Bitcoin (CRYPTO: BTC) recorded its largest weekly inflows this year even as the chaos surrounding Terra (CRYPTO: LUNA) sent markets plummeting last week.

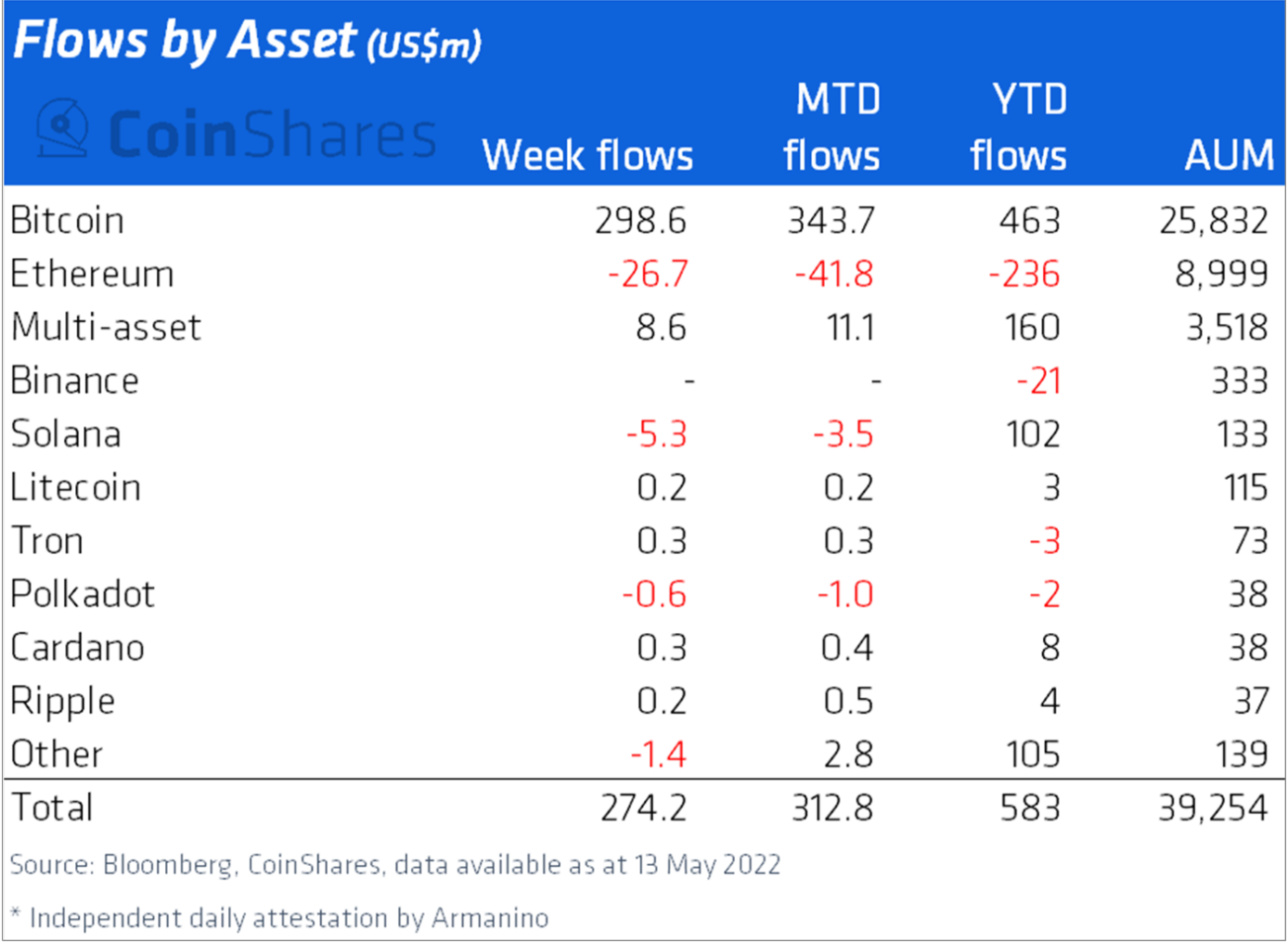

What Happened: According to last week’s CoinShares report examining fund flows into digital asset products, Bitcoin saw $298.6 million worth of inflows for the week ended May 13.

Meanwhile, Ethereum (CRYPTO: ETH) products continued to see an exodus of capital with outflows totaling $27 million for the week.

“Multi-asset investment products saw inflows totaling $8.6m suggesting investors saw a diversified approach as an opportunity to buy into this recent price weakness,” noted Coinshares.

Overall, digital asset investment products saw record weekly inflows of $274 million over the week. According to CoinShares, this can largely be interpreted as “a strong signal that investors saw the recent UST stable coin de-peg and its associated broad sell-off as a buying opportunity.”

North American investors appeared to be the driving force of the week’s strong institutional buying. Inflows from the region totaled $312 million, while funds saw $38 million in outflows from European investors.

Price Action: According to data from Benzinga Pro, the leading digital asset Bitcoin was trading at $30,264, down 0.34% over 24 hours. Ethereum was trading at $2,070, down 0.31% over the same period.