KEY POINTS

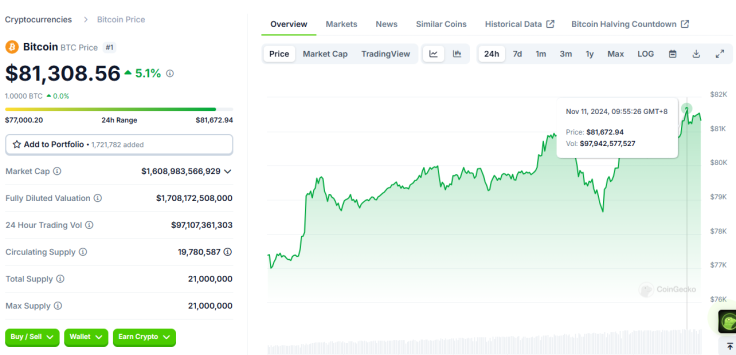

- Bitcoin hit $81,672 at one point on Sunday – a new all-time high

- Bitcoin has been rallying by over 18% in the last seven days

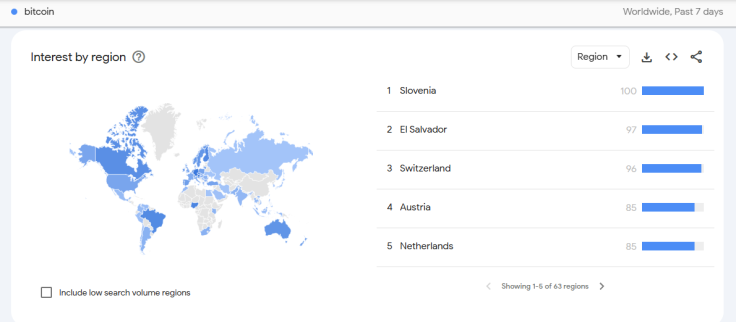

- Slovenians and El Salvadorans were the most interested in $BTC in the past week

Bitcoin has been pumping significantly since election day, and as the United States confronts the aftermath of one of the biggest moments in the country's political history, the world's largest decentralized cryptocurrency by market cap continues to soar.

Data from CoinGecko showed that at one point on Sunday, BTC hit $81,672.94, setting a new all-time high after it first surpassed its March record above $73,000 last week. The digital coin has been on a wild 18.4% surge in the past seven days, driven by bullish expert views under a second presidency under Donald Trump.

Bitcoin Interest Hikes Post Election

Bitcoin's new all-time high came as interest in the world's first crypto asset dramatically spiked on Nov. 6, as the election numbers started pouring in and after the Associated Press called the race for the Republican presidential nominee.

Data from Google Trends shows that Bitcoin searches skyrocketed throughout Wednesday before gradually declining later in the week. Over the weekend, interest picked up again as more people sought to know about BTC.

Notably, the top three countries that had the highest number of Bitcoin searches in the past seven days were Slovenia, El Salvador, and Switzerland. Melania Trump, the president-elect's wife, is of Slovenian-American descent.

El Salvador is often dubbed a "Bitcoin country." Its President, Nayib Bukele, is known for being a BTC maximalist and started the Central American nation's Bitcoin investment strategy, wherein the country buys 1 Bitcoin daily.

Toward an Orange-Pilled Future

Meanwhile, industry experts are expecting more milestones for BTC now that Trump has reclaimed the White House following his 2020 loss to outgoing President Joe Biden.

For Simon Gerovich, the CEO of Japanese firm Metaplanet, the new all-time highs that BTC prices logged after the elections indicated "a world waking up to a monetary system it can finally trust – one where freedom, not debt, defines prosperity."

Metaplanet has gone by tech firm MicroStrategy's playbook. The Japanese company adopted its own BTC strategy and has been piling up its Bitcoin treasury over the past months.

Prominent BTC analyst Willy Woo said it's clear that "optimism is returning to the Western world," given the incoming administration's expected embrace of Bitcoin and the broader cryptocurrency industry.

Fred Thiel, the chairman and CEO of MARA Holdings, said he assumes MicroStrategy executive chairman Michael Saylor is "feeling glad today knowing that more people are awakening to the fact that there is no better alternative than Bitcoin as a strategic treasury asset."

Thiel was referring to the recent reaffirmation from Sen. Cynthia Lummis, R-Wyo., that the U.S. government under Trump will establish a Bitcoin national strategic reserve.