KEY POINTS

- Spot Bitcoin ETFs had a huge day Thursday, logging $365.7 million in positive flows

- Bitcoiners are looking forward to 'Uptober,' which could kick off a positive 4th quarter for $BTC

- Gensler on Thursday affirmed that Bitcoin is a commodity, not a security

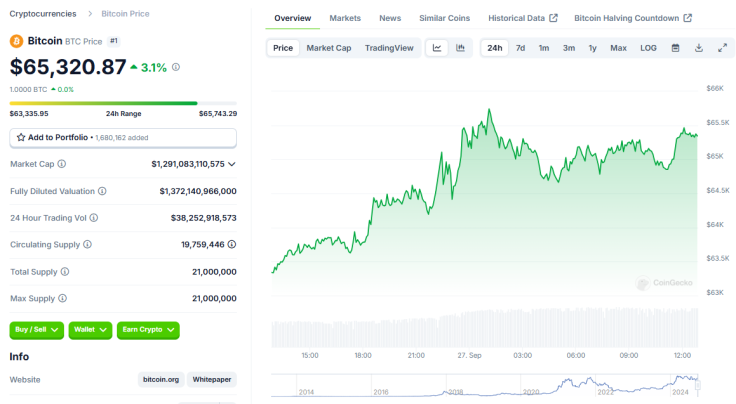

Bitcoin has finally broken the $65,000-line after days of struggling between $63,000 and $64,000. The world's first decentralized cryptocurrency has been on an uptrend in recent weeks, but on a slower pace compared to its speedy surges earlier this year.

As of early Friday, BTC is trading at around $65,300, data from CoinGecko shows. The digital coin has seen a 3% increase in the last 24 hours and has been surging by over 2% in the past week. Why is Bitcoin up today?

Cryptocurrencies are, by nature, volatile. Various aspects around the financial and geopolitical landscape affect the digital assets, but Friday's $BTC spike can be attributed to three factors.

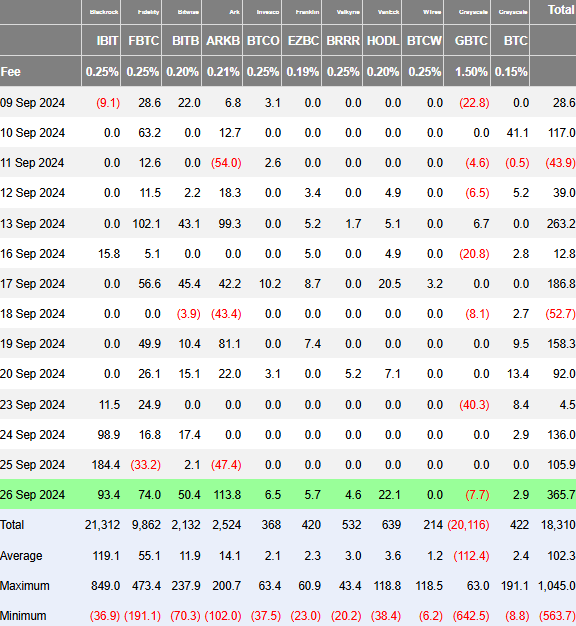

Spot $BTC ETFs Log Huge Inflow Day

Thursday was a big day for U.S. spot Bitcoin exchange-traded funds (ETFs). The funds collectively hauled in $365.7 million, led by Ark/21 Shares' ARKB ($113.8 million), BlackRock's IBIT ($93.4 million), and Fidelity's FBTC ($74 million), as per data from Farside Investors.

The data from Thursday marks the sixth consecutive day of positive inflows in U.S. spot BTC ETFs, triggering optimistic views about the digital currency and driving expectations about Bitcoin finally erasing its often bitter history with the month of September.

$BTC Users Look Forward to 'Uptober'

Historically, the fourth quarter of the year has been relatively good to the world's top digital currency by market value. For instance, last year, Bitcoin started October at $27,900 and wrapped up the month at $34,600, as per Yahoo Finance data. It ended the year at $42,200.

Crypto executive EljaBoom said Wednesday that BTC's "parabolic phase has started," so users should expect an "Uptober," followed by a "Moonvember," a "Pumpcember," and a "Bulluary" to kick off 2025.

Gary Gensler Affirms Bitcoin's Legal Status

Also on Thursday, the Bitcoin community was in an upbeat mood after U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler affirmed in an interview that BTC is not a security.

While many Bitcoiners have already been sure from the start that BTC is a commodity, Gensler's affirmation brought excitement and renewed trust among smaller Bitcoin holders who may have started losing faith due to the SEC's enforcement-first approach toward digital assets.

Harris-Walz Economic Playbook Mentions Digital Assets

Possibly lingering through Friday was the impact of the economic plan published by the Harris-Walz campaign, which mentioned digital assets, albeit just once throughout the 80-page playbook.

Some prominent figures in the crypto space welcomed Vice President Kamala Harris's seemingly softer stance on the industry, considering how the Biden administration was not as friendly to the sector.

Bitcoin has been on a wild ride in recent months, but it wavered multiple headwinds throughout the second quarter, including the massive German government dump and two crypto market bloodbaths in August.