KEY POINTS

- Crypto researcher Abram noted that whales "took advantage" of Tuesday's price correction

- Whale Alert revealed one whale moved nearly 8,000 BTC from Coinbase Tuesday

- Some crypto users on X said BTC whales snapped up the coins when small holders had "paper" hands

Bitcoin whales, or the largest holders of the world's first decentralized cryptocurrency, bought the dip Wednesday, when prices plunged following significant spot BTC exchange-traded funds (ETFs) outflows.

According to data compiled by digital assets sleuth Abram, who is also a community manager and author at crypto market intelligence provider CryptoQuant, there were over 20,000 in BTC flows into whale wallets on Tuesday. "It appears that the whales took advantage of yesterday's correction in Bitcoin and accumulated additional quantities," he wrote Wednesday.

$BTC: Are whales still buying?

— CryptoQuant.com (@cryptoquant_com) June 12, 2024

“More than 20,000 #Bitcoin flow to whale wallets. It appears that the whales took advantage of yesterday’s correction in Bitcoin and accumulated additional quantities.” – By @abramchart

Read more 👇https://t.co/OAXOA5uBFz pic.twitter.com/KUDnP6BVyb

Whale Alert, which tracks the activity of some of the world's largest crypto holders, also posted about significant Bitcoin transfers on Tuesday, including one that 7,999 BTC out of crypto exchange giant Coinbase.

🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 7,999 #BTC (537,464,654 USD) transferred from #Coinbase to unknown new wallethttps://t.co/CSpD5crOcy

— Whale Alert (@whale_alert) June 11, 2024

Some crypto users on X (formerly Twitter) commented on the massive transfer, with one saying the Bitcoins were "scooped up on you paperhands," a term in the digital assets space that refers to people who sell their assets when prices slump. Another user said Bitcoin holders were "panic selling" to the industry's "big dogs."

The latest development comes as Bitcoin's price has been struggling since the halving event on April 20 that split Bitcoin mining rewards in half.

BTC whales are known to move either when prices spike or when they see a significant slump. At one point on Tuesday, Bitcoin prices plunged to $66,000 upon news that spot BTC ETFs saw $200 million in net outflows. BlackRock's popular IBIT may have missed the beating, but it did not see any inflows on Tuesday.

The scenario was different last week, when whales moved some $500 million worth of Bitcoins across exchanges and digital wallets. At the time, Bitcoin was nearing the $70,000-mark.

Other dormant BTC whale accounts have also been waking up after years of no activity. For instance, a wallet with 8,000 Bitcoins that was opened late in 2018 saw 17x in gains after the wallet was reactivated just this week. The wallet's BTC holdings were worth over $500 million when it was opened after more than five years.

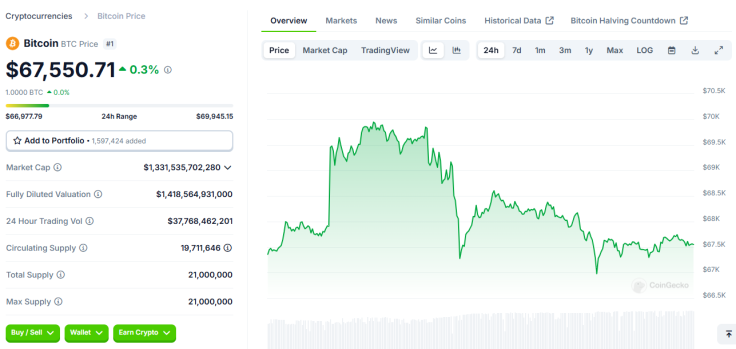

The world's most popular digital asset has since bounced back after the plunge. As of early Thursday, BTC prices are trading at around $67,500. It is also up by 0.3% in the last 24 hours and is up by over 9% in the last 30 days as per CoinGecko.