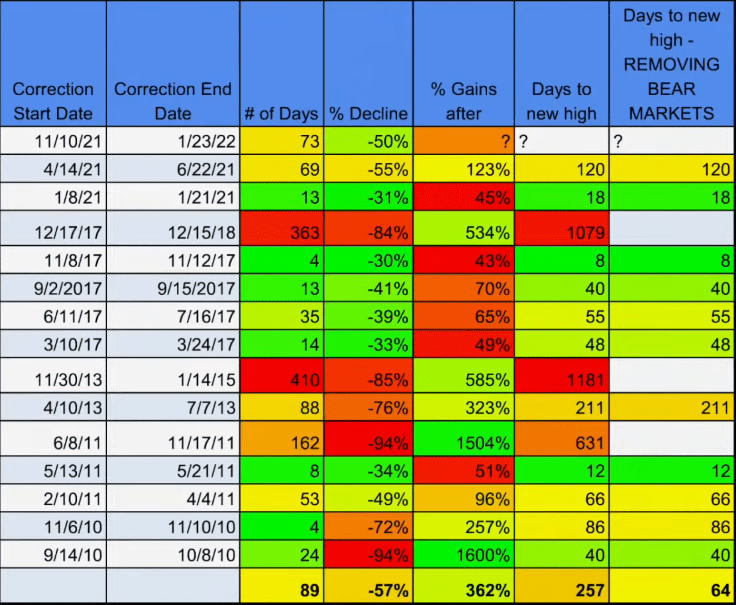

The market-leading cryptocurrency Bitcoin (CRYPTO: BTC) has taken an average of 64 days to recover from every major price crash, excluding bear markets.

What Happened: According to an analysis of historical price data from InvestAnswers, Bitcoin has lost around 57% of its value during every major correction. When factoring out bear markets, the digital asset recovered in 64 days.

When including three-year bear markets, the average time for Bitcoin to recover was 257 days.

Historical data also shows that the average duration of a correction is 87 days. Seeing as it has been 70 days since Bitcoin began its decline from a peak price near $69,000, market participants may have reason to believe that the end of negative price action for Bitcoin may be fast approaching.

It is also worth noting that the average gain after a Bitcoin correction stands at 362%.

“Will we get back to where we were 70 days ago — $68,800? Yes, we will. I just don’t know when, but it could be soon because historically, the rebound happens within 64 days. These are just numbers. History. I know things are a lot longer now. Cycles are longer, but also markets fall and crash much faster than ever before too,” said InvestAnswers host James Mullarney.

Price Action: Bitcoin was trading at $36,500, up 8.45% in the last 24 hours. The leading digital asset had a daily trading volume of $44.3 billion.

Ethereum (CRYPTO: ETH) was trading at $2,400, gaining 7.66% over the same period.

Several altcoins like Avalanche (CRYPTO: AVAX), Polkadot (CRYPTO: DOT) and Solana (CRYPTO: SOL) also posted significant recoveries, gaining more than 10% in the last day.

Large-cap meme-based cryptocurrencies like Dogecoin (CRYPTO: DOGE) and Shiba Inu (CRYPTO: SHIB) were up by 5% and 6% respectively over the last day.