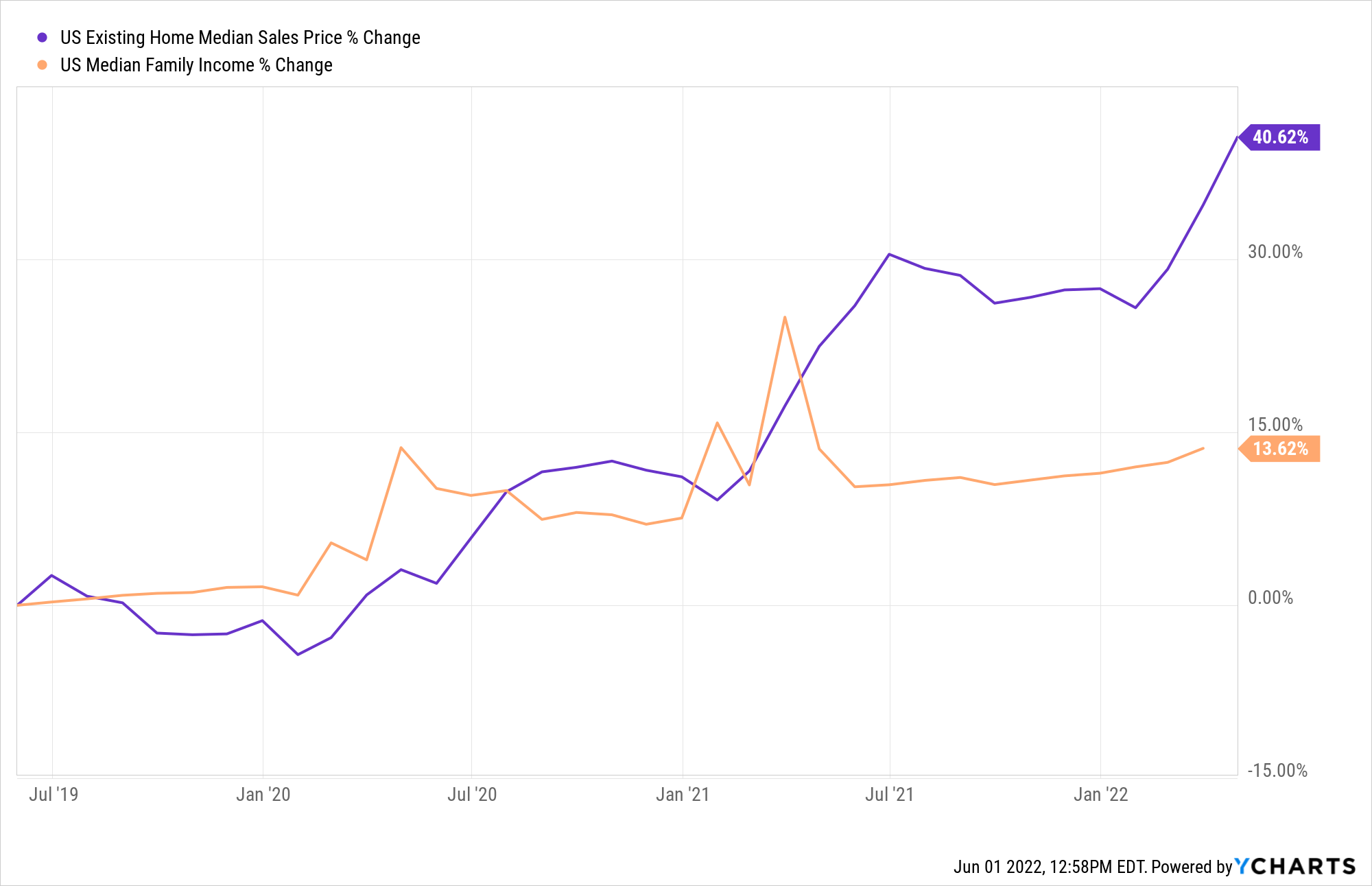

Over the past three years, the U.S. existing home sale price has increased 40.62%, while the U.S. family median income has only increased by 13.62%. Recent interest rate hikes have only added to the affordability problem, leaving many families with no option but to rent.

Retail investors have also taken notice of this growing demand for rentals. Investment activity on real estate investment platforms that offer fractional ownership of income-producing properties or access to crowdfunded offerings has increased significantly since the beginning of 2021. Most of the properties offered on these platforms have been multifamily assets, single-family rental homes and the development of build-to-rent communities.

Related: Jeff Bezos Increases His Bet On The Single-Family Housing Market

While some have concerns of a looming housing market crash, Moody’s Analytics estimates that the shortage in the housing supply is over 1.5 million homes nationwide. The shortage might mean a prolonged period of inflated housing prices and a continued growing demand for rentals across the country.

Photo by Andrew Zarivny on Shutterstock