KEY POINTS

- Grayscale's GBTC was the day's leader, with $121 million in outflows

- Tuesday's outflows led to the total net asset value of BTC ETFs falling below $60 billion

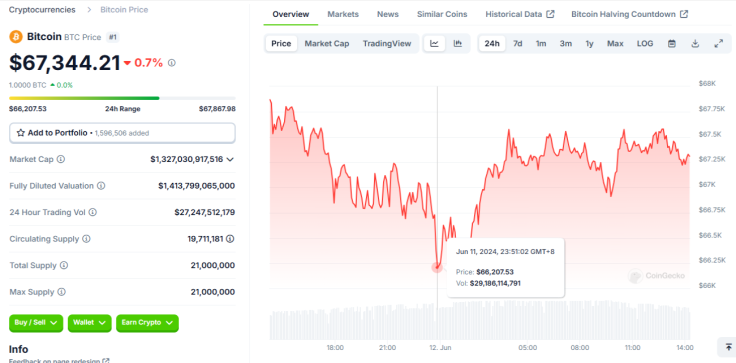

- Bitcoin has since bounced back above $67K but is still down by over 5% in the last 7 days

Bitcoin was down at the beginning of the week and it dipped further Tuesday after U.S. spot BTC exchange-traded funds (ETFs) saw staggering net outflows of $200 million, led once more by Grayscale's GBTC.

A total of $200 million worth of Bitcoins left the care of spot BTC ETFs on Tuesday, as per data from London-based investment management firm Farside Investors.

As was the case in previous days, Grayscale's GBTC saw the largest amount of outflows at $121 million. ARK 21Shares' ARKB had outflows of $56.5 million, Bitwise's BITB had $11.7 million in outflows, and $7.4 million in BTC left Fidelity's FBTC.

However, the bigger shocker was that BlackRock's popular IBIT, which has significantly lower management fees compared to GBTC, saw zero inflows Tuesday. The ETF snapped its five-day streak of millions in net inflows.

Like IBIT, no other American Bitcoin ETFs had inflows, marking a dark day in the journey of the funds that drove the world's largest cryptocurrency by market cap to an all-time high of $73,000 in mid-March.

Due to the massive outflow on Tuesday, the total net asset value of BTC ETFs has fallen below $60 billion, as per crypto expert Colin Wu.

On June 11, the total net outflow of US Bitcoin spot ETFs was $200 million, the second consecutive day of outflow. Grayscale ETF GBTC had a single-day outflow of $121 million, and the total net asset value of Bitcoin spot ETFs fell below $60 billion, currently at $59.227 billion.…

— Wu Blockchain (@WuBlockchain) June 12, 2024

The Bitcoin ETF outflows news brought the world's first decentralized digital asset to its knees from over $67,500 on Monday to $66,200 at one point late Tuesday before climbing slowly. The digital currency has since bounced back above $67,000 as of early Wednesday but is still down 0.7% in the last 24 hours as per data from CoinGecko.

On Monday, the popular token also lost around $2,000 in value after U.S. spot Bitcoin ETFs saw outflows of nearly $65 million, snapping their 19-day positive net inflows streak. The coin was trading above $69,600 before it plunged to around $67,500 after the outflows report.

Bitcoin has been down 5.2% in the last seven days. Other cryptocurrencies also declined in the past week, with Ether (ETH) is down by 7.1%, Binance Coin (BNB) declined 13.3%, Solana (SOL) follows closely with the downtrend with a 13% decline, and XRP is in the red by 8.3% in the last seven days.

Meanwhile Bitcoin whales have been on the move since Monday's inflows streak was broken. On Tuesday, a whale wallet moved 881 Bitcoins worth nearly $60 million out of Coinbase, as per large crypto wallets tracker Whale Alert.

Also on Tuesday, a wallet with 8,000 BTC moved its balance to Binance after five and a half years of no activity. The wallet was opened when prices were at $3,800, bringing the value of the transferred Bitcoins to over $500 million following a five-year dormancy.